Online retail transition inspires major moves

|

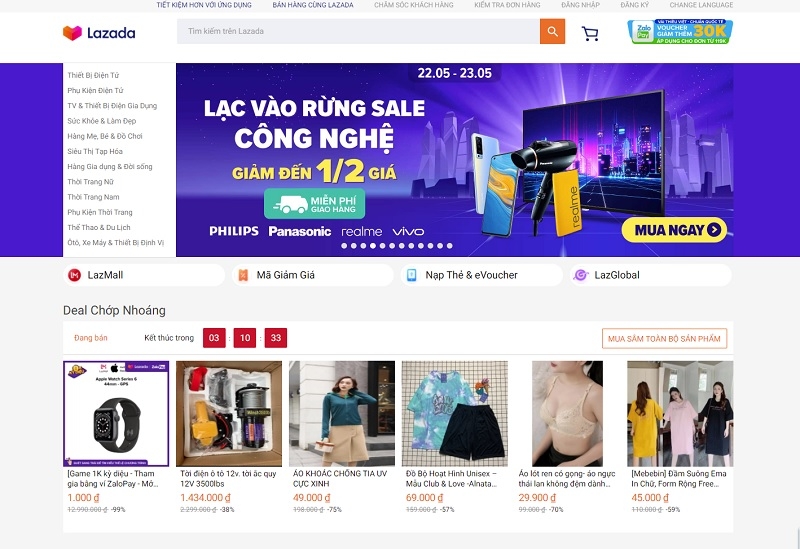

| Online retail transition inspires major moves - illustration photo |

Chinese commerce giant Alibaba Group and Baring Private Equity Asia are leading a consortium to acquire a 5.5 per cent stake in Masan Group’s The CrownX with a total cash consideration of $400 million.

The CrownX, which consolidates Masan’s interest in VinCommerce (VCM) and Masan Consumer Holdings, is valued under the deal at $6.9 billion, equivalent to $93.50 a share. The investment also opens up a stronger partnership between The CrownX and Alibaba’s Lazada platform to expand an omnichannel presence in Vietnam.

Specifically, Lazada is the main vehicle for Alibaba’s expansion into the Southeast Asian consumer market. In 2018, Alibaba announced it would inject $2 billion into Lazada.

Richard Burrage, CEO of market research company Cimigo, told VIR that this moves Masan and VinMart+ firmly into the omnichannel space, driving expansions in both stores and ecommerce. VinMart+ can become pick up points for e-commerce improving efficiencies, but also enabling a wider portfolio of consumer goods to be purchased than those available on the shelf, acccording to Burrage, and this will provide a huge boost packaged consumer goods purchased online and will accelerate growth of e-commerce sales in the grocery sector.

“Meanwhile, Lazada will benefit from the network of VinMart+ stores as distribution points which will provide further convenience for the consumer and operational efficiencies,” he added.

According to Nguyen Dang Quang, chairman of Masan Group, the group aims to develop VCM from a pure grocery offline store into a seamless on-to-offline “point of life” – a total consumer solution spanning fast-moving consumer goods (FMCG), fresh foods, and financial and value-added services accounting for over 50 per cent of the consumer wallet. This was the end game the group envisioned when it entered the retail space and the critical foundations are and will be in place in 2021 to start its point of life journey.

Masan Group has aspirations for The CrownX’s online gross merchandise value to account for at least 5 per cent of its total sales value in the upcoming years, and it is expected that the partnership with Lazada helping Masan Group fulfil its vision quicker.

In the same suit, other retailers are also stepping up the omnichannel strategy to keep up with evolving consumer behaviour changes during the crisis. Yol Phokasub, CEO of Thailand’s Central Retail Corporation Pcl., revealed that the company intends to enhance the customer experience through the development of its omnichannel platform including online sales channels; e-commerce platforms such as Lazada, Shopee, and Tiki; quick commerce such as Grab, Chopp, and Baemin; and social platforms like Zalo.

“Our supermarket chain has developed omnichannel services in response to the COVID-19 crisis with 5 per cent sales contribution at the end of 2020 from zero at the beginning of the year, while Nguyen Kim electronics chain experienced eight per cent,” Phokasub added.

In the same vein, a representative of Japan’s AEON Vietnam said that the retailer is carrying out numerous digital transformation activities such as developing its own website and an AEON app as well as partnering with grocery delivery partner GrabMart. The company will speed up the omnichannel transition in the 2021-2022 period in order to stay relevant.

Likewise, Mobile World Group is channeling its resources to develop both online and offline presence for its retail chain Bach Hoa Xanh. The retailer is making efforts to build a user-friendly website which features over 10,000 items. The retailer is also developing a modern logistics system with 30 pick-up centres across the locality to create a seamless omnichannel experience for consumers.

According to a Vietnam Omnichannel 2020 report by Kantar Worldpanel, the online channel has reached over half of the population yet has many obstacles to get over in order to tap into the other half – mostly people over 50 years old. Online shopping for FMCG has seen a step change in monthly shopper traffic under the pandemic, which will likely to accelerate afterwards, the report said. With current trends, it is expected that monthly penetration will be between 17-25 per cent in one year.

“For FMCG purchases, more and more consumers are moving online. There is still headroom for further growth in both the shopper base and shopping traffic, which is expected to be more incremental to the FMCG market,” said the report.

The e-Conomy SEA 2020 report from Google, Temasek, and Bain & Company pointed out that e-commerce has driven significant growth in Vietnam at 46 per cent, alongside strong growth across most sectors except for travel. Looking at 2025, the overall internet economy will likely reach $52 billion in value, re-accelerating to around 29 per cent compound annual growth rate.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version