Advanced search

Search Results: 1,371 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

New tax policy has no blind spots

22-06-2017 11:15

The new price range for the calculation of the natural resource tax that will come into effect from July 1, 2017is found to be remarkably wide. Moreover, in specific cases, the highest price used to calculate the tax is 1.42 times as much as the minimum level. Still, Nguyen Huu Tan, deputy director of the Tax Policy Department under the General Department of Taxation, told VIR’s Manh Bon that illegal profiteering is simply not possible with this tax policy.

MoF rejects tax calculation changes

15-03-2017 14:29

The Ministry of Finance has rejected a petition from traditional taxi companies to introduce tax calculation measures such as Uber and Grab cars, Vietnam News Agency reported.

Tax reform and transfer pricing

26-12-2016 08:00

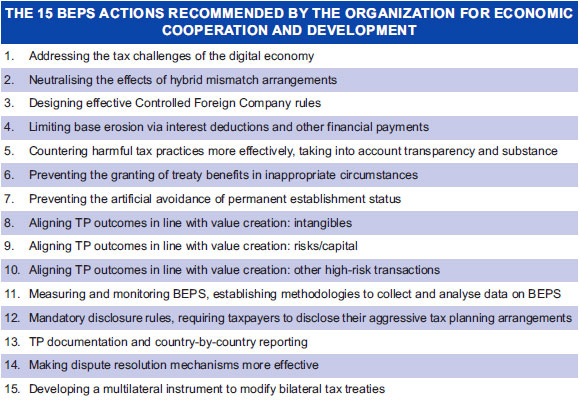

The year 2016 marked a major watershed regarding transfer pricing in Vietnam, with regulations now having been in effect for a decade, and the announcement of a new round of tax reforms by the Ministry of Finance (MoF) introducing regulatory changes to tackle base erosion profit shifting practices.

Circular outlines tax incentives

21-07-2016 09:45

The finance ministry issued Circular No. 83/2016/TT-BTC (“Circular 83”) on June 17, 2016. It guides the implementation of investment tax incentives prescribed in the Investment Law and government decree No. 118/2015/ND-CP, which details and regulates several articles of the Investment Law.

Expat tax in VN to come under scrutiny

25-08-2016 10:01

Viet Nam is likely to intensify scrutiny of income tax paid by foreign workers, a seminar heard in HCM City yesterday.

VASEP raises voice against US tax

21-09-2016 09:29

Higher anti-dumping duties on Vietnamese frozen warm-water shrimp exports levied by the United States Department of Commerce (DOC) will affect the psychology of businesses and shrimp farmers in Viet Nam.

PM okays petrol tax changes

21-03-2016 15:00

Prime Minister Nguyen Tan Dung has approved calculation of petroleum import tax based on weighted average of the tariffs, taking into account Most Favoured Nation (MFN) status and Free Trade Agreement (FTA).

IT businesses to enjoy tax incentives soon

26-02-2016 14:54

Deputy Prime Minister Vu Van Ninh has recently assigned the Ministry of Finance to finalize the draft government resolution on tax incentives for information technology (IT) businesses before collecting opinions of relevant ministries and submitting it to the Government this month.

Business tax cheats found out

24-01-2011 20:31

The Ministry of Finance is checking up on the application of corporate income tax preferences to small and medium sized enterprises during the global economic crisis.

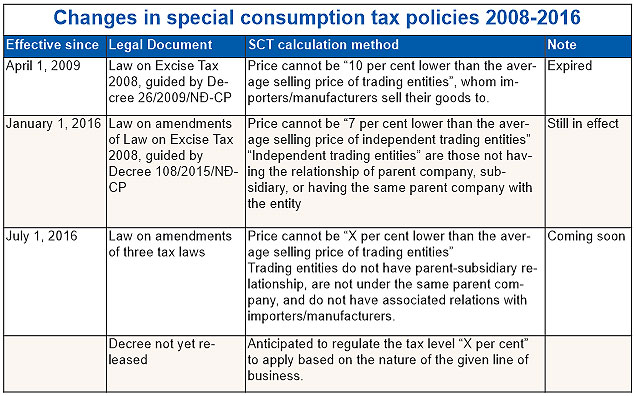

New tax law stymies business

13-04-2016 10:56

Though a new excise tax calculation method has been legislated, it seems impossible for some businesses subject to the tax to declare tax liability compliant with the new requirements.

Understanding the US-Vietnam tax agreement

24-02-2016 15:53

On July 7, 2015 the governments of Vietnam and the US entered into an “Agreement for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion With Respect to Taxes on Income”. Nguyen Huu Hoai, a partner of law firm Russin & Vecchi, summarises key points of the agreement from Vietnam’s perspective.

First full tax regime for securities

26-07-2004 18:15

The first comprehensive tax regime for the securities sector – including new tax breaks – is expected in August.

New tax to be levied on auto imports

10-11-2015 09:00

The Government will levy a special consumption tax on cars with 24 seats and below from January 1, 2016, according to a Prime Minister's new decree.

Gov't prepares IT tax incentives

11-01-2016 10:35

Deputy Prime Minister Vu Van Ninh this week asked the Finance Ministry to complete a draft resolution on tax incentives for IT firms and collect suggestions from relevant ministries and the Ministry of Justice for submission to the Government this month.

Mobile Version

Mobile Version