Is Vietnam missing out on foreign indirect investment?

The legislative system, with the promulgation and amendment of the laws on investment, securities, and foreign exchange control ordinance, has seen the State Bank of Vietnam (SBV) and other competent state agencies issuing more regulations to provide specific guidance on investment capital accounts, broaden regulations on determining the rates of capital contribution and share purchases by foreign investors, and guide other relevant matters on the management of foreign exchange and repatriation of foreign investors’ income.

|

| Kent Wong, Partner and head, Banking and Capital Markets VCI Legal |

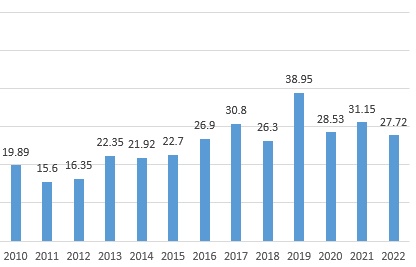

Vietnam’s stock market has grown since its foundation, which has started to generate interest and draw more capital from foreign indirect investment (FII). With regards to share transfer activities, Vietnam’s macroeconomic orientation to promote the equitisation of state-owned enterprises has stimulated demand and paved the way for foreign investors with large sources of capital to enter by way of the purchase of shares and capital contributions.

At the same time, some share purchase mergers and acquisitions and cross-border acquisitions of Vietnamese enterprises are also open and attractive opportunities for international investment funds and financial institutions to take a role in the capital markets of Vietnam.

However, when looking at the big picture, the scale of FII activities in Vietnam is limited and has not had a great impact on the macro investment environment, receiving inadequate attention and management from state management agencies. In order to boost this, Vietnam should greatly increase foreign investor capital ownership in sectors and areas where full direct investment has been made. The government has not focused on encouraging capital sources and financial services.

Moreover, FII has been used as a secondary source, implementing capital for directly funded projects. Other weaknesses are attributed to the fact that most Vietnamese private companies are not yet transparent enough to meet requirements for foreign investment funds, since Vietnam sets a limit on FII into joint-stock companies and access to sectors capable of receiving FII.

Vietnam’s stock market is a marginal market that is still nascent, of which presently, the proportion of transactions by foreign investors is still minor. The derivatives market is developing, but providing very limited opportunities for foreign investors to be interested in.

Generally, FII into Vietnam includes money from foreign sources deposited in Vietnam’s banks or purchases of stocks and corporate bonds issued by Vietnamese companies.

Over the past few years, the stock market has witnessed significant fluctuations. The management mechanism to monitor the disclosure of information has been ineffective, as evidenced by recent, consecutive breaches related to securities manipulation conduct by some businessmen. These might be the negatives that have driven professional foreign investors’ reluctance to invest with FII capital in securities transactions in Vietnam.

In addition, in 2022-2023, the SBV has been maintaining credit thresholds to control the inflation and liquidity capacity of the banking system. Meanwhile, the capacity to control and supervise transactions in the bond market still needs some time to become more appropriate and feasible, especially for private issuance of bonds.

The system of monitoring and forecasting the securities market is still incapable of building and operating a mechanism to ensure the transparency, safety, and balance of information as well as the ability to warn and control risks on capital markets.

This year, the disbursement of the budget for public investment in some hubs, such as Ho Chi Minh City, has been stagnant, which has caused obstacles for businesses to access capital sources. Furthermore, the progress for equitisation in some state-owned groups seems to have been kept neglected and delayed, with no increase in FII capital to invest in these processes.

The decline in the aggregate demands of the global economy together with the impact of instability from banking giants have had negative effects on the financial system, and particularly, the shift of foreign capital flows.

A new shift in policy, including the introduction of global minimum tax regulations which take effect in 2024, and domestic policies from developed countries such as the US, Japan and South Korea, has encouraged large investment capital to return to domestic businesses and markets. These countries have been considered investor/funds exporters of Vietnam in recent times.

Vietnam should also push economic reforms to foster financial and stock markets and facilitate the development of joint stock enterprises to step up FII into the country. On the other hand, the government needs to restrict ownership of foreign capital in such fields as banking, insurance, aviation and telecommunications, although foreign ownership in these Vietnamese sectors should have fewer limitations and restrictions.

| Foreign investment in HCM City up 43 per cent in two months As much as 332.3 million USD in foreign investment was poured into Ho Chi Minh City in the first two months of this year, up 43.1 per cent year on year, the municipal Statistics Office reported. |

| Patience a virtue for rally of foreign direct investment While foreign investment inflow into Vietnam is continuing at a leisurely pace this year, some commitments on large investments ahead could be a glimmer of hope to restrain the decline. |

| National railway investment requiring foreign push Foreign investors are being urged to explore funding railway lines linking seaports as part of the country’s railway development plan – despite high costs, few successful projects, and a lengthy period to see returns. |

| Changes in labour market since Vietnam's Law on Foreign Investment The official passage of the Law on Foreign Investment in Vietnam in 1987 is considered a historic turning point that contributed to attracting an increasing number of foreign-led enterprises to the nation. Nguyen Xuan Son, operations manager for Staffing and Outsourcing Services at ManpowerGroup Vietnam, discusses the law’s effect on the labour market and employees in Vietnam, as well as the expected trends for the next few years. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version