Advanced search

Search Results: 141 results for keyword "alternative lending".

GoBear to accelerate development for digital lending and insurance

21-01-2020 08:00

Three years after officially launching in Vietnam, GoBear closes a record year of on-year revenue growth to become the leading financial supermarket in Vietnam.

Foreign currency lending abolished – impact on enterprises

19-07-2019 14:47

Enterprises can borrow money in Vietnamese dong (VND) and then purchase foreign currency for payment when they need the capital to import input materials, say commercial banks.

Easy Credit launched consumer lending on Zalo

24-07-2019 13:43

Consumer-oriented consumer lender Easy Credit under state-owned EVN Finance has begun to implement its online loaning programme via Zalo.

Banks boost retail lending for solar energy

25-06-2019 08:15

Banks in Vietnam race to offer loans for household solar energy projects, using low interest rates and long repayment periods as incentives.

Social housing lending rate proposed to be lowered

04-03-2019 14:59

The HCM City Real Estate Association has proposed social housing lending rates be lowered to 3-3.5 per year to create favourable conditions for low-income earners to afford homes.

Experts forecast lending rates to remain stable

28-08-2018 11:19

Many commercial banks have recently increased deposit interest rates, but experts forecast that the rise will last only a short time and won’t have a domino effect on lending rates.

Central bank takes no responsibility for 'black' lending

03-10-2018 15:36

Some online lenders that offer very high interest rates are in fact a form of ‘black’ credit and the State Bank of Viet Nam (SBV) is not responsible for management over such activities, SBV deputy governor Nguyen Thi Hong has said.

Securities firms seek margin lending funds

05-01-2018 10:19

Many securities companies have opted to issue corporate bonds to raise capital to finance their margin lending service, following upbeat forecasts for the market in 2018.

Consumer lending in VN surged 65% in 2017

09-01-2018 16:00

Consumer lending in 2017 surged sharply by 65 per cent compared to 50.2 per cent in 2016, according to estimates of the National Financial Supervisory Commission (NFSC).

Stocks fall on worries of tight margin lending

17-01-2018 09:24

Vietnamese shares ended Tuesday on a negative note as large-cap stocks were hit by strong selling as investors worried about a draft amendment on the initial margin to be passed by market regulators.

Consumer lending potential in VN untapped: experts

28-09-2017 09:35

Researchers at Vietnam National University (VNU) on Wednesday presented results of a consumer lending survey showing that the majority of Vietnamese people have never used a consumer loan.

Thriving online lending carries potential risks

31-07-2017 16:30

Along with the development of digital technology, online lending is getting more popular by inducing numerous benefits for both borrowers and lenders. However, it also contains some possible risks that all should be wary of.

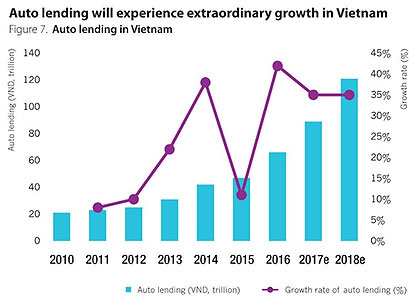

Auto lending growing rapidly in Viet Nam

09-05-2017 09:14

Auto lending in Viet Nam recorded faster growth than other Southeast Asian emerging markets in the period between 2011 and 2016, according to a research by Singapore-based The Asian Banker.

New regulations on lending activities of foreign credit organizations

16-02-2017 10:46

The State Bank of Viet Nam has issued Circular No.39/2016/TT-NHNN stipulating lending activities of foreign credit organizations and bank branches for customers.

VN bank profits surge on services, not lending

09-11-2016 09:06

Some commercial banks have reported high profits in the first nine months of the year thanks to a restructuring effort which focuses on services instead of lending as previously done.

Mobile Version

Mobile Version