Instant noodle business rebounds after a slump

|

| Instant noodle business rebounds after a slump |

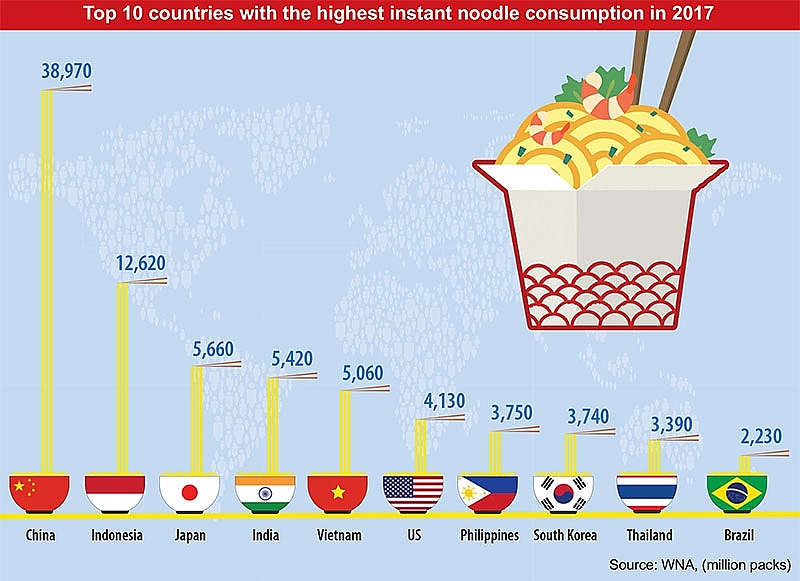

Instant noodles consumption in Vietnam totalled at 5.06 billion packages last year, up 3 per cent against 2016 and ranking fifth in the world, trailing China, Indonesia, Japan, and India, according to the World Instant Noodles Association (WINA).

Vietnam’s instant noodle market reached its peak between 2012 and 2014, with 5.2 billion packets sold. However, producers reported a slump in sales in the following three years.

Ho Chi Minh City-based Colusa-Miliket Foodstuff JSC, the owner of the Miliket brand, saw sales slip to their lowest point in 2016, at VND459 billion ($20.3 million). Meanwhile, Acecook Vietnam’s sales declined from VND13 trillion ($575 million) in 2013 to VND8 trillion ($354 million) in 2016.

Junichi Kajiwara, president of Acecook’s subsidiary in Vietnam, pointed out three reasons for the slump. Producers have yet to diversify their products to meet customer demands. There are misunderstandings about instant noodle among consumers. Last but not least, some producers are resorting to unhealthy competitive practices.

However, Kajiwara said, “Despite the intensifying competition in the food processing market, Acecook maintains a positive growth rate at 7 per cent annually.”

He noted that Acecook aims to increase its growth rate to 10-15 per cent per year. In the next five years, it will raise the per capita instant noodle consumption in Vietnam from 52 packs to 60 packs servings.

Masan Consumer, which produces the popular Omachi brand, also saw a recovery in its instant noodle sales up 16. 3 per cent in the second half of 2017, against the fall of 18.7 per cent in the first half of last year.

In the first half of 2018, the net revenue of Masan Consumer’s convenience food businesses including instant noodles and instant congee was up by 37 per cent to VND1.99 trillion ($88 million). Masan Consumer expects convenience food sales to reach approximately VND4.5 trillion ($199.1 million) in the 2018 financial year.

Local vs. imported noodles

Instant noodles have seen a recovery, but with slow increase. In reality, local instant noodle producers were engaged in a fierce war with increasing competition to launch new products, with added competition from imported noodles which are appealing to youthful tastes and trusted by homemakers.

According to economist Dinh The Hien, instant noodle is part of the fast-moving consumer goods (FMCG) market, in which the success of manufacturers depends on a large degree on good marketing strategies, financial potential, and selling prices. Both local and imported noodles have their own advantages.

Products are imported from Thailand, South Korea, and Japan, but Vietnamese people have a particular fondness for Thai products, including Thai food. In general, Thai instant noodle products suit Vietnamese people’s taste and are trusted by Vietnamese people due to their food safety hygiene, according to Hien.

Meanwhile, instant noodle products from South Korea and Japan are successfully penetrating the Vietnamese market thanks to good marketing strategies, namely telecommunications via music and movies.

“Despite the selling price of imported instant noodle being double or even triple of local products, the imports are favoured by the youth who want new experiences. Meanwhile, homemakers select imported instant noodle because they trust the quality of these products,” Hien said.

The biggest advantage of local products is their low cost, which appeals to almost all Vietnamese people. The higher production capacity leads to a lower selling price.

Hien said that local producers already have stable output and a large local consumption market as well as export markets, generally in Asia. They will run production lines at full capacity to ensure a lower cost for their products.

The cup noodle trend

In 2017, many Vietnamese consumers, especially in first-tier cities such as Ho Chi Minh City and Hanoi, began to favour cup noodle. The trend towards single households and the rising demand for convenience were the key drivers for the good performance of instant noodle cups, according to London-based market research firm Euromonitor International.

Moreover, the rapid development of convenience stores, which also offer free hot water and seats for consumers in their outlets, was another main factor supporting the growing preference for cup noodles.

To meet the rising trend, Acecook has developed a cup version of Hao Hao, an instant noodle brand that is highly popular in Vietnam, utilising a production facility known for advanced hygiene management and production efficiency.

Acecook sold the cup version for VND8,000 ($0.35) apiece in cities on a trial basis, to pave the way for nationwide sales starting in September 2016. The company maintains operations in Vietnam profitable thanks to its advanced plant in Ho Chi Minh City, which is capable of producing 420 cups per minute, or 40 per cent more than comparable production facilities in Japan.

According to Masan Consumer, its Omachi Cup brand is expected to contribute 10-12 per cent of Omachi’s revenue during the 2018 financial year. Sell-out growth was robust at 31 per cent during the first half of this year, while distributor inventory was lower at VND138 billion ($6.11 million) as of the end of June 2018.

Similarly, Nissin Foods also launched cup noodles in Vietnam in 2016 with a focus on supermarkets and convenience store chains. To scale up its operations in the country, the Japanese instant noodle giant has built a factory covering 60,000 square metres in the southern province of Binh Duong.

The throne of the market

After seeing the potential of the instant noodle industry, a number of local firms have also jumped into the sector to reap the benefits. At the peak of the instant noodle market in 2014, KIDO Group made its debut with the Dai Gia Dinh brand.

As a newcomer on the market, KIDO did not compete directly with other brands but focused on high-end products. It was confident of its success, owing to the company’s wide network with 300 distributors and 200,000 retail stores. However, since mid-2017, KIDO’s instant noodle products have almost disappeared from the market.

Explaining the failure of KIDO, Hien said that KIDO has advantages in the confectionary manufacturing sector. However, when it joined in the instant noodle sector, it had no good marketing strategies. In addition, it had not built a stable output, which is an important factor ensuring low costs for its instant noodle products.

Colusa-Miliket Foodstuff, once the king of Vietnamese noodles, ruling over about 90 per cent of the domestic market in the 1990s, is struggling to keep its head above the water amid the competition. The company now focuses on niche markets in rural areas for low-income people as well as distributing its products to hotpot restaurants.

Fabrice Carrasco, strategic initiatives regional director of Kantar Worldpanel Asia, an international company dealing in consumer knowledge and insights based on continuous consumer panels, told VIR that the competition to win market share is getting fiercer. All producers are making efforts to diversify their portfolio to meet all types of consumer demands, from diversifying flavours, ways of eating, and packaging types to the price tier. In particular, those who are already very strong in the economy price tier – under VND3,000 ($0.13) per pack – such as Kokomi, 3 Mien, and Gau Do brands now push mainstream products in a price range of VND3,000-5,000 ($0.13-$0.22). The move aims to leverage the upward trading trend and aid the fight against Hao Hao.

“On the other hand, the premium segment of VND5,000-10,000 ($0.22-$0.44) per pack is getting much more complex and exciting. There are 34 active brands in premium compared to 16 brands in economy and 19 in mainstream. Meanwhile, the super-premium range including the cup or bowl format and international products with prices over VND10,000 ($0.44) are emerging and getting consumers,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version