Market hits head winds

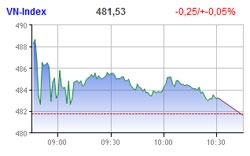

Ho Chi Minh Stock Exchange’s VN-Index ended lower today, down 0.25 points or 0.05 per cent to 481.53 points, after spending almost all the session in positive territory.

Much of the session was supported by two blue-chips Bao Viet Holdings BVH and Masan Group MSN.

The other major codes were strongly sold at the session’s end. Saigon Securities Inc. SSI closed VND700 lower at VND31,100, Vietcombank VCB shed VND1,400 to VND30,500, while Itaco ITA hit the floor to VND16,400.

DPM hit floor and PVD, HCM, FPT, VNM, OGC all closed from VND500 to VND2,000 lower.

Sacombank STB was the most active in terms of liquidity today with more than 4.3 million shares traded, followed by SSI and ITA with 4.1 million and 2.6 million units respectively.

Some penny stocks including VTO, VST, MHC, PXL and PVT hit the ceiling.

Liquidity slightly fell also with 61.5 million shares worth VND1.4 trillion ($70 million) changed hand, down 9.98 per cent and 14.70 per cent respectively.

Some 61 stocks advanced with 14 high, 159 fell with 13 hit the floor and 59 unchanged.

The Hanoi Stock Exchange’s HNX-Index fell down to 113.73 points, after rising for two-thirds of this session, down 1.27 points or 1.1 per cent.

The bourse’s liquidity continued to decline with just 36 million units worth VND685.37 billion traded, down 32.07 per cent and 28.71 per cent in terms of volume and value respectively.

Foreigners today continued to be net buyers with more than 7.78 million shares of 179 stocks bought in on HoSE, strongly focusing on blue-chips like CTG, SSI, HPG, PPC and KBC.

More than VND20 billion ($1 million) was cashed in by foreigners on HNX. More than 1.3 million shares were bought by foreigners, of stocks like PVX, KLS, ICG, while some 307,400 units were sold, with codes like PVX, KLS and VCG.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- HDBank in triple victory at listed company awards (November 25, 2024 | 11:38)

- Malaysia's Solarvest and Finhero launch first solar financing fintech solution in Vietnam (November 22, 2024 | 19:50)

- SHB honoured at VLCAs for fourth time (November 22, 2024 | 19:08)

- Central Bank of Cuba chief visits Hanoi to work with VBSP (November 22, 2024 | 15:49)

- Credit sees steady growth towards year-end (November 21, 2024 | 17:46)

- HDBank wins three titles at Vietnam Listed Company Awards (November 21, 2024 | 10:01)

- VLCA’s corporate governance mission (November 21, 2024 | 10:00)

- The promotion of ESG via banking (November 21, 2024 | 09:32)

- Standard Chartered committed to Vietnam’s financial success (November 21, 2024 | 09:24)

- Full ESG adoption the priority for Agribank (November 21, 2024 | 09:07)

Mobile Version

Mobile Version