Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Central bank acts to tighten dong liquidity

02-10-2022 17:07

The State Bank of Vietnam (SBV) has net withdrawn VND57.6 trillion through open market operation (OMO) and foreign currency selling channels to maintain the liquidity of the banking system at a sufficient level and create indirect impacts on the interbank interest rates.

Banks moving to restructure bad debts

26-09-2022 16:31

As a circular on debt rescheduling for clients affected by the pandemic has expired, banks will face several scenarios to deal with in terms of debt restructuring.

State Bank revises up interest rates by 1 percent from September 23

23-09-2022 15:16

Governor of the State Bank of Vietnam Nguyen Thi Hong has issued decisions on revising up several interest rates by 1 percent, starting from September 23.

Investors and buyers play waiting game in credit switch

22-09-2022 09:00

The State Bank of Vietnam finally created extra credit room for some banks on September 7. However, the extension is deemed low and may not help real estate businesses and homebuyers access feasible capital sources for their projects.

Loosened credit may not be enough for real estate capital

21-09-2022 16:39

While the State Bank of Vietnam (SBV) has expanded credit limits for several banks, the stricter control of credit in areas like real estate may impact project liquidity in the sector.

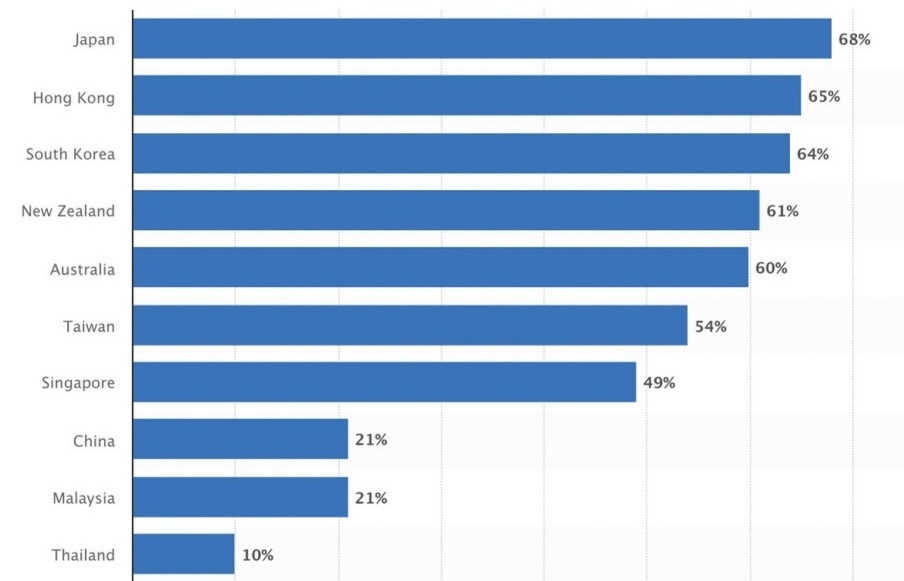

Financial titans seeking to prompt credit card adoption

21-09-2022 14:00

Despite several competitive advantages, the number of domestic credit card holders in Vietnam is still relatively low, but some financial institutions are attempting to break into this budding market.

Lenders contend with interest rates

21-09-2022 11:42

Maintaining steady interest rates is set to be a challenge for Vietnam’s central bank amid unfavourable global events and domestic pressures.

Myriad of choices available for monetary policy in Vietnam amid global fluctuations

21-09-2022 11:24

As today’s markets are undoubtedly volatile, the State Bank of Vietnam is in a dilemma to adopt a proper monetary policy. Economic expert Vu Dinh Anh discussed with VIR’s Hong Dung the potential approaches for Vietnam to sail through the challenging period.

MB redirects funds towards economic revival with new credit extension

19-09-2022 18:03

Recently authorised an extended credit limit by the State Bank of Vietnam (SBV), the Military Commercial Joint Stock Bank (MB) is swiftly disbursing the allocation, concentrating on lending to priority sectors to aid economic recovery. Vu Thanh Trung, a member of the board at MB, discusses the bank’s extra credit line and its preferential loan packages for businesses with VIR’s Luu Huong.

Real estate market would be better if credit growth targets rise: experts

16-09-2022 10:04

The State Bank of Vietnam's decision to raise credit growth targets for banks is expected to create favourable conditions for businesses to lend capital, including real estate firms, according to experts.

Extensions ease credit access for businesses

13-09-2022 10:04

A round of fresh credit extensions for commercial banks is expected to help businesses obtain easier access to capital as they continue their post-pandemic recovery.

SBV adjusts credit growth targets for banks

12-09-2022 12:00

The State Bank of Vietnam (SBV) has announced adjustments to credit growth targets for banks in 2022.

SBV adjusts credit growth targets for banks

12-09-2022 08:00

The State Bank of Vietnam (SBV) has announced adjustments to credit growth targets for banks in 2022.

Reference exchange rate down 18 VND

09-09-2022 16:36

The State Bank of Vietnam set the daily reference exchange rate for the US dollar at 23,263 VND/USD on September 9, down 18 VND from the previous day.

SBV raises selling price of USD to 23,700 VND

08-09-2022 15:16

The State Bank of Vietnam (SBV) decided to sharply increase the selling price of the US dollar by 300 VND to 23,700 VND/USD on September 7.

Mobile Version

Mobile Version