Advanced search

Search Results: 105 results for keyword "private equity".

Online retail transition inspires major moves

26-05-2021 08:00

The growing collaboration efforts between traditional retailers and e-commerce platforms is expected to accelerate omnichannel transition in Vietnam.

Toshiba CEO resigns as buyout offer stirs turmoil

14-04-2021 11:10

Toshiba's president Nobuaki Kurumatani has resigned, the firm announced Wednesday, as a buyout offer from a private equity fund reportedly stirs turmoil inside the Japanese company.

ABC World Asia leads $24 million Series B round in Kim Dental

31-03-2021 14:55

ABC World Asia, the Singapore-based private equity fund focused on impact investing across Asia, today announced that it has led a $24 million Series B round in Kim Dental – one of Vietnam’s leading dental system operators – alongside existing backer Aura Private Equity and others. The new capital will further support Kim Dental with expanding the delivery of affordable and reliable oral healthcare services across Vietnam.

Vietnam standing its ground in private equity realm

10-03-2021 10:58

The COVID-19 pandemic has disrupted countless lives and businesses, causing the world’s economy to slump as global GDP shrunk by 4.1 per cent in 2020, as estimated by S&P. Nonetheless, Vietnam stood out as one of the brighter spots of 2020 with an estimated GDP growth rate of 2.91 per cent thanks to its effective handling of the pandemic.

NPX Point Avenue closes stellar Series A round for K-12 primacy

05-03-2021 08:00

Named as one of Vietnam’s SME 100 Fast Moving Companies, Singapore-based NPX Point Avenue, an education technology company focused on the fast-growing K-12 private international school market and K-12 after school training market, recently closed $12 million in a Series A funding round led by Hong Kong-based private equity firm Gaw Capital.

Lodgis Hospitality’s long-term vision and investment strategy in Vietnamese tourism

04-03-2021 08:00

Lodgis Hospitality – the investment partnership between the leading global private equity firm Warburg Pincus and Vietnam’s leading investment manager, VinaCapital – is focused on Vietnam’s tourism industry, with the strategic aim of supporting the development of Vietnam as an international tourism destination by delivering a range of high-quality hospitality real estate developments and services.

Cross-border dealmaking bridging expectations

30-11-2020 08:55

Asia-Pacific and the continent as a whole has been and continues to attract a lot of foreign investment, having cemented its position as the region with the highest growth rates in the world, drawing in foreign investors and private equity funds by the droves.

Bright prospects for private equity

27-10-2020 19:05

Dealmaking in the private sector is expected to grow as more private equity funds target the Vietnamese market.

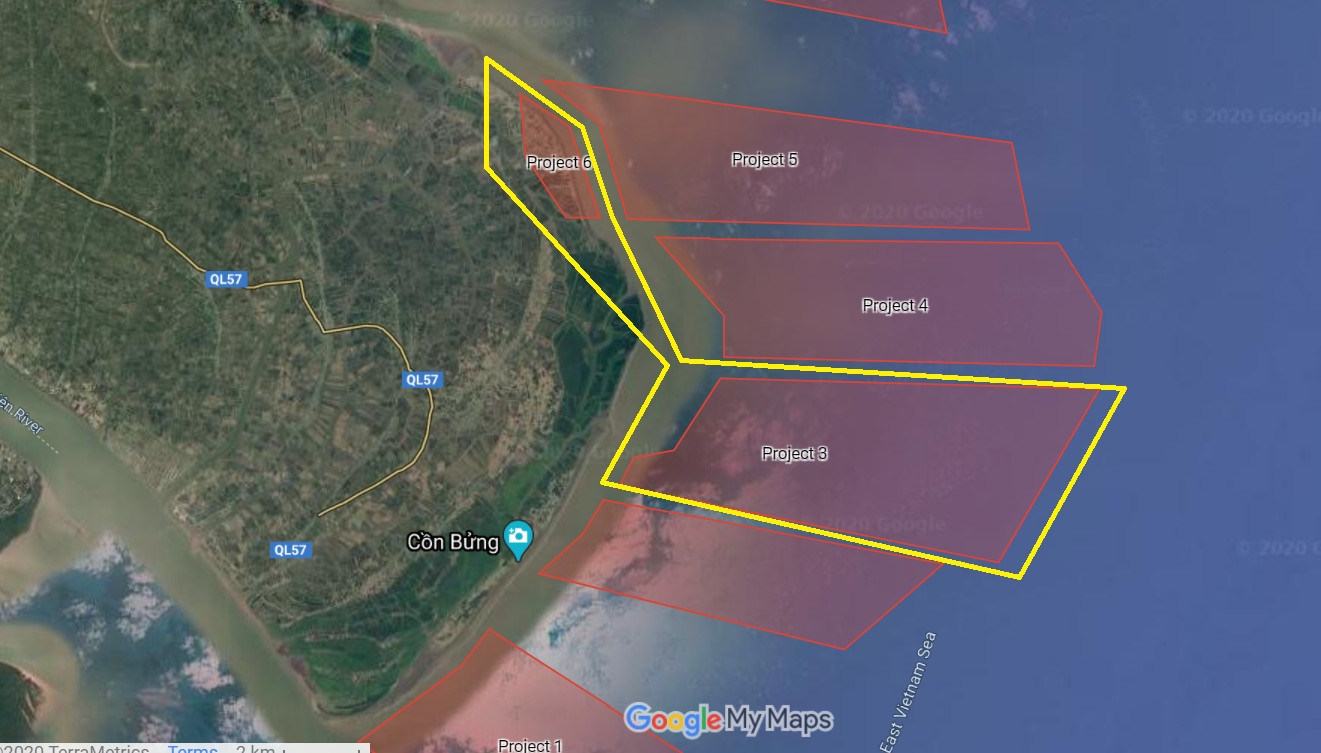

Queen Capital Finance signed MoU to jointly develop 560MW of wind farms in Vietnam

05-10-2020 13:19

The premier Asia-focused independent private equity investment firm, Queen Capital International Limited, signed an MoU with Lee&Lee JSC and Thien Phu Energy Investment JSC for the joint development of two wind farms with a total installed capacity of up to 560MW.

Gaw NP Industrial pushes for 2021 operation date

07-05-2020 08:00

Gaw NP Industrial, the latest development in Vietnam funded by global real estate private equity firm Gaw Capital Partners, is actively pushing its investment process in order to be operational in the first quarter of 2021.

Penm Partners fifth fund held up by COVID-19 uncertainties

17-03-2020 16:52

Danish private equity company Penm Partners is seeing a sluggish fundraising process for its fifth fund as the firm encountered choppy waters due to the COVID-19 outbreak.

Lone Star Funds to acquire BASF’s Construction Chemicals business

23-12-2019 16:38

BASF and an affiliate of Lone Star, a global private equity firm, signed a purchase agreement for the acquisition of BASF’s Construction Chemicals business.

Gaining from PE involvement

02-07-2019 09:56

During the development journey of a private company, there will be points when private equity funding is critical for the company to grow and prosper. Nguyen Thi Ngoc Chau, senior manager of transaction advisory services at Grant Thornton Vietnam, outlines the factors involved in ensuring both investors and investees are on the same page when working together.

Warburg Pincus focuses investment on China, Southeast Asia and Vietnam

28-06-2019 14:58

New York-based international private equity firm Warburg Pincus has made the final close for its equity fund in China-Southeast Asia and Vietnam (China – SEA II). The equity fund attracted $4.25 billion investment from Warburg Pincus' current funds as well as new investors.

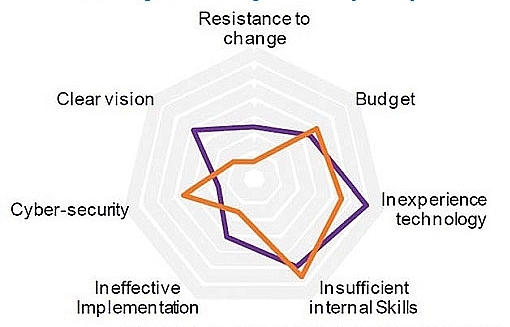

Focus on upside lessons from the private equity

24-06-2019 09:15

Maintaining, or returning to, sustainable profitable growth is always a huge challenge for any business, with many of them initiating complex transformation programmes to achieve this goal. Unfortunately, many of these initiatives often fail to deliver the expected benefits. One of the primary reasons for these failures is a lack of attention to the upside sources of value.

Mobile Version

Mobile Version