Moody’s upgrades ratings on Vietnamese banks

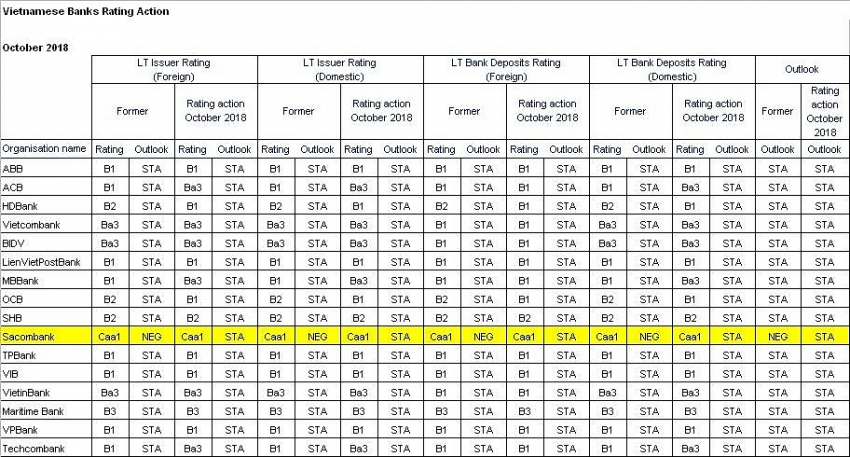

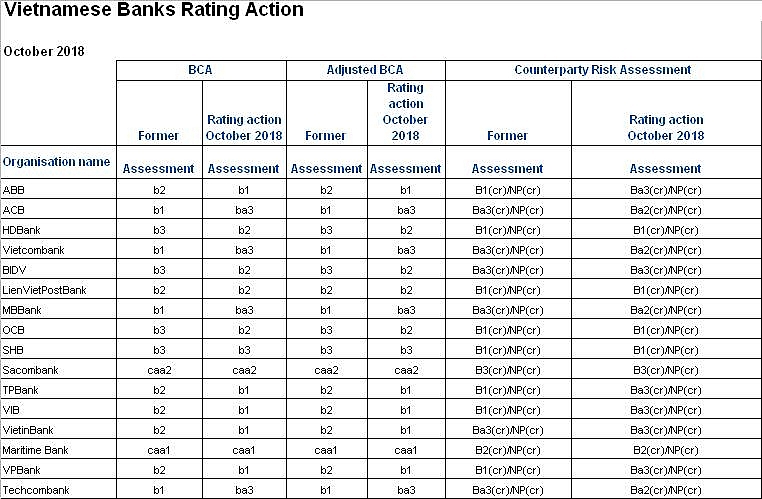

At the same time, Moody’s has upgraded and affirmed the long-term Counterparty Risk Ratings (CRRs) and Counterparty Risk Assessments (CRAs) for some 16 local banks. The credit rating agency has also upgraded and affirmed the baseline credit assessments (BCAs) and Adjusted BCAs for the same number of banks.

The outlook on Sacombank’s ratings was changed to stable from negative, to reflect its stabilised solvency profile and progress in the recovery of problem assets.

The ratings outlooks on the other 15 rated Vietnamese banks remain stable.

|

The rating action reflects Moody’s expectation that the strong economic growth evident in Vietnam will support the asset quality and profitability of the banks. To capture these developments, Moody’s increased Vietnam’s Macro Profile to ‘Weak+’ from ‘Weak.’

|

The upgrade of the BCAs of 12 Vietnamese banks, according to Moody’s, is driven by the higher Macro Profile, and also by these banks’ progress in writing off legacy problem assets.

Upgrade of BIDV, Vietcombank, and VietinBank’s BCAs

The upgrade in the banks’ BCAs largely reflects improvements in asset quality. Funding and liquidity for these banks are stable, a result of their relatively lower reliance on market funds. At the same time, capital remains a weakness for all three.

Upgrade of ABB, ACB, MBBank, OCB, TPBank, VIB, and Techcombank’s BCAs

The upgrade in these banks’ BCAs reflects improvements in their standalone credit strength, particularly progress in writing off legacy problem assets, and in the case of OCB, TPBank, and Techcombank, a strengthening of their capitalisation.

Moody’s expects profitability for these seven banks to improve over the next 12-18 months as the burden of credit costs reduces.

Upgrade of VPBank’s BCA

The upgrade of VPBank’s BCA takes into account its high profitability and strong capitalisation, which offset the high credit risks from its consumer finance portfolio.

Upgrade of HDBank’s BCA

The upgrade in HDBank’s BCA reflects improvements in the bank's capitalisation and profitability. At the same time, this rating action also takes into account the impending merger between HDBank and Petrolimex Group Commercial Joint Stock Bank (PGBank, unrated), a small private sector bank in Vietnam.

Based on the two banks’ financials for 2017, the key credit metrics of the merged entity, with the exception of asset quality, will be broadly similar to that of HDBank.

Moody’s calculates the pro forma problem loan ratio of the merged entity – including loans under categories 2-5 of Vietnamese accounting standards, and gross bonds issued by Vietnam Asset Management Company (VAMC) – to be at around 6.8 per cent, while that of HDBank is 4.9 per cent.

Moody’s expects the merged entity's return on tangible assets to decline because of higher credit and operating costs. Moody’s expects funding and liquidity for the bank to remain stable.

Affirmation of Maritime Bank, Sacombank, SHB, and LienVietPostBank’s BCAs

The affirmation of MSB, SHB, and LienVietPostBank’s BCAs reflects Moody’s expectation that the banks’ credit profiles will broadly remain stable over the next 12-18 months.

The solvency of these banks is modest compared to that of other rated Vietnamese banks, but somewhat balanced by their funding and liquidity.

The BCA of Sacombank was affirmed because the bank still faces a significant risk from its problem assets, which exceeded 20 per cent of total assets as of June 30, 2018.

The adjusted BCAs of all rated Vietnamese banks are at the same level as their BCAs as Moody’s did not factor in any affiliate support for these banks.

| Moody’s: Vietnam’s banks show diverging capital profiles The profitability of Vietnamese banks is strengthening as robust economic growth fuels credit demand and supports an improvement in asset quality, but challenges are also ... |

| Moody's: Vietnam's credit profile reflects robust growth Moody’s Investors Service said in its latest announcement that the Vietnamese government’s B1 positive credit profile reflects the economy’s robust growth, supported by the country’s ... |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Hanoi police roll out comprehensive security for upcoming elections (March 07, 2026 | 10:00)

- Finance Minister Nguyen Van Thang meets voters in Dien Bien ahead of NA elections (March 06, 2026 | 17:23)

- Viettel and Qualcomm to co-develop AI smartphones (March 06, 2026 | 09:00)

- Ministry: no further merger of government units (March 05, 2026 | 14:43)

- Greece seeks to expand economic cooperation with Vietnam (March 05, 2026 | 14:05)

- Middle East tensions drive cost pressures for seafood exporters (March 04, 2026 | 13:56)

- VN-EAEU trade talks target market access and supply diversification (March 04, 2026 | 11:27)

- Online election contest launched to boost public understanding (March 04, 2026 | 09:27)

- US-Iran conflict affecting asset prices (March 04, 2026 | 09:17)

Tag:

Tag:

Mobile Version

Mobile Version