Advanced search

Search Results: 2,237 results for keyword "banks".

Lenders search for further credit room

12-01-2023 11:36

As the gap widens among banks in terms of profit growth, on-year credit growth remains an important driver for banks, as it makes the largest contribution to pre-tax profit growth. Thus, banks are looking for an allocation of credit room this year.

Cake efforts make sweet gains

05-01-2023 12:52

Though newly established, leveraging significant investment in technology, Cake by VPBank has emerged as one of Vietnam's top digital banks in terms of customer growth and service quality.

Green credit initiatives urged to push ahead development

05-01-2023 10:45

Given stringent domestic capital mobilisation, Vietnam’s banks are turning into international financial institutions for growth expansion, particularly to strengthen their sustainable and environmentally friendly loan portfolios.

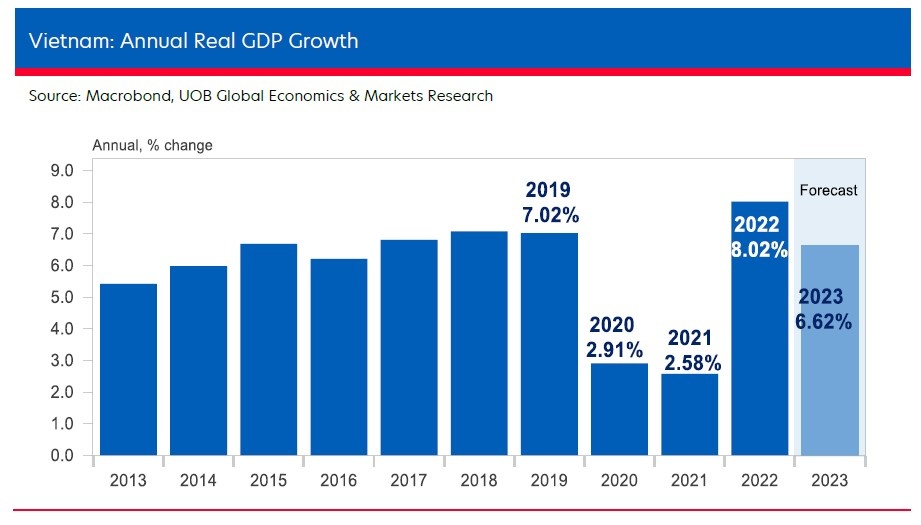

Potential for 6.6 per cent GDP growth in 2023

04-01-2023 18:05

Overall growth momentum is likely to moderate further this year, as policy tightening from major central banks weighs on external demand. With that, UOB has kept its 2023 GDP growth forecast at 6.6 per cent.

Tough year expected for banks in 2023

04-01-2023 16:20

With a dim outlook for the banking industry, most securities firms forecast that banks will post conservative profit growth in 2023.

Top 10 international events in 2022

02-01-2023 22:12

Russia's military campaign in Ukraine, central banks raising interest rates, the global population reaching 8 billion, and the World Cup in Qatar are among the top stand-out international events in 2022.

Developers seeking further support in approaching loans

30-12-2022 18:00

Many real estate businesses are concerned about the feasibility of approaching loans despite the State Bank of Vietnam increasing the credit room, simultaneously requiring commercial banks to reduce payable interest.

Profits not yet forthcoming for commercial lenders

30-12-2022 12:27

Impacted by a number of factors, banking activities slowed down in the fourth quarter of 2022, causing speculation over local banks’ profits.

Financial institutions’ role in lending to domestic banks

30-12-2022 12:09

The Vietnamese banking system has had to contend with a myriad of internal and external factors in 2022. Andrew Jeffries, country director of the Asian Development Bank in Vietnam, told VIR’s Hong Dung about the current liquidity situation and explained how businesses can access loans from major financial institutions.

Legal streamlining required for business support package

29-12-2022 15:00

While businesses are thirsty for capital, removing legal obstacles is now essential to enable the confidence of businesses, commercial banks, and local authorities to unlock resources for growth and production.

VIB leads industry in 'Top 50 Most Effective Companies in Vietnam'

28-12-2022 18:44

During the recent ceremony to recognise the 'Top 50 Most Effective Business Companies in Vietnam in 2022,' eight banks with outstanding business performance and sustainable growth rates were named: VIB, Vietcombank, ACB, MB, VPBank, Techcombank, TPBank and SHB.

Comprehensive finance to underpin Vietnam’s sustainabble growth

19-12-2022 10:21

Personal finance management is highly important to all. David Jimenez Maireles, deputy CEO of TNEX, the first digital-only bank in Vietnam honoured in the Global Top 100 Digital Banks 2022 by The Asian Banker, explained to Hong Thuy why expertise for this and digital banks are instrumental to promoting sustainable economic development.

The future of commercial banking

16-12-2022 16:53

The commercial banking sector is rapidly evolving through digitalisation. Nguyen Ngoc Hoang, director and digital innovation lead for KPMG in Vietnam, looks at what the future of the commercial banking landscape looks like, and what commercial banks should do to stay competitive.

How the SBV deals with climate risks

16-12-2022 12:16

Around the world, central banks are increasingly worried about climate change. Rising temperatures, lengthy droughts, weather disasters and high sea levels have deep economic and financial consequences. Pierre Monnin, senior fellow and Patrick Lenain, senior associate of the Council on Economic Policies, share their view on what the State Bank of Vietnam can do to limit those risks.

Undervalued banks winning bet for investors

07-12-2022 09:36

Although banking profits are expected to grow slower in Q4/2022 and in the first half of 2023, experts still have an optimistic outlook on bank stocks in the short term.

Mobile Version

Mobile Version