Gaining from PE involvement

|

| Nguyen Thi Ngoc Chau |

Both academia and practitioners point out that a company that accepts private equity (PE) funding can harvest from its investors benefits in four key areas: industry knowledge, networking, people, and finance.

However, accepting a PE investor on board can be a very tough decision for business owners because it is not like the story of a bank giving loans, where the bank just simply gives money to the company and basically remains an outsider. PE investors become insiders in the company.

In our Private Equity Investment Survey 2019, Grant Thornton gathered perspectives from both investors and investees with regards to PE funding. The survey report noted key investment opinions such as the positive economic outlook for 2019, Vietnam being the most attractive investment destination among selected ASEAN markets, and fintech, education, and green energy being among the top three PE investment sectors.

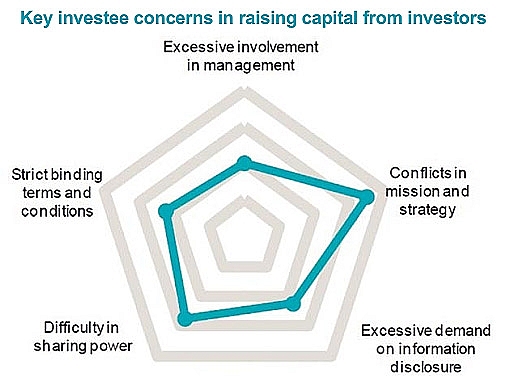

When asked what the key concerns are when raising capital from PE funds, the responses from private companies showed concerns with different levels of significance, at the top of which were “Conflicts in mission and vision” and “Difficulty in sharing power”.

The factors involved

These concerns are the basis for opinion divergence in different areas as noted in the survey results.

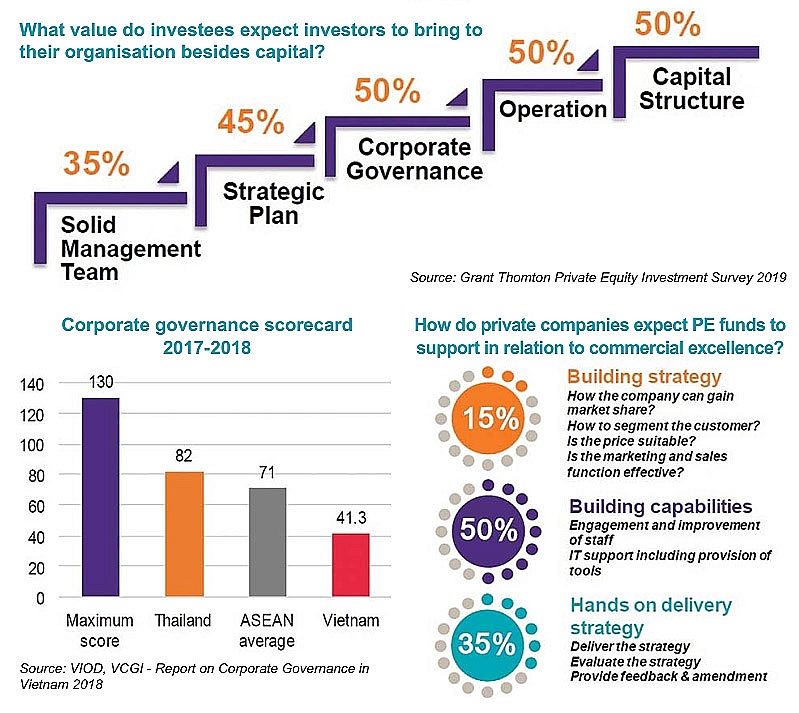

The first area is in commercial excellence. While both sides agree that it is one of the key fundamental shifts in approach that can prepare private companies to power a new wave of value creation, the concern on strategy difference as well as sharing of power seems to result in a response where 85 per cent of respondents place the importance on building capabilities and hands-on delivery, while only 15 per cent say they need investors to support in strategy building.

Investors and investees shared similar viewpoints about the second area, of the digitalisation level in private companies in Vietnam. Most of these companies are only at the early stage of the digital transformation journey. Unlike established enterprises with abundant resources, small and medium private companies in Vietnam are slow to catch up with the trend.

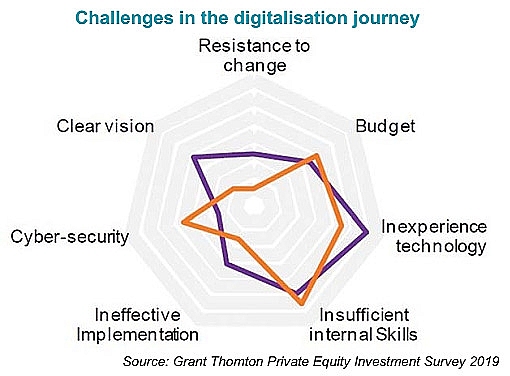

However, when asked about challenges in the digitalisation journey for private companies, significant matters raised by PE investors included a lack of clear vision, resistance to change, and ineffective implementation. On the other hand, these factors were of low concern to investees, which appears to be more evidence supporting the concern of conflict in the strategy and vision of both sides.

The third factor is talent management. In the survey, 92 per cent of PE investors chose a strong management team as the main source of value creation in recent successful deals.

Nevertheless, investors pointed out that it is difficult to put the right talent in place. Some 70 per cent of PE funds have challenges in terms of people and leadership with a majority of their portfolio companies.

In the viewpoint of the other side, 70 per cent of private companies believe they have a solid management team. Furthermore, the survey reveals that private companies in Vietnam only rank “building a solid management team” as the fifth priority factor among six aspects they expect PE investors to support.

The divergence in viewpoint is also reflected in the corporate governance area. A majority of private companies in our survey believe the current state of corporate governance practices in their companies is good, and particularly high based on a few areas. In one, 85 per cent said their organisation is in good compliance with laws, regulations, and best practices. In another, 80 per cent thought transparency, and quality of financial and non-financial information of their organisations are in a good status.

However, in the view of experts, corporate governance in Vietnam is still poor. A study in Vietnam conducted by the Vietnam Institute of Directors and the Vietnam Corporate Governance Initiative in 2018 did reveal a contradiction. The findings show that improper management practices and lack of effective corporate governance are hindering Vietnamese companies’ competitiveness, making them “slow to grow”.

In addition, together with difficulties in sharing power, the survey also highlighted that high valuation and lack of attractive deal opportunities are the top two challenges for private equity investment in Vietnam.

|

|

|

How to bridge the gaps

Fundraising from PE firms can be a difficult process, however, businesses could better benefit from investors’ financial capability, profound expertise, and extensive networks in the industry. Being a knowledgeable business owner with a clear understanding on investor strategy, and with proper preparation before approaching investors, business owners could help their companies make the most of those benefits that PE firms can bring.

Once invested, PE firms will be in the same boat with the company’s owner. Their profits will depend on the growth and profitability of the company. If you win, they win. If you fail, they fail. So while the money is important, it is essential that private company owners find an investor that they trust and can see themselves working and collaborating with, rather than keeping the mindset of having to deal with an intruder.

Further, in order to have a smooth deal process, it is both recommended by PE funds and most merger and acquisition advisors for private companies to go through a preparation stage before approaching investors, in order to ensure they are ready. Companies could take advantage of the preparation stage to “groom” their business to make it more attractive to investors. Those cosmetic mechanisms could be migrating from two sets of accounts to one, conducting a tax inspection to mitigate any potential risks that may exist, and clearing up other non-compliance issues, for example.

After a sale and purchase agreement is signed and funds have been transferred, the deal is not closed as people would normally believe. For business owners and the PE fund, it is the start of the new journey. The investment terms vary, but generally funders will want a seat on the board, appoint particular people to the management team, and have a say in all the major decisions of the company. It is important to get all these details worked out and agreed before signing.

In order to have a happy marriage and make the most from such a relationship, both PE firms and its portfolio companies need to thoroughly understand the expectations of the other side, and any significant gaps in those expectations should be fully aware and properly filled up before entering into such a marriage.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Tag:

Tag:

Mobile Version

Mobile Version