Sluggish real estate market poses financial risks

The slowdown in real estate development has affected financial markets

Less FDI investment may affect economic prospects

According to the Ministry of Planning and Investment’s Department of Foreign Investment, foreign direct investment in real estate was only $305 million in the first six months of this year. This is the lowest figure for the past five years.

The figure peaked at $23.6 billion in 2008 and reached $6.84 billion in 2010, the department said.

At a seminar on in Hanoi on August 18, experts worried that a decrease in FDI investment in real estate may signal a negative impact on Vietnam’s economic prospects because the country still heavily depends on outside resources.

In addition to the slowdown in real estate, the rate of increase in the country’s overseas remittances have decreased considerably over recent months. Overseas remittances were recorded at $4.3 billion in the first half of this year, compared to a total of $8 billion for the whole of last year, a marked contrast to the 25 per cent increase in remittances in previous years.

A recent survey of 4,000 households showed that the majority of overseas remittances to Vietnam were used to buy land and housing, boosting domestic investment in property.

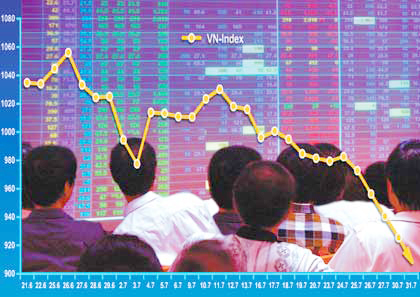

Tightened monetary policies have also had a negative impact on real estate. Investors are finding it hard to raise capital through the stock market due to the falling prices of their shares.

Dr. Le Xuan Nghia, Vice Chairman of the National Financial Supervisory Commission, said liquidity in the stock market has sharply decreased in recent times. As of July 22, share prices in both Hanoi and Ho Chi Minh City Stock Exchange plunged, with 76.3 per cent of shares posting prices below their book value and 48.1 per cent of shares below their face value.

The decline in the stock market has affected real estate developers. To date, 58 real estate companies have floated their shares on the market. Share prices in this sector recorded a fall of 50-70 per cent in the first half of this year, hindering their ability to raise capital.

Real estate companies find it hard to raise capital via the stock market

Inflation and slowed development

Speaking at the seminar, Deputy Minister of Construction Nguyen Tran Nam said, in developing countries, if investment in real estate increases by $1, it would stir up development of some related industries by an equivalent value of $1.5-$2. The construction of one square metre of housing needs between 17 and 25 workdays.

This means that changes in the real estate market could affect other markets including financial and labour markets.

According to Nghia, if tight monetary policies are further maintained, it could result in stagnation in economic development.

Investors are scrutinising market trends before making investment decisions, which has hindered money flows and locking the market. Real estate experts forecast that for the short term the market may become increasingly gloomy.

To deal with the situation, Nghia called for more flexible monetary policies to ensure stable credit growth, along with introducing policies to raise domestic and foreign financial resources and reduce dependence on bank credit.

In the meantime, Nam suggested that more regulations should be made to encourage FDI investment in real estate.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign fruits flood Vietnamese market (December 09, 2025 | 13:22)

- Vietnam’s fruit and vegetable exports reach $7.8 billion in first 11 months (December 05, 2025 | 13:50)

- Vietnam shapes next-generation carbon market (November 26, 2025 | 15:33)

- PM urges Ho Chi Minh City to innovate and remain Vietnam’s economic locomotive (November 26, 2025 | 15:29)

- Experts chart Vietnam's digital finance path: high hopes, high stakes (November 14, 2025 | 10:56)

- Vietnam’s seafood imports surge 30 per cent in first 10 months (November 10, 2025 | 19:35)

- Vietnam’s durian exports hit $1 billion milestone (October 30, 2025 | 17:41)

- Beyond borders: Sunhouse and new era of Vietnamese brands on Amazon (October 28, 2025 | 10:46)

- Record-breaking trade fair set to open in Hanoi (October 15, 2025 | 15:59)

- Timber sector seeks solutions to VAT refunds (October 14, 2025 | 18:58)

Tag:

Tag:

Mobile Version

Mobile Version