Power overhaul plan picks up steam

Vietnam’s long-awaited Power Development Plan VIII (PDP8), confirmed in mid-May, is a milestone in the country’s journey towards energy transition. The main objective of the legislation is to achieve energy security for Vietnam, progressing on its climate change commitments towards the middle of this century, and more specifically to export 5,000-10,000MW of power by 2030.

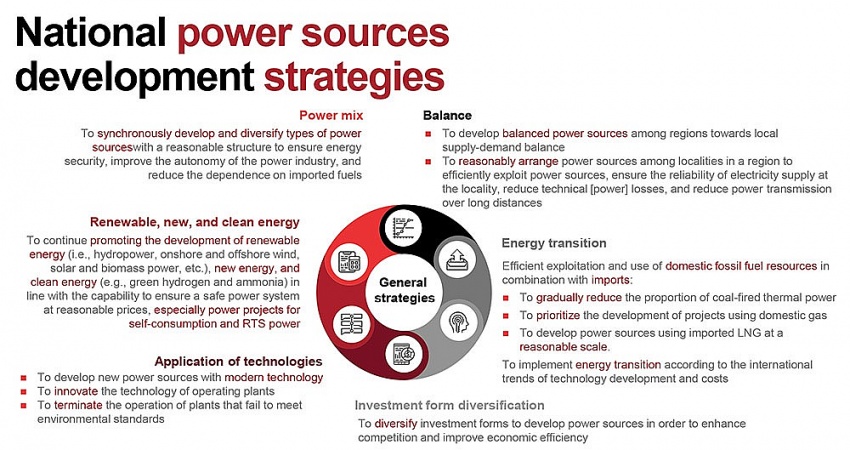

Towards these goals, the PDP8 proposes a new energy mix with a substantial reliance on renewables and the development of smart transmission grids to support the renewables industry, including connecting the power grids with neighbouring countries.

“We appreciate the government for the approval of the PDP8, as it provides a clear path to the completion of the grid interconnection, which is critical for us and Electricity of Vietnam (EVN) to complete agreement on the tariff and schedule of the power purchase agreement (PPA). We target completion of the PPA in Q4 of 2023 in order to break ground in 2024,” said Ian Nguyen, managing director of Delta Offshore Energy.

Delta Offshore is the developer of the 3,200MW liquefied natural gas (LNG) project in the Mekong Delta province of Bac Lieu. The project was adopted by the prime minister for inclusion into Vietnam’s adjusted PDP7, and was the first such project that is 100 per cent private under the Law on Investment.

The PDP8 has been years in the making, after the previous versions required severe adjustments in order to be robust enough for reality. Tran Viet Ngai, chairman of the Vietnam Energy Association, noted that lack of transmission, uncontrolled development of solar power, and delayed coal and gas-fired projects have been the main factors leading to the disruption of the previous planning.

“According to the experience of developed countries in renewable energy, to be able to develop renewable energy strongly and sustainably, it is necessary to focus on such contents as policies, transmission infrastructure, and electrical system operation,” Ngai said.

For example, implemented in 2017, the build-operate-transfer Nhon Trach 3 and 4 LNG projects from PV Power have been stagnant for two years with little progress in negotiating electricity prices and PPA with EVN.

The main problem is said to be the commitment of the total annual electricity purchase from EVN and the annual gas output, which is a significant criterion and a basis for financial institutions to consider credit financing for the project.

“It is necessary to ensure the interests of all parties. Investors also pour a large amount of money to carry out these ventures, and if it is not clear and transparent now, it will be difficult to entice investment later,” Ngai added.

Giles Cooper, partner of consultancy firm Allens in Hanoi, pointed out that key concerns with the implementation of the PDP7 and PDP8 revised were a lack of coordination that resulted in too much renewable capacity – particularly solar – being constructed and connected in a short space of time.

“Not only were the amounts far in excess of the plan set out in PDP7, but the over-development also caused issues for everyone involved,” Cooper said. “The grid infrastructure was insufficient to absorb and transfer the power to where it was needed, resulting in curtailment and losses. Although the headline numbers were impressive, and eventually the system will be adequately upgraded to integrate the power, it was a very inefficient way to build out the capacity.”

|

Delivery of a clear plan

Now that the PDP8 is just around the corner, all eyes are now on actual implementation. The targets under the plan call for substantial investment – the estimated total in terms of development of power sources and transmission before 2030 is expected to be around $134.7 billion, and for 2031-2050, the figure is $399-523 billion.

To assist in this, in December 2022, Vietnam signed a just energy transition partnership agreement with a group of developed countries in which it will receive $15.5 billion to assist in its energy transition.

Bui Vinh Thang, country manager in Vietnam at the Global Wind Energy Council, said that as outlined in a paper published last year, the next step for the government and the offshore wind industry is to put the right policy framework into position to enable the targets to be delivered.

“For onshore wind, the challenges are to quickly resolve the issues of nearly four GW of transitional projects to connect them to the grid and attract investment into new projects, especially in the fast-growth-demand north,” Thang said.

Meanwhile, Stuart Livesey, CEO of Copenhagen Offshore Partners Vietnam, told VIR that after the PDP8 was approved, the next priority is to ensure there is a clear implementation plan to allow offshore wind projects to be delivered.

“The government and other stakeholders will need to address issues such as delivering the implementation plan, establishing pilot projects, allowing for offshore survey licences to commence at potential offshore wind sites, upgrading the grid and transmission system in good time, and utilising bankable PPAs,” Livesey said.

He stressed on mobilising the support of internationally experienced and competent developers.

“Key aspects of the grid and transmission system upgrades must be secured and delivered on time to support new offshore wind projects, with support from private investors where possible, and ensure that functional PPAs are in place to provide the necessities for international investors to deliver competitive projects where the risks of termination and curtailment, for example, have been removed or reduced to a manageable level,” he added.

“If the Vietnamese government can focus on reducing uncertainties by delivering the aspects mentioned, and establishing a clear and transparent process, this will allow projects and the wind industry to reduce risk and therefore costs,” he said.

Thanh Hai Nguyen, a partner on energy and infrastructure at Baker McKenzie Vietnam, said that not only does the PDP8 include proposals to reform the Law on Electricity and the auction process, but it also leaves more flexible room.

“For example, if there is a delay in the implementation schedule of a project, to avoid impact on national energy security, it provides a backup plan with either replacement projects or permitted acceleration in project implementation, subject to compliance with relevant laws,” Nguyen said.

“It also allows certain state authorities to synchronise the implementation of PDP8 taking into account various factors, including the actual progress of infrastructure development, tech development, and national electricity demand, amongst others.”

|

Building a functional regime

While investors and developers of all shapes and sizes have welcomed recent developments, Cooper of Allens warned that the devil lies in the detail.

“The PDP8 is, uniquely, a master plan with built-in flexibility and a living nature. Technology and circumstances will shape the future direction and, unlike prior power master plans, the PDP8 does not purport to be set in stone,” said Cooper. “Much remains to be done to give effect to the worthy principles underpinning the ambitious targets, but recent history shows that enabling policy and legislation is slow.”

Cooper pointed out further challenges to implementing the plan, including an absence of a functional regulatory regime that will enable private sector financing.

“Most notably, we currently lack regulations on how investors will be selected to implement specific projects, how much they will be paid for power, and on what terms. These are fundamental requirements that need answers as quickly as possible to provide direction and certainty to the market,” he added.

The PDP8 plans to produce power with a renewable energy rate of between 30.9 and 39.2 per cent by 2030, and between 67.5 and 71.5 per cent by 2050. Two interregional service and industrial centres for renewable energy will be established in order to do this – these will include the generation, distribution, and consumption of electricity; the development, construction, and installation of renewable energy equipment; and the creation of an ecosystem for renewable energy in locations with high potential.

The new plan includes approval of a grid interconnection strategy for the existing 500kV national grid backbone linked to the power load system. This will allow supply to foster economic development in the region as well as support more efficient use of existing and proposed wind and solar projects.

In addition, total energy capacity will rise from 76GW to over 158GW by 2030, and coal capacity will rise to 30GW from 24GW.

| Mong Cai city imports electricity China’s Dongxing The Mong Cai (Vietnam) - Dongxing (China) 110kV transmission line was completed and put into operation at 6 am on May 22, adding power supply to Mong Cai city in the northeastern province of Quang Ninh, according to the Mong Cai City Electricity. |

| All systems go for energy security The newly approved Power Development Plan VIII for 2021-2030, with a vision to 2050, is designed to improve the country’s energy security and set out a roadmap for developing energy sources towards a green path. However, realising the targets will be a profound challenge for all involved. |

| EVN intends to raise electricity prices from September EVN considers that the 3 per cent rise in electricity prices enacted at the start of May 2023 has not been sufficient to cover its costs. The energy provider is seeking permission to adjust the price from September 1 to counterbalance the additional expense incurred from high input costs to ensure the company's financial stability. |

| Neighbourly efforts in tow to aid electricity prospects Vietnam intends to boost its imports of electricity from Laos and China in order to avoid an electricity shortfall this summer. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Tag:

Tag:

Mobile Version

Mobile Version