Financial titans seeking to prompt credit card adoption

Statistics from the Payment Department of the State Bank of Vietnam (SBV) showed that by the end of the second quarter of 2022, the number of domestic credit cards in circulation in Vietnam was roughly 543,000, equivalent to only 7 per cent of the number of international credit cards and 0.5 per cent of the total number of cards in the market.

|

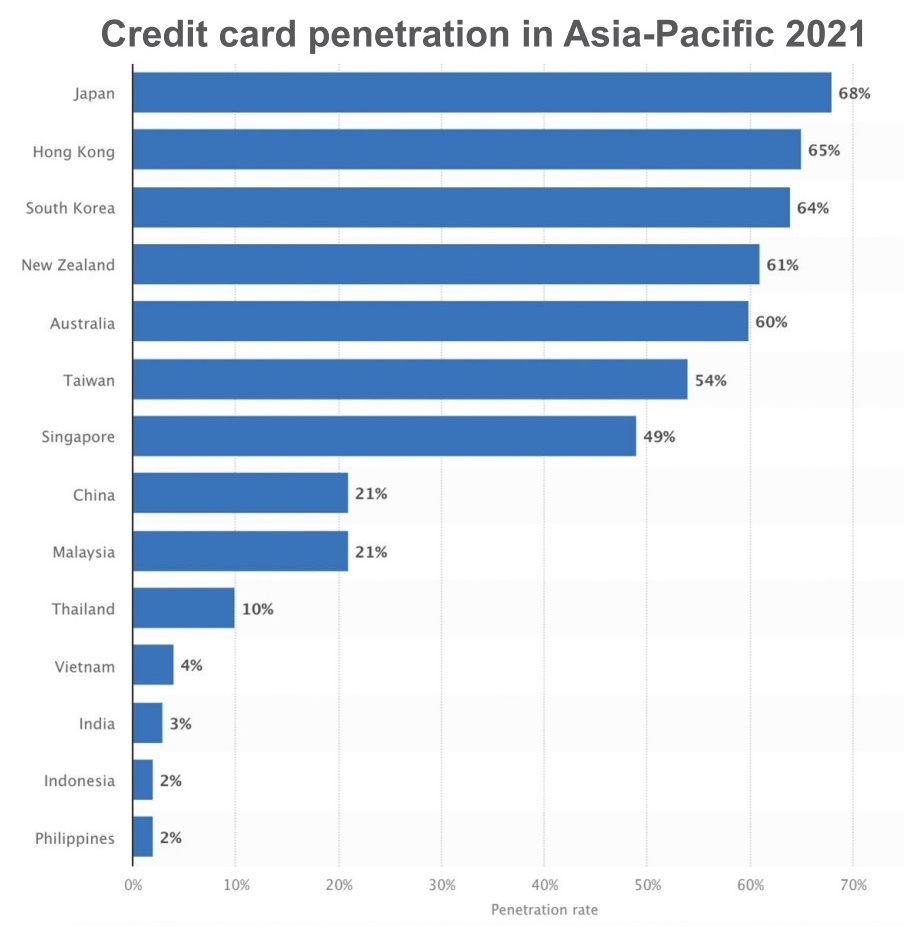

In the bigger picture, only 4 per cent of the Vietnamese population owns a credit card, while in neighbouring countries this rate is 10 per cent for Thailand, 21 per cent for Malaysia, 49 per cent for Singapore, and 68 per cent for Japan.

As credit card use in the country is still a relatively new concept, the playing field for credit card issuance holds immense opportunities. Many credit institutions have recently started exploring the advantages of domestic credit cards, which include simple registration processes, long interest-free periods, and low transaction fees.

“At present, 12 organisations have issued domestic credit cards, including nine banks and three financial companies. The number of cards at the end of June increased by 26 per cent compared to the end of 2021,” said Pham Truong Giang, deputy head of the Payment Department. “As features of this product are suitable for first-time access to banking services, it contributes to realising the goal of financial inclusion and helping to combat black credit.”

Do Van Vu, deputy director of HDBank’s Card Centre, said that the bank’s domestic credit card growth rate exceeded expectations in the first seven months of 2022, up more than 300 per cent compared to the whole of 2021.

“We first issued domestic credit cards in 2016. However, in the past year when we focused on workers in industrial zones as the main customer segment, we’ve seen a breakthrough in revenue,” Vu said.

“Domestic credit card also plays a big role in our digital transformation process, with credit assessment, card issuance, and customer service all done online,” he added.

Aside from banks, financial companies are joining the race, with domestic credit cards being their main product. According to Ho Minh Tam, general director of VietCredit, domestic credit card products have a competitive edge over their international counterparts for a number of reasons.

“While international credit cards have been in Vietnam for 20 years, this segment focuses only on high-income customers living in urban areas, with all features and payment terms designed based on their behaviours and habits. As such, banks are currently missing out on the potential of middle- and low-income customers,” Tam said.

“In addition, the rapid development of e-commerce has been a driving force for cashless payments in recent years, with a card-acceptance network of payment points established everywhere in the country. The biggest weakness of domestic credit cards is now eliminated,” he continued.

Nevertheless, for domestic cards to reach their full potential, a combination of regulation refinement and public outreach needs to be in place. Many employers still have reservations about domestic credit card guarantees due to cases where payment responsibility was transferred to them when workers quit before payment deadlines.

“In general, any card issuer or lender requires the company or manager to commit to a guarantee, but it just adds a burden to us,” said one chairman of a textile and garment company in Hanoi. “Sometimes employees quit before the statement period, and the company is then considered a debtor. I have received many phone calls from financial companies and banks to resolve these issues.”

On the other hand, cashless payment is still a novel concept for low-income workers and people in rural areas of Vietnam. In addition, international cards are still ahead in terms of card integration, with embedded microchips compatible with a wider network of point of sale (POS) machines.

According to Phan Thi Thanh Ha, deputy director of Agribank’s Card Centre, all lending activities in Vietnam must strictly comply with legal regulations to ensure capital safety.

Currently, for small loans, legislation mandates that banks must appraise customer business plans before lending, and after signing loan contracts, banks must perform a series of procedures to ensure the correct use of the loans.

“Therefore, to accelerate the development of domestic credit cards, it is urgent for the SBV to issue separate regulations on consumer loans, overdraft loans, and temporary capital shortfalls in payment,” Ha said.

| High fees are currently the biggest competitive disadvantage of international credit cards. According to the Vietnam Banks Association, on average, an international card organisation like Visa or Mastercard collects around 270 fees of various sorts from a Vietnamese bank annually, with a total value of hundreds of millions of US dollars. Fees are charged based on both the number of transactions and the transaction turnover, and transaction processing fees usually account for about 80 per cent of total fees collected from banks. Last year, the association urged international card organisations, namely Visa and Mastercard, to reduce several types of these fees on Vietnamese banks. For customers, the international credit card issuance fee is generally from $2.50 to $35 per card depending on the class, the cash withdrawal fee is 3.6-4 per cent of the transaction, the interest rate is 15-36 per cent per year depending on the bank, and the card termination fee is typically $2 per card. Some banks allow their customers to spend over the limit with a fee of 5-15 per cent and with a 2-4 per cent service fee for international transactions. |

| Visa study: Unlocking immense benefits of commercial credit cards Towards realising the goal of turning Vietnam into a cashless nation and boosting electronic payment acceptance among consumers, merchants, and businesses across the nation are enhancing market awareness about commercial credit cards and the sizeable financial and practical benefits they offer. |

| Credit cards for corporates facilitating cashless adoption Besides the retail customer segment, banks are offering a range of credit cards designed to fit the evolving comprehensive needs of small- and medium-sized enterprises and corporates to heighten efficiency and manage business expenses. |

| Shinhan Finance teams up with Mastercard to launch flagship credit card Shinhan Vietnam Finance Co., Ltd. (Shinhan Finance) has been cooperating with Mastercard to launch THE FIRST international credit card for the former’s customers with attractive privileges and incentives. |

| Be-Cake Visa credit card launched to enhance digital payment experience Digital bank Cake by VPBank (Cake), the on-demand multi-service consumer platform from Be and Visa – the world’s leader in digital payments – is releasing Vietnam’s first collaborative co-branded credit card product. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

Tag:

Tag:

Mobile Version

Mobile Version