Lowdown on tax for expatriates

Vietnam has become an increasingly popular destination for expatriates. The country has become more and more open over the last few decades and, as such, both individuals and companies have recognised the country as a great investment location. Thus foreign investment continues to rise and there is a need for employees with international experience to compliment the skills and experience offered by their local counterparts.

The new year came with many new policies that will have a significant impact on the domestic market. Although there have been several changes to the tax regime, few of them are specific to expatriate employment. However, with a new year starting, expats are often on the move and it seems timely to recap the major issues often faced in Vietnam. In this article, we explore some of the basic regulations which foreign individuals should be aware of when considering working in Vietnam.

Expatriates working in Vietnam will be subject to Vietnam taxes and work permit requirements. Their liability to tax will be principally determined by their residency status and where the income is considered to be sourced.

Pre-arrival procedures and employment regulations

Expatriates planning on living and working in Vietnam should be aware that certain procedures should be initiated before arrival. In Vietnam these procedures are fairly clear. At least 20 days prior to commencement of work in Vietnam, the employer must apply for the issuance of a work permit for the expatriate employee with the Department of Labour in the province or city where the expatriate will regularly work. This department will issue a work permit for the foreign employee within 15 working days from the date of receipt of a complete and valid application file.

Expatriates planning on living and working in Vietnam should be aware that certain procedures should be initiated before arrival. In Vietnam these procedures are fairly clear. At least 20 days prior to commencement of work in Vietnam, the employer must apply for the issuance of a work permit for the expatriate employee with the Department of Labour in the province or city where the expatriate will regularly work. This department will issue a work permit for the foreign employee within 15 working days from the date of receipt of a complete and valid application file.

In addition to having a valid work permit, certain requirements with regard to advertising the position and the ratio of Vietnamese to non-Vietnamese employees must be met.

Recent regulations have removed the 3 per cent limit on the number of foreign expatriates working for Vietnamese enterprises. Thus, employers are now permitted to employ expatriates where Vietnamese workers are not yet able to fully satisfy the production and business requirements, regardless of the ratio of expatriate to Vietnamese employees. However, there are still some restrictions on expatriate employment at management levels and above.

In the case of a foreigner internally transferring within an enterprise, at least 20 per cent of the total number of the managers, executive directors and experts of each enterprise must be Vietnamese citizens. However, each foreign enterprise is permitted to have a minimum of three managers, executive directors or experts who are not Vietnamese, regardless of the ratio of Vietnamese to expatriates.

Any foreign individual working in Vietnam must have a work permit unless:

- They are entering Vietnam to work for a period of less than three months.

- They are a member of a limited liability company with two or more members.

- They are the owner of a one member limited liability company.

- They are a member of the board of management of a shareholding company.

- They are entering Vietnam to offer services.

- They are entering Vietnam to work to resolve an emergency situation subject to conditions; or

- They are a foreign lawyer to whom the Ministry of Justice has issued a certificate to practice law in Vietnam in accordance with legal regulations.

Residence for tax purposes

Tax residency is an important issue as an individual’s residency status is used to determine tax rates, allowances and declaration methods. Generally, an individual will be treated as a resident in Vietnam for tax purposes if they stay in Vietnam for 183 days or more in the 12-month period from the date of initial arrival in Vietnam. However, in order to determine residency for double tax treaty purposes, other specific rules may apply. Clearly, understanding the residency regulations is important as individuals overstaying their welcome may be exposed to additional taxes, higher rates and more detailed information disclosures.

Tax returns and compliance

Complying with tax regulations in an unfamiliar jurisdiction is often more complex than it may first appear. Understanding the nuances of the local system is imperative to maintaining compliant and at the same time, tax efficient. The pertinent regulations are as follows:

Complying with tax regulations in an unfamiliar jurisdiction is often more complex than it may first appear. Understanding the nuances of the local system is imperative to maintaining compliant and at the same time, tax efficient. The pertinent regulations are as follows:

For the first year, the tax year is the first 12 months from the date of first arrival in Vietnam.

For salaries and wages, the tax procedures must be performed by the employer or its authorised tax agent following the withholding method.

Residents with income from overseas must register, declare, pay and finalise their Vietnamese tax liability directly at the local tax office.

Personal income tax is generally required to be declared and paid monthly by the employer or by the employee declaring directly with the tax office and finalised on an annual basis.

The monthly declaration dossier must be submitted not later than the 20th day of the following month. The deadline for the submission of the annual tax finalisation dossier is the 90th day from the end of the calendar year.

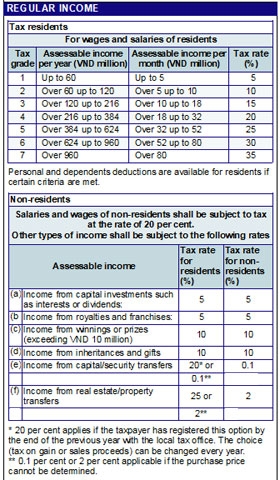

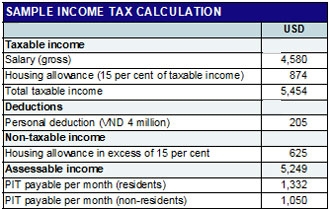

Current personal income tax rates are dependent upon the individual’s tax residency status and the type of income.

Vietnam imposes personal income tax on income depending on its source and the residence status of the individual.

lFor residents, taxable income includes income from all sources (i.e. worldwide income).

lFor non-resident expatriates, taxable income includes only Vietnam sourced income.

An individual is liable to tax on income. Tax on income includes salaries, wages, allowances and subsidies, and most forms of remuneration. The source of employment income is generally determined based upon where the services are rendered, regardless of where the remuneration is paid. Relief or reductions in personal income tax may be applicable under a tax treaty provided certain conditions are met.

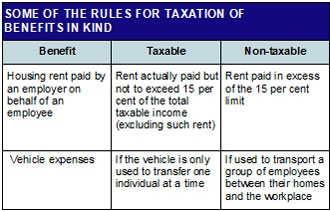

Benefits (in kind)

Generally, all wages, salaries and payments in cash or in kind in respect of employment exercised in Vietnam are taxable in full. The benefits in kind are required to be valued in monetary terms for tax calculation purposes.

Deductions against income

The following deductions are allowed to residents:

The following deductions are allowed to residents:

1. Personal deduction of VND4 million per month and dependent deduction of VND1.6 million per month per dependent

2. Compulsory insurance premiums

3. Charitable contributions subject to certain requirements.

If taxable income is received in foreign currency, then it must be converted into Vietnamese dong at the average trading exchange rate on the inter-bank foreign currency market as of the date when the income arose. Any type of foreign currency that does not have an exchange rate with the Vietnamese dong must first be converted into a type of foreign currency with such an exchange rate.

Social security taxes

Expatriates are not subject to social security taxes in Vietnam. However, mandatory health insurance payments are regulated.

Social and health insurance payments which are compulsory in the home country of the employee are non-taxable. However, supporting documentation should be submitted to the tax office in order to have the value of these insurance payments excluded from taxable income.

Conclusion

Remaining compliant with all local tax regulations may not be at the first thing one considers for many expatriates. However, attention should be paid to avoid any unpleasant surprises. As this article demonstrates, working in a new country is never as simple as packing a bag and catching a flight. Care should be given to ensuring that necessary documentation has been prepared before entering the country, and that operations are planned in such a way as to be tax efficient when multiple jurisdictions are involved. Vietnam is a great destination for expatriates, provided the intricacies of the tax and regulatory system are properly navigated.

If you have any questions or need further clarification, please do not hesitate to contact us at Ronald.Parks@gt.com.vn or (08) 3 910 9120

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version