Rising state budget revenues point to business confidence

Global analysts Trading Economics last week reported that the current account to GDP in Vietnam is expected to reach 3 per cent of GDP by the end of 2022. In the long-term, the rate is projected to trend around 0.5 per cent of GDP in 2023.

This figure in Vietnam averaged -2.73 per cent of GDP from 1980 until 2020, reaching an all-time high of 4.8 per cent 2012 and a record low of -12.7 per cent in 1995, Trading Economics said.

According to the International Monetary Fund (IMF), Vietnam witnessed a deficit of 1.1 per cent of GDP or $3.81 billion in the current account last year (see chart), reflecting a narrowing trade balance and subdued tourism activities.

The IMF forecast that Vietnam’s current account surplus is expected to increase modestly to around 1 per cent in 2022-23, and financial inflows strengthen as the economy reopens and a strong recovery takes hold.

The World Bank, which has predicted that the Vietnamese economy will grow 7.5 per cent this year, 6.7 per cent next year, and 6.5 per cent in 2024, has projected that Vietnam’s current account will be 0.2 per cent of GDP this year, 0.6 per cent next year, and 0.5 per cent in 2024.

Amid Vietnam’s good control of state coffers, the country has seen seven months of 2022 with a positive trade picture and a rise in disbursement and addition of foreign direct investment (FDI), which are all to a large extent responsible for such above-said projections in the economy’s current account landscape.

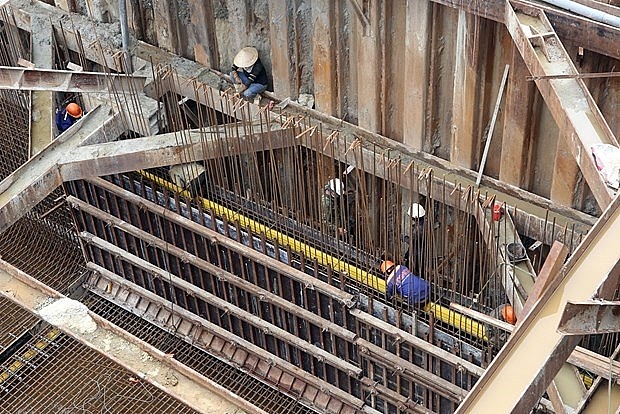

|

| The disbursed public investment increased 22.5% in July compared to the same period last year. (Photo: VNA) |

Boosting trade

The General Statistics Office (GSO) reported that by the end of July, total state budget revenues in 2022 are estimated to be $47.54 billion, up 18.1 per cent on-year; and total state budget expenditures are estimated to sit at $36.64 billion, up 3.7 per cent on-year. This has resulted in a 7-month budget surplus of $10.9 billion.

Almost all revenues for the state budgets have risen on-year. For example, the revenue from crude oil exports hit $1.87 billion, up 91.6 per cent as compared to that in the same period last year.

State-run PetroVietnam last week reported that its 7-month exploitation of crude oil hit 6.38 million tonnes, equal to 73 per cent of the 2022 plan. Its 7-month consolidated revenues reached $23.81 billion, completing 98 per cent of the year’s plan and up 56 per cent on-year. PetroVietnam’s contribution to state coffers in the period is estimated to be $3.46 billion, up 47 per cent on-year.

Currently, PetroVietnam’s consolidated assets are worth approximately $41 billion, its equity is valued at about $21 billion. From 1986 to 2020, the group’s total revenues reached nearly $400 billion, with a contribution of over $110 billion to the state.

A big factor helping to create an expected surplus in the current account is that Vietnam has been boosting its trade in the first seven months of the year. Specifically, the economy’s export-import turnover reached nearly $$431.94 billion, up 14.8 per cent on-year, with a trade surplus of about $764 million. The export turnover of goods was $216.35 billion, up 16.1 per cent, and import turnover of goods is $215.6 billion, up 13.6 per cent.

In one example, the Vietnam Textile and Apparel Association last week reported that the 7-month export turnover of the textile and garment industry is estimated to touch $26.55 billion, up 16.5 per cent on-year, while the total import turnover of materials in the period is estimated to hit $15.48 billion, up 7.9 per cent on-year. The industry reaped a trade surplus of $11.07 billion, an on-year increase of 31 per cent.

Phan Thi Thanh Xuan, vice chairwoman of the Vietnam Leather, Footwear, and Handbag Association, said that the industry’s total export turnover reached $13.8 billion in the first six months of this year, up 14 per cent on-year, including $11 billion for footwear exports – up 13 per cent, and over $2 billion for suitcase and handbag exports – up 20 per cent.

“Exporters have expanded their markets to nations sharing free trade agreements with Vietnam. The industry has set a target of hitting $20 billion in exports this year,” Xuan said.

|

Gradual improvements

Figures from the Ministry of Planning and Investment’s Foreign Investment Agency (FIA) showed that, from January to July 20, the total of newly-registered, newly-added, and stake acquisition-related FDI in Vietnam stood at over $15.54 billion, equal to 92.9 per cent of that in the same period last year.

“The newly-registered FDI in the period continued decreasing but the reduction level has been improving as compared to the first months of the year. On a monthly basis, if the January-April period saw a strong reduction, since May this type of capital has gradually bounced back on-year, at 12.8, 14.6, and 34.6 per cent for May, June, and July, respectively,” said an FIA report released two weeks ago.

Also, the added FDI from almost 600 operational projects in the seven months reached $7.24 billion, up 59.3 per cent on-year.

“Many projects producing electronic and high-tech products have increased capital in this period. This shows that investors continue placing their strong confidence in the economy’s outlook as well as the country’s investment and business climate via their decisions to expand their existing projects,” stressed the report.

Moreover, disbursed FDI in this period is estimated to be $11.57 billion, up 10.2 per cent on-year.

“This is the highest figure of disbursed 7-month FDI over the past five years. It includes $8.87 billion for the manufacturing and processing industry – accounting for 76.7 per cent of the economy’s total disbursed FDI; more than $1 billion for property business, holding 8.7 per cent; and $912.9 million for production and distribution of electricity, gas, hot water, and air conditioning, occupying 7.9 per cent,” stated a GSO report on Vietnam’s 7-month economic situation.

Also according to the IMF executive board, which last month worked with Vietnamese authorised agencies about the country’s economic situation, Vietnam’s foreign currency reserves are broadly adequate at the current juncture. Reserve accumulation slowed slightly on account of a narrowing current account balance.

Gross international reserves (GIR) increased by $14.3 billion in 2021, compared to $23.3 billion and $16.6 billion in the same period of 2019 and 2020, respectively. As of December 2021, GIR was at $109.4 billion, equivalent to 107 per cent of the ARA metric that refers to assessing reserve adequacy, or risk-weighted metrics.

Regarding external debt sustainability, Vietnam’s total external debt-to-GDP ratio was 36.4 per cent in 2021. Under the baseline, external debt would reach 35.6 per cent of GDP in 2022 before stabilising at around 33 per cent of GDP over the medium term.

“The external debt to exports ratio and gross external financing needs remain manageable at below 50 and 12 per cent, respectively,” said the IMF executive board last month. “Vietnam’s external debt is vulnerable to real depreciation and current account shocks, while growth and interest rate shocks have only a limited impact on the external debt dynamics. The currency’s observed long-term real appreciation trend is an upside risk.”

| Leaders urged to kick on with disbursement Slow implementation of the national fiscal and monetary initiative is expected to dent economic growth, with legislators urging the government to soon review the policy to provide further assistance for enterprises and people. |

| Institutional improvements to set stage for disbursement Disbursement of public investment since early this year remains slow. Minister of Planning and Investment Nguyen Chi Dung explained to VIR’s Nguyen Huong the reasons behind this situation, and proposed solutions to speed up progress. |

| Direction for disbursement tightened after mixed results Despite the challenges surrounding various projects, public investment disbursement has continued to be prioritised as a key task for the country to boost economic growth. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version