Advanced search

Search Results: 198 results for keyword "Vietcombank".

Banks report higher profit

20-10-2019 15:16

Banks are reporting better profit for the third quarter this year, with Vietcombank leading the way despite the predicted slowdown in credit growth.

BIDV, Vietcombank, and Vietinbank amass nearly $2 billion in bad debts

04-08-2019 11:28

Growing bad debts reaching hundreds of millions of US dollars keep pressuring BIDV, Vietcombank, and VietinBank.

Vinamilk, Vietcombank, and PetroVietnam in top 100 of Asia300 ranking

12-07-2019 14:54

Covering everything from Indian computer services companies to Indonesian property developers, Asia300 offers a glimpse of the players aiming to be the dominant forces in the 21st century and the multinationals poised to challenge established Western brands, of whom Vietnam contributes five representatives.

Chip cards may minimise bank card crime

03-06-2019 11:46

Replacing magnetic strip cards with chip cards is expected to resolve the long-going security issues affecting bank cards, resulting in loss of money and personal data leaks in banks.

Vietnamese banks target more overseas markets

07-05-2019 10:32

Vietnamese banks are stepping up plans to expand their markets globally instead of focusing only on the Indochina region.

Vietcombank, PwC cooperate on digital banking transformation

16-04-2019 22:02

Vietcombank and PwC Consulting Vietnam have officially kicked off Vietcombank’s Digital Banking Transformation project today in Hanoi. This is considered a pioneering project of its kind among large commercial banks in Vietnam.

SHB warns of fake websites

25-02-2019 14:32

Following the troubles of VietinBank, Vietcombank, and BIDV, most recently, Saigon-Hanoi Commercial Joint Stock Bank (SHB) warned about fake websites imitating its official site to swindle customers.

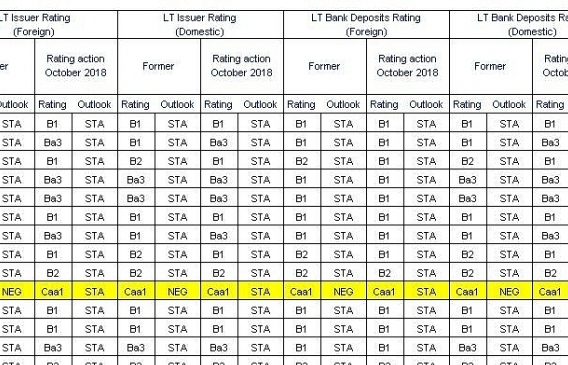

Moody’s upgrades ratings on Vietnamese banks

31-10-2018 15:45

Moody’s Investors Service has upgraded and affirmed the long-term local and foreign-currency issuer ratings and deposit ratings for numerous Vietnamese banks, and changed Sacombank’s outlook to stable from negative.

Banks race to fund green energy projects

29-10-2018 09:34

Commercial banks are rushing to provide loans for green energy projects amid a wave of investment in the growing industry, dubbed a landmark for the country’s renewable energy outlook.

Strong lenders continue to flourish

19-10-2018 14:00

Vietnamese banks have reported positive third-quarter results for 2018, continuing on the recovery path and making it easier for them to seek foreign capital in the future.

Quang Ngai and Doosan bring a new industrial cluster to Dung Quat EZ

23-08-2018 08:58

The expansion and opening of Vietnamese subsidiaries by six Korean companies with an investment sum of $11 million showed a cooperative effort between the Quang Ngai People’s Committee, Doosan Group and Vietcombank.

Vietnam M&A Forum: Top ten deals in 2009-2018

24-07-2018 17:35

During the past ten years, Vietnam continued to witness high-value mergers and acquisitions (M&A) transactions in a variety of sectors, such as food manufacturing, real estate, banking, and retail, among others.

Banks post impressive profit growth in H1 2018

21-07-2018 11:21

Many banks have reported impressive profit growth in the first half off 2018, compared to the same period last year, thanks to the high credit growth and the improvement from the retail banking segment.

Credit Suisse AG allocates $200 million credit package to FLC Group

14-07-2018 12:28

FLC Group is the latest partner of Credit Suisse in Vietnam, along with VPBank, Vietcombank, and FE Credit.

Banks to hike service fees this month

10-07-2018 11:07

After two months postponing the increase in service fees for ATM cash withdrawals as required by the central bank, some commercial banks have now resumed the plan, announcing that a new service fee framework will apply from the middle of this month.

Mobile Version

Mobile Version