Advanced search

Search Results: 1,371 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

New guidelines on tax policies

28-06-2016 09:13

The Law on amendments and supplements of some articles of the Law on Value Added Tax, the Law on Special Consumption Tax, and the Law on Tax Management will come into force from July 1, 2016.

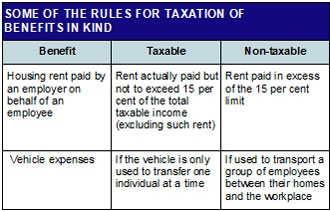

Lowdown on tax for expatriates

24-01-2011 08:00

“Vietnam is a great destination for expatriates, provided the intricacies of the tax and regulatory system are properly navigated”

The use and abuse of tax havens

16-05-2016 08:00

The infamous Panama Papers leak has made headlines in Vietnam, naming some high-profile Vietnamese businesspeople. To help readers gain a better understanding of this matter, lawyer Luong Van Trung from Lexcomm Vietnam LLC, explains in detail about the Panama Papers and the global issue of tax havens.

PepsiCo in tax limbo

04-04-2016 08:02

The long-running tax dispute between Suntory PepsiCo Vietnam Limited and Vietnam’s tax authorities over preferential treatment for its expanded investment project in the Mekong Delta city of Can Tho is continuing with no end in sight.

Firms welcome tax revisions

16-12-2013 15:03

The business community may celebrate upcoming new changes to corporate income tax policy.

Firms need tax grace

31-10-2012 10:31

National Assembly members are expressing fears that the removal of tax grace period in the draft revised Law on Tax Administration will put additional financial burdens on enterprises already facing many difficulties.

Filing big tax changes

28-08-2012 09:37

Minister of Finance Vuong Dinh Hue sheds some light on the revised Law on Tax Administration slated to come into force from July 1, 2013, half a year earlier than initially projected.

Further amendments could ease tax environment

22-02-2023 12:30

The Vietnamese government made welcome efforts in providing support to all enterprises in 2022 with effective tax policies including deferral and VAT reduction of 2 per cent, as well as positive and transparent changes of regulations such as the circular on tax administration, including in e-commerce.

Tax extension excites firms

18-09-2011 22:59

Large-scale enterprises in Vietnam might breathe easier if a proposed corporate tax paperwork deadline extension becomes reality next year.

What businesses should prepare for the tax inspection

23-06-2022 19:44

As tax authorities are tightening their grip on tax collections, taxpayers in Vietnam need to prepare for the growing number of inspections in the upcoming years.

VCCI proposes changes to tax policies

14-03-2022 21:15

The Vietnam Chamber of Commerce and Industry (VCCI) recently sent an official dispatch to the Ministry of Finance, suggesting changes to tax policies.

Participants get to grips with tax changes for 2022

05-12-2021 21:32

Details on the implementation of the Law on Tax Administration have been put across by the Hanoi Centre for Investment, Trade, and Tourism Promotion in a bid to prepare fresh detailed guidelines for tax agencies and businesses.

New tax on land, property transfers

24-08-2011 08:10

People who transfer land use rights and ownership of houses and apartments will be subject to a tax of 25 per cent on their income from the transactions, said the Ministry of Finance.

New tax rates on second-hand cars

16-08-2011 20:11

The Customs Department in Vietnam has begun to implement new tax rates on second-hand cars imported into Vietnam on all the country’s border crossings since August 15, as per the Prime Minister’s directives.

Tax aid comes as relief for businesses

18-08-2021 15:00

Vietnam’s tax agencies and banking groups are taking more drastic concerted efforts to buttress the domestic economy and foster resilience against the current wave of COVID-19 infections.

Mobile Version

Mobile Version