Insights garnered in high-tech FDI

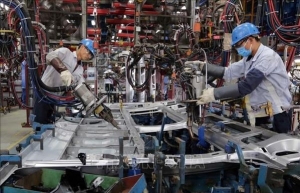

According to recent statistics, foreign direct investment (FDI) disbursement in Vietnam in 2022 reached a record of $22.4 billion, an increase of 13.5 per cent on-year.

|

| Peter Ryder - CEO at Indochina Capital |

Vietnam’s attractive geographical location, ample supply of young and skilled labourers, and a consistent track record of high-performing economic growth have contributed to the country’s success in attracting FDI. Additionally, the Vietnamese government has implemented attractive incentives, making the country a desirable destination for foreign investors.

One notable example of FDI in Vietnam’s high-tech sector is Samsung, which has invested heavily in the country. In December 2022, Samsung opened Southeast Asia’s largest research and development centre in Hanoi, with an estimated cost of $220 million. The company also announced plans to increase funding in Vietnam from $18 billion to $20 billion.

Moreover, the Samsung Electro-mechanics Vietnam project located in Thai Nguyen province has recently augmented its capital by a substantial amount of $920 million. This development supplements the growing inventory of manufacturing centres that manufacture electronics, network equipment, and multimedia audio products in Bac Ninh and Nghe An provinces, and Haiphong city. Additionally, an electronic component manufacturing project in Phu Tho province has observed an investment capital hike of $163 million.

Apple has demonstrated its commitment to Vietnam’s high-tech sector through significant investments. In June 2022, the company announced the relocation of its iPad production from China to Vietnam and requested Foxconn, its largest partner, to establish a MacBook production line in Vietnam this year.

By 2025, Vietnam is expected to produce 65 per cent of AirPods earphones, 20 per cent of iPad tablets and Apple Watches, and 5 per cent of MacBook laptops. Currently, 25 of Apple’s 190 partners operate factories in Vietnam.

Three major Apple partners in Vietnam, Foxconn, Luxshare, and GoerTek, have been continuously expanding their electronic production facilities to meet the increasing demand from Apple. Foxconn and GoerTek have each announced additional investments of $300 million in Bac Giang province. Luxshare currently operates six factories in Vietnam, employing a total of 40,000 workers.

Pegatron is pumping approximately $481 million in building a factory in Haiphong and plans to relocate its research and development centre from China to Vietnam in the near future. Other notable companies such as BYD, OPPO, Quanta, Amkor, Brose, Xiaomi, Panasonic, and Compal are also considering opening new production plants or relocating their existing ones to Vietnam.

Pros and cons

The trend of diversifying supply chains and production is being propelled by the China+1 strategy, as multinational corporations seek to broaden their supply chains beyond China. Vietnam has emerged as a pivotal regional manufacturing hub due to its initiatives in developing infrastructure, fostering a favourable investment environment, and enhancing market access.

Vietnam has been able to redirect its focus from exporting low-tech manufacturing products to more sophisticated high-tech goods, including electronics and machinery, thanks to free-trade agreements. This shift has created a possibility for foreign investors to capitalise on a skilled labour force at a reduced labour cost than that of China and other Southeast Asian nations.

The Vietnamese government has set clear targets and objectives to draw high-tech FDI. Specifically, the strategy aims to raise the percentage of registered foreign capital from Asia, Europe, and the US to over 70 per cent of the total disbursed in Vietnam by 2025 and 75 per cent by 2030. The government has also pledged to enact new regulations, policies, and incentives to maintain the expansion of FDI in priority sectors such as the high-tech industry.

Vietnam is a desirable destination for foreign investors, although it has its own set of challenges. One of these historical challenges has been controlling inflation and exchange rates, but in recent years, the government has been effective in managing these issues.

Another challenge that they face in Vietnam is the rapid growth of land rental prices in industrial parks (IPs) in recent years. According to a recent report by CBRE, the average industrial land rental price in tier-1 markets in the north was $120 per sq.m per term at the end of 2022, an increase of 11 per cent compared to 2021. In the south, the average land rent in the tier-1 market increased by 8-13 per cent on-year and reached $166 per sq.m per remaining lease term by the end of 2022, about 38 per cent higher than the average of the northern region.

Although land prices in Vietnam are currently competitive in the region, sustained rapid growth could diminish the appeal of FDI for establishing manufacturing facilities in the country.

To draw high-tech foreign-led companies, it is essential to enhance both the quantity and quality of infrastructure and facilities. Although transportation infrastructure in the northern region of Vietnam has made significant strides in the last five years, there is a need to improve the road transport systems and airports in the southern region to meet the surging demand and logistics requirements of existing and potential manufacturers.

An attractive location

The implementation of eco-industrial parks is critical for Vietnam’s sustainable economic growth and attracting high-quality FDI. Despite having approximately 400 IPs and economic zones, some parks have neglected the construction of essential infrastructure such as wastewater treatment plants, thereby posing a threat to the environment and the health of people residing in the surrounding areas. The current number of eco-industrial parks in Vietnam is meagre compared to the total number of IPs.

Therefore, it is imperative for the government to offer a comprehensive incentive package to encourage the development of eco-industrial parks in the country. Such initiatives would not only enhance the overall economic wellbeing of the nation, but also preserve the health and wellbeing of its people, making Vietnam an attractive destination for foreign investment.

The competition to attract FDI in Southeast Asia has intensified, with countries like Indonesia offering new preferential policies such as reducing corporate income tax to 20 per cent by 2022 and allocating 4,000 hectares of land for building new IPs. Meanwhile, Thailand is prioritising high-tech projects in the medical equipment sector and providing a 50 per cent corporate income tax reduction for three years along with human resource development support.

To stay competitive in the region, Vietnam’s government must take note of these developments and ensure that our incentive packages remain attractive to potential investors.

With more than two decades of experience in Vietnam, we have noticed that the complex administrative procedures pose a significant challenge to funding opportunities. The approval and licensing process can be onerous, with differing requirements and timelines between provinces.

To enhance the country's attractiveness for investment, we urge the Vietnamese government to streamline the licensing and approval procedures for projects. Simplifying the process will enable companies to establish their operations promptly and encourage more inflows into the country.

Vietnam has made progress in attracting high-tech FDI, but there are still several challenges that must be addressed. Infrastructure development, the lack of innovative industrial real estate properties, eco-industrial parks, and the complexity of the administrative procedures and approval process must be addressed to maintain Vietnam’s competitiveness in the region. The Vietnamese government must take steps to address these challenges to remain an attractive destination for investors.

| Is Vietnam missing out on foreign indirect investment? Vietnam’s legal framework and management mechanism related to foreign indirect investment have gradually developed to contribute to the completion and stabilisation of capital and financial markets. |

| Partnerships the key for next 35 years of foreign investment Vietnam Investment Review is holding a major conference on May 15 to discuss the 35-year journey of foreign investment in Vietnam, and how to foster new investment in the future, thus contributing more to Vietnam’s vision of becoming a developed, high-income country before the middle of the century. |

| PM orders enhancement of foreign investment attraction efficiency Prime Minister Pham Minh Chinh has signed a directive clarifying tasks and solutions to enhance the efficiency of foreign investment attraction in the new period. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Tag:

Tag:

Mobile Version

Mobile Version