Advanced search

Search Results: 105 results for keyword "private equity".

Dean Wilkinson Joins Private Equity backed DanMagi as Executive Chairman

3 ngày trước

DanMagi is pleased to announce the appointment of Dean Wilkinson as a pivotal addition to the company leadership.

EQT completes acquisition of PropertyGuru

5 ngày trước

EQT Private Capital Asia and PropertyGuru Group Limited, one of the Southeast Asia’s leading property technology (PropTech) companies, on December 13 announced the completion of the acquisition of PropertyGuru by BPEA Private Equity Fund VIII for $6.70 per share in cash in a transaction that values PropertyGuru at an equity value of approximately $1.1 billion.

J.F. Lehman & Company Raises $2.2 Billion for Oversubscribed Fund VI

11-12-2024 02:00

J.F. Lehman & Company, a leading middle-market private equity firm focused exclusively on the aerospace, defense, maritime, government and environmental sectors, today announced the successful closing of its latest flagship fund, JFL Equity Investors VI, L.P. and affiliated investments vehicles.

The One Destination partners with Singapore investor and institutional fund to build ESG real estate complex

11-11-2024 10:32

The One Destination officially announced an investment agreement with Singapore's Terne Holdings, a multi-sector investment group, and BTS Bernina Private Equity Fund, an Asia-focused regulated mutual fund.

Warburg Pincus aims to expand investment footprint in Vietnam

26-09-2024 15:13

Renowned private equity firm Warburg Pincus is planning to expand its investment in Vietnam to capitalise on growing industries.

NextBold Capital eyes $100 million fund to back SMEs in Vietnam, Cambodia, and Laos

20-09-2024 10:15

NextBold Capital, a private equity firm focused on supporting the growth of small- and medium-enterprises (SMEs) in Southeast Asia, is raising its first fund to invest in SMEs across Vietnam, Cambodia, and Laos.

Vietnam Private Capital Agency aims to drive $35 billion in private investments by 2035

12-09-2024 14:35

The Vietnam Private Capital Agency (VPCA) was launched on September 12 to promote best practices in the venture capital and private equity sectors.

Healthcare groups bring expertise and innovation

05-08-2024 15:27

Vietnam’s burgeoning healthcare market remaining a bright spot for Singaporean companies and private equity funds has spurred a flurry of investments and partnerships involving Singaporean investors.

METUB secures $15.5 million from Morgan Stanley-managed fund to bolster creative economy

10-07-2024 19:24

Vietnamese startup METUB, which operates in the creative economy sector, has raised $15.5 million from a private equity fund managed by Morgan Stanley.

Warburg Pincus invests in Xuyen A hospital chain

15-04-2024 17:06

Private equity firm Warburg Pincus announced on April 15 it is investing in Xuyen A private general hospital group.

M&A Vietnam: Gearing up for a new era

30-03-2024 10:30

The M&A market in Vietnam at present is so much different than decades ago. As foreign investors step into a new era, understanding the intricacies of the Vietnamese market becomes paramount.

KKR scoops up a majority stake in Medical Saigon Group

22-01-2024 09:35

US private equity firm KKR has acquired a majority stake in Medical Saigon Group (MSG), becoming the largest shareholder of the eye hospital chain.

HSBC France retail bank sold to US fund Cerberus

02-01-2024 12:20

After more than two years HSBC transferred on Monday for an undisclosed amount its retail banking network in France to My Money Group, controlled by US private equity fund Cerberus.

Warburg Pincus celebrates 10 years in Vietnam

10-11-2023 20:21

Renowned private equity firm Warburg Pincus celebrated its 10th anniversary of investing in Vietnam on November 9 in Hanoi, with the attendance of Marc E. Knapper, US Ambassador to Vietnam, and Tran Duy Dong, Deputy Minister of the Ministry of Planning and Investment of Vietnam.

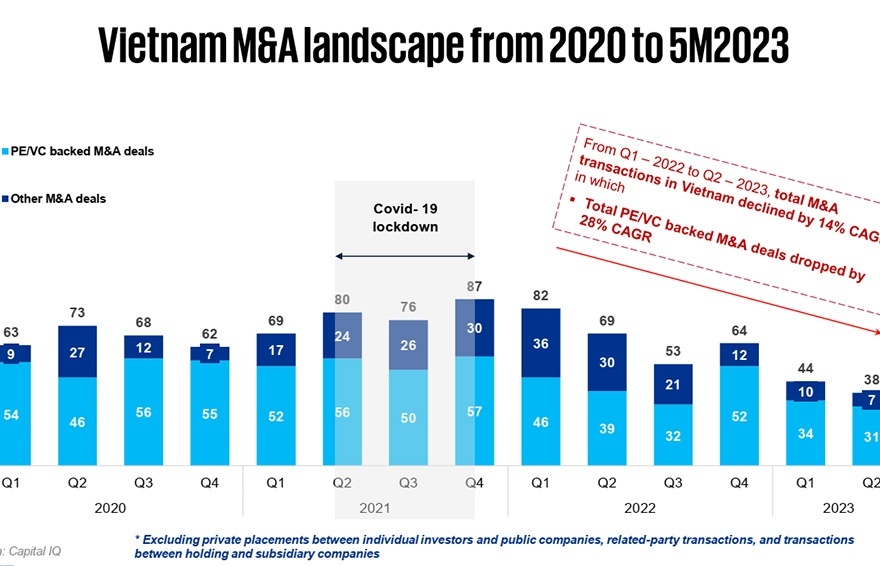

Fundraising challenges must be navigated in uncertain M&A market

20-06-2023 17:00

Warnings about a slowdown in the Vietnam merger and acquisition market, particularly for investment from private equity and venture capital (PE/VC), were raised in late 2022. As of now, we are experiencing one of the toughest downturns.

Mobile Version

Mobile Version