New business definition eases M&A accounting

|

From an accounting point of view, the impacts on a buyer’s financial statements will differ depending on whether the buyer has acquired a business or simply a group of assets. Accounting for the former is generally more complex. Differences exist in the recognition of goodwill, recognition and measurement of contingent consideration, accounting for transaction costs, and deferred tax accounting, among others. Over the years, many financial statement users have complained that the current definition of a business in IFRS 3 was too broad, resulting in too many transactions qualifying as business combinations. The latest amendments to IFRS 3, published in October 2018, aim to make the distinction easier by revising the definition. This change will likely result in more transactions being accounted for as asset acquisitions, rather than business combinations. The impact will be seen across all industries, particularly in real estate, pharmaceuticals, and oil and gas.

|

| By Tran Hong Kien Partner of Assurance Services PwC Vietnam |

New definition of a business

Under the new definition, to be considered a business, an acquisition would have to include an input and a substantive process that together significantly contribute to the ability to create outputs. The definition emphasises that the outputs are goods and services provided to customers. The new guidance also introduced a framework to evaluate when an input and a substantive process are present (including for early stage companies that have not generated outputs). To be a business without outputs, there will now need to be an organised workforce.

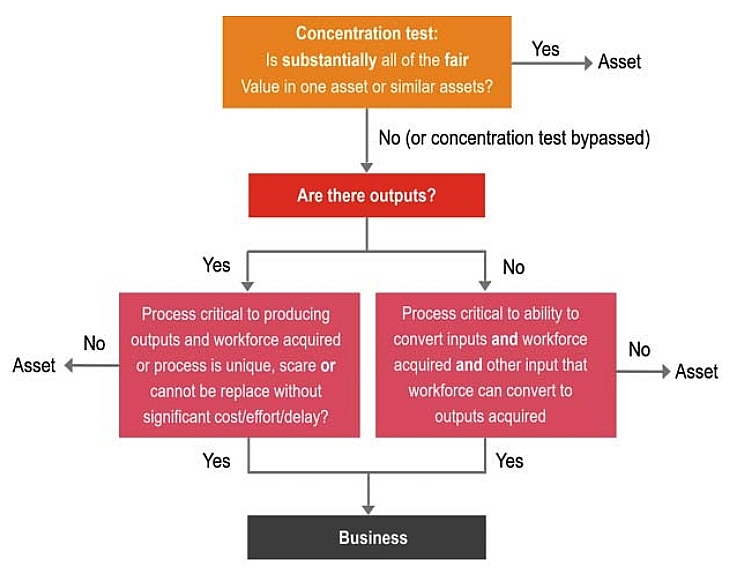

The amended guidance also allows buyers to apply a concentration test that, if met, eliminates the need for further assessment. The test provides a shortcut for accountants to conclude whether the acquired set of assets is not a business, thus avoiding the costs and complexities of performing a further assessment.

Under this optional test, a set of acquired assets is not a business when substantially all of the fair value of the gross assets is concentrated in a single asset, or a group of similar assets. Gross assets acquired exclude cash, deferred tax assets, and any goodwill that results from the effects of deferred tax liabilities.

The optional concentration test includes the concept of aggregating similar assets. In the real estate industry, for example, it is common for acquisitions to include several properties. Companies should carefully consider the specific facts and circumstances – including class of property, location, risk characteristics, and so on – when concluding whether assets purchased in a transaction are similar.

To illustrate, take the case of a real estate company buying a portfolio of 10 residential homes. All homes are leased out to separate tenants and comprise land and buildings. Each home is considered to be a separate investment property for accounting purposes, and has a different design and layout. However, all homes are located in the same geographical area and the risk profile of the real estate market across that area is similar. In addition, no employees, other assets, or other activities are transferred.

With the concentration test the buyer would be able to conclude that this is an asset acquisition, and not a business acquisition. This is because substantially all of the fair value is concentrated in a group of similar assets.

However, it should be noted that a transaction is not automatically a business combination if the optional concentration test does not result in an asset classification. The buyer would need to assess the transaction in more detail under the full framework of IFRS 3 in order to make a conclusion.

Looking ahead

The latest amendments to IFRS 3 are effective for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after January 1, 2020, as well as for asset acquisitions that occur on or after the beginning of that period. Early application is permitted.

IFRS 3 itself and the amendments do not explicitly require additional systems and processes. However, there are a number of features of the standard that could have implications for systems, controls, and the level of expertise required within an entity.

Any organisation in Vietnam engaging in cross-border M&A with businesses based in IFRS jurisdictions would be well advised to determine the accounting treatment for transactions and make necessary preparations ahead of time.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

- Proposed changes to interest deductibility rules may be welcomed by taxpayers (January 22, 2025 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version