Advanced search

Search Results: 2,237 results for keyword "banks".

Most Asian markets rise but wary eyes on Fed, Russia

27-06-2023 14:00

Asian markets mostly rose Tuesday after more than a week of losses but traders remained anxious about central banks' plans to continue hiking interest rates to fight stubborn inflation.

Vietnam seeks support from SK financial institutions in bank restructuring

25-06-2023 11:31

Vietnam is eagerly seeking the proactive involvement of South Korean financial institutions in its ongoing efforts to restructure the country's banking system.

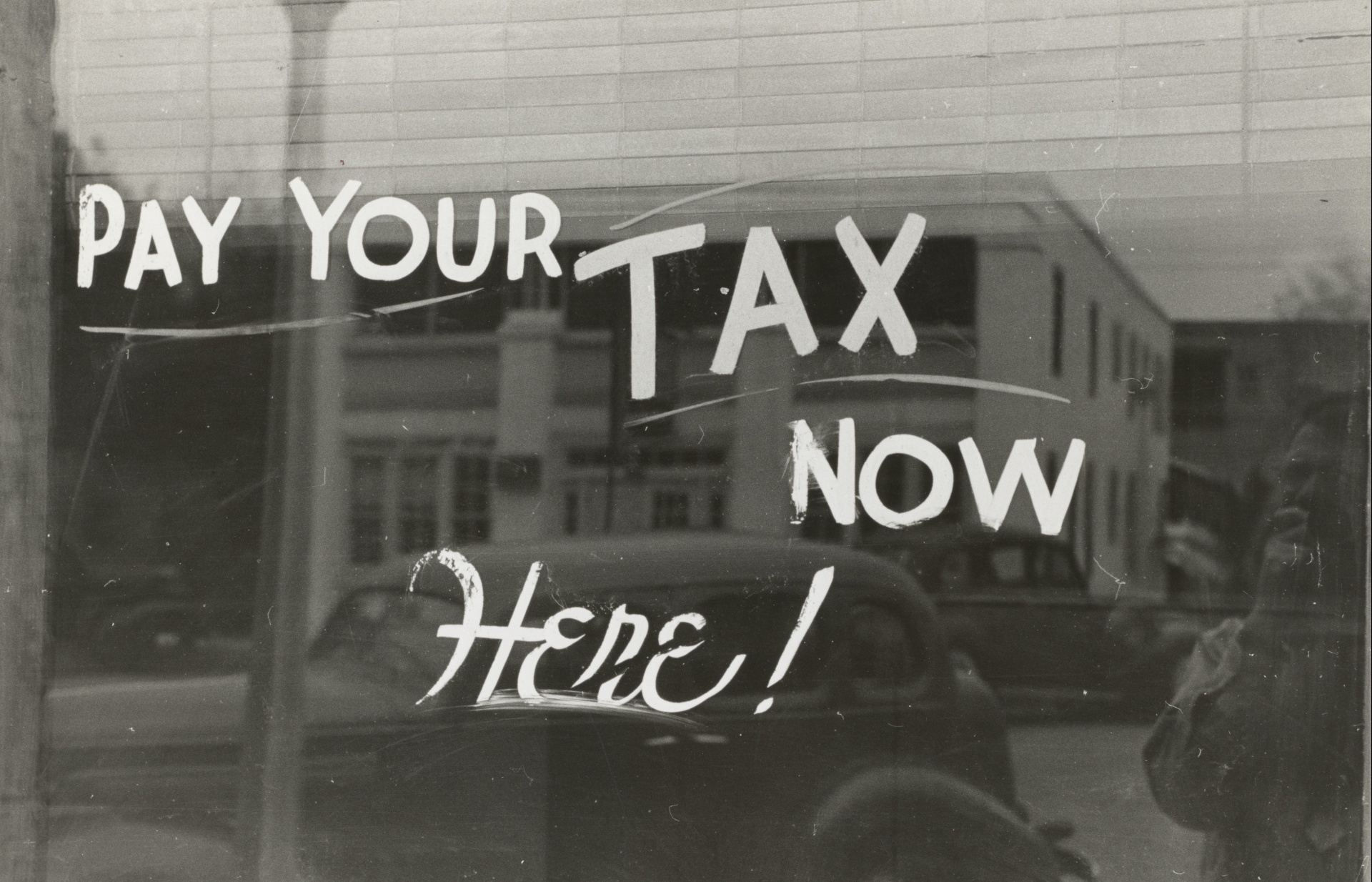

Tax Department in Vietnam asks banks to provide transaction information

23-06-2023 18:00

The General Department of Taxation has issued a letter requesting commercial banks and other credit institutions to provide transaction information, account balances, and data as requested by the directors of local tax departments.

Top 10 prestigious Vietnamese banks in 2023 revealed

23-06-2023 11:10

2023 is seen by the banking industry as a challenging year as they have to continue to share resources and help cushion pressure on businesses amid slowing global economic growth.

Lenders reinforce security measures

21-06-2023 15:00

By harnessing the power of chip-embedded ID cards, AI, and reliable population data, banks in Vietnam are reinforcing security measures and revolutionising banking services for their customers.

ASIFMA highlights Vietnam stock market's emerging status

19-06-2023 10:46

The Asia Securities Industry and Financial Markets Association (ASIFMA) has lauded Vietnam's stock market as it approaches the status of an emerging market. However, amid the promising growth, there remains a crucial bottleneck that foreign depository banks are eager to see resolved.

Vietnam's banking powerhouses secure spots on Forbes' global 2,000 list

14-06-2023 11:57

Forbes last week unveiled its annual list of the 2,000 largest companies worldwide in 2023. In a significant feat, Vietnam's banking sector has made a resounding impact, with Vietcombank, BIDV, VietinBank, Techcombank, and MBBank emerging as prominent players in the global financial arena.

Discover a miniature Mediterranean in the heart of Hoi An

13-06-2023 17:32

Nestled on the banks of Hoai River at Bay Resort Hoi An, the Olive Tree Restaurant is a new culinary highlight for visitors to enjoy the best of the Mediterranean cuisine.

Further fall projected for interest rates

13-06-2023 09:27

Several banks have followed the State Bank of Vietnam’s (SBV) lead by lowering their base interest rates, aiming to encourage and facilitate increased credit demand within the market.

Banking legacies and family ties shaping commercial banks in Vietnam

12-06-2023 18:16

Explore the intriguing dynamics of Vietnam's private banks, such as Techcombank, TPBank, LPBank, OCB, SHB, ACB, and SeABank, where family members of top executives wield significant influence and play key roles in shaping the institutions' operations and strategies.

Banks pin hopes on non-interest income sources

07-06-2023 16:21

Banks expect to rely more on non-interest income sources in the face of the credit expansion slowdown and challenging business environment to see any considerable profit growth this year.

Chief Justice calls for action to reduce number of banks in Vietnam

07-06-2023 13:57

Vietnam’s Chief Justice Le Minh Tri has highlighted the need for proactive measures to tackle non-performing loans and collateral assets, noting the importance of reducing the number of commercial banks in Vietnam to prevent unhealthy competition.

Banks to promote online lending through national population database access

05-06-2023 17:22

Through a series of newly-issued regulations and access to the national population database, banks are planning to expand their online money-lending services.

Local banks seek foreign funding

31-05-2023 18:08

Saigon-Hanoi Bank (SHB) announced the completion of the transfer of a 50 per cent stake in its consumer finance subsidiary SHB Finance to its Thai partner, Krungsri Bank. Over a year on from initially signing the contract to sell the stake, SHB has now received $78 million from its foreign partner.

Preparedness crucial in safeguarding banking sector

30-05-2023 18:40

Banks are inherently fragile, it is therefore unavoidable that banks face turmoil periodically. Patrick Lenain, CEP senior associate, analyses how to limit the global banking stress impacts in Vietnam’s banking system.

Mobile Version

Mobile Version