Vietnam strives for ambitious outcomes

Prime Minister Pham Minh Chinh early last week urged authorities nationwide to make greater efforts to reach double-digit economic growth in 2025, following a rate of more than 7 per cent in 2024.

The Ministry of Planning and Investment has been assigned to coordinate with agencies to formulate a growth scenario for 2025, and to propose specific tasks for hitting the growth target. Other ministries and agencies are required to design concrete goals in line with the GDP growth scenario for the year.

The prime minister ordered the Ministry of Industry and Trade (MoIT) to work with other ministries and localities to find ways to expand trade and make use of advantages from free trade agreements. The request followed a strong performance in 2024, when total trade turnover was estimated to have hit a record of at least $783.4 billion, up from $681 billion in 2023.

This consisted of $403.7 billion worth of exports, up 13.8 per cent, and $379.6 billion for imports, up 16.3 per cent. The total trade surplus stood at $24.1 billion.

The industry and trade sector has set a new ambitious export target of $451 billion in 2025, up 12 per cent against 2024.

Vietnam’s export-import turnover from Asia and Africa in 2024 continued to play a strategic role, standing at an estimated 519.7 billion, up 13.7 per cent against the previous year, and accounting for 66.3 per cent of the country’s total export-import turnover.

Total export value came in at $197.4 billion, up 8.4 per cent, and total import value sat at $322.3 billion, up 17.2 per cent. The total trade surplus was $124.9 billion, up 34.6 per cent.

|

Major pressures

According to the MoIT, though Vietnam’s trade with the world has been on the rise thanks to an increase in foreign direct investment and the development of domestic enterprises, it may be challenging for the country to reach a 12 per cent growth rate in exports in 2025. Vietnam will continue to face great difficulties in the international market as it is an open economy with trade turnover often doubling GDP.

In 2024, GDP is estimated to reach $470 billion, which is far lower than total trade of $783 billion. This would mean any shock in the international market can have a negative impact on Vietnam’s exports.

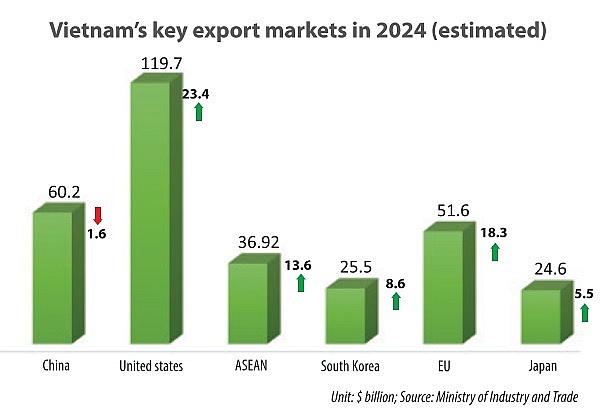

Moreover, the country’s exports are largely dependent on a number of large markets, mainly with Northeast Asia, the United States, ASEAN, and the EU, which are now responsible for nearly 80 per cent of Vietnam’s total export turnover.

“Vietnam’s key export items to the EU and the United States have been and will continue facing pressures about trade defence investigations, trade default, and technical barriers on environmental protection, sustainable development, and the green transition,” the MoIT said.

The ministry’s latest update showed that 28 investigations of the type were initiated in 2024, on Vietnam’s exports to 12 markets, among which 13 cases were initiated by the US. Thus far, about 270 investigations have been initiated by 25 countries and territories on Vietnam’s exports, including 148 anti-dumping, 54 self-defence, 38 anti-circumvention, and 30 anti-subsidy cases.

The year 2024 had the second-highest number of trade defence investigation cases ever, after 2020 when there were 39 initiations, which shows that the protectionism is escalating throughout the world. This trend will continue expanding, according to the MoIT’s Trade Remedies Authority of Vietnam.

For instance, the United States in 2024 launched its cross-border subsidy investigation on solar panels and capsules imported from Vietnam for the first time. Other markets also investigated and applied anti-dumping, anti-subsidy, safeguarding and anti-circumvention measures on the same product.

Nguyen Minh Vu, Deputy Minister of Foreign Affairs, said, “Though the global economy is recovering, there are many potential risks, and supply chain disruptions. This necessitated urgent market opening, and diversification of export markets. Moreover, there must be policies on greener industrial production. New environmental and trade standards in the international market are creating significant challenges for Vietnam’s export activities.”

At present, industrial production enterprises are continuing to face many difficulties in access to bank loans, despite some reduction in lending rates. Additionally, costs for importing raw materials have increased, along with the high USD exchange rate, which has reduced the price competitiveness of export products. Also, domestic production depends heavily on imported materials from outside.

At present, the country’s supporting industry remains weak, leading to a high level of imports in service of export-oriented production.

The General Department of Vietnam Customs reported that in the first 11 months of 2024, the goods import value is estimated to have touched $345.62 billion, up 16.4 per cent on-year. In which, $126.05 billion was from Vietnamese enterprises, up 18.5 per cent, and $219.57 billion came from foreign invested enterprises (FIEs), up 15.2 per cent.

Weak links

Deputy Minister of Industry and Trade Phan Thi Thang admitted that although Vietnam’s export turnover hit a record sum of $403 billion in 2024, it is not yet sustainable.

“Over 70 per cent of Vietnam’s export turnover largely comes from FIEs, but these businesses’ exports mainly rely on global supply chains and fail to create spillover effects, boosting domestic enterprises to participate in global value chains,” Thang noted. “The trade surplus in Vietnam’s trade balance [$23 billion in 2024] has been created by FIEs, while domestic enterprises’ trade balance always suffers from a deficit with an uptrend.”

According to a World Bank study released in November, underlying Vietnam’s current export model is an economic structure with export activity concentrated within FIEs and limited participation of domestic firms.

The study pointed out that FIEs, while representing only 3 per cent of the total 900,000 enterprises operating in Vietnam, employ a significant number of people - 17.8 million workers, or 35 per cent of the country’s official workforce.

“These firms are crucial to the export sector, particularly in specific subsectors. For example, majority-owned foreign affiliates accounted for over three-quarters of Vietnam’s exports in machinery and equipment, and around half of the exports in the computer, electronics, and telecom and IT services sectors,” the World Bank said.

“Meanwhile, domestic firms are largely involved in traditional sectors such as construction, repairs, and hospitality, and are generally inward-looking, focusing on servicing the domestic market,” the bank added. “As such, FIEs largely operate in isolation rather than as a catalyst for economy-wide growth, with limited spillovers from FIEs to the domestic private sector in the form of increased demand for inputs, access to new technology, managerial skills, demonstration effects and agglomeration benefits.”

According to experts, weak links between FIEs and Vietnamese companies limit technological and productivity spillovers, hampering the efforts of domestic firms. Compared to other economies, Vietnam has a smaller proportion of firms with global value chain links, suggesting that the opportunity for productivity spillovers is less than that of its peers.

According to the Organisation for Economic Co-operation and Development’s Activity of Multinational Enterprises database, foreign manufacturing firms in Vietnam source a lower percentage of their inputs from within the country (53 per cent) compared to comparator countries.

Similarly, the World Bank’s 2023 Multinational Enterprises Pulse Survey indicated that multinationals in Vietnam source the smallest share of inputs locally among East Asia and Pacific region countries. Notably, Vietnam’s domestic manufacturing businesses also exhibit a lower reliance on local inputs than many of their counterparts in other countries, pointing to supply-side constraints in domestic production capabilities.

“While weak links are not specific to Vietnam, challenges such as skill shortages, a lack of information about domestic suppliers, and weak management capacity have been identified as barriers preventing Vietnamese firms from more effectively participating in value chains,” the World Bank said.

| Export businesses upbeat about 2025 Many firms have secured export orders for 2025, adding vibrancy to production as the year comes to a close. However, challenges ahead remain a concern. |

| High goals set for import-export The Ministry of Industry and Trade has set a target of 12 per cent export growth in 2025 as Vietnam achieved impressive economic results in 2024, with imports and exports being the main driver of economic growth. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version