Ice cream franchises pursue dominance

|

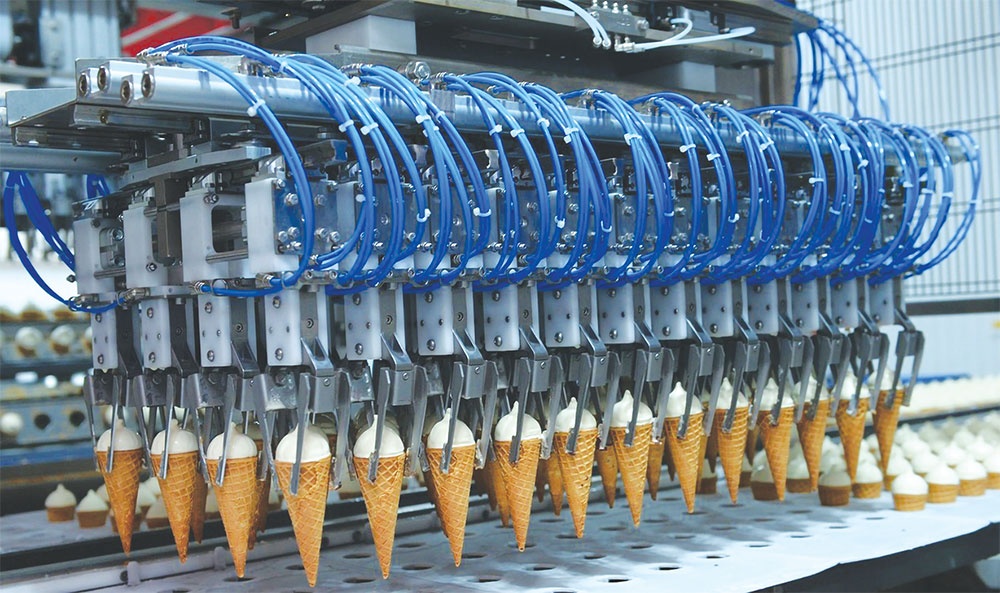

| Local companies are competing with global names in the ice cream segment, Photo: Le Toan |

Vietnam’s fiercely competitive food and beverage market, particularly the ice-cream sector, is witnessing a surge in competition with the entrance of Cooler City, a new player originally from China. Having inaugurated its flagship store in Hanoi in March, the company has wasted no time in expanding its footprint, with nine branches already established in the capital city and plans for more underway.

Cooler City bears a striking resemblance to Mixue – the affordable Chinese chain – in terms of brand, image, strategy, and product offerings. In its quest to capture a wide-ranging customer base, Cooler City has honed in on specific demographics, such as students and families with children. Founded in 2018, it operates under the umbrella of Boduo Corporation based in Zhejiang, China, with over two decades of experience in the segment.

Meanwhile, Mixue’s recent announcement of surpassing 1,000 stores in Vietnam has had a significant impact on the ice cream sector. The Chinese chain’s ambitious growth strategy and focus on affordability have forced established players to reconsider their market positions and adapt their strategies.

Since its entry into the Vietnamese market in 2018, Mixue has strategically positioned itself as a provider of low-cost ice cream and pearl milk tea, leveraging aggressive pricing to rapidly expand its customer base. With a strong presence in Hanoi, Mixue has successfully expanded into other northern provinces through franchising.

In its pursuit of expanding scale and revenue, the brand has proactively ventured into franchise operations at an early stage.

One industry insider told VIR that the underlying business model of Mixue revolves around the essence of business-to-business operations. As of now, in its native China, the band boasts an expansive network of 21,500 stores.

“The resounding triumph experienced in the Chinese market augurs a remarkably prosperous and burgeoning franchise landscape within Vietnam. However, given the brand’s dependence on the sale of raw materials, it is inclined to pursue a multiplicity of outlets. Yet, as the franchise density intensifies, franchisees will inevitably contend with heightened competition among themselves,” he said.

On the flip side, the Vietnamese market has witnessed a rise in imported ice cream from renowned sources such as South Korea, Thailand, and New Zealand in recent years.

Nevertheless, due to the comparatively higher price positioning of these products compared with domestic alternatives, their influence has remained confined to evoking temporary curiosity among consumers, failing to exert significant competitive pressure on local enterprises.

Presently, in the ice cream market, three major players dominate: Kido, Vinamilk, and Unilever. Kido, through its subsidiary Cold Storage Food JSC (KDF), holds the largest market share of around 44.5 per cent, with its Merino brand commanding 24.2 per cent and Celano capturing 19.2 per cent, according to Euromonitor.

Kido’s recent transfer of 24.03 per cent of its charter capital of KDF to an undisclosed partner signals a noteworthy development. While details remain undisclosed, this move has reduced Kido’s ownership in KDF from 73.03 per cent to 49 per cent.

Vinamilk, with its strength in boxed ice cream offerings, competes alongside other local brands like Thuy Ta and Trang Tien, which, while prominent in their respective localities, lack the scale and competitive reach of industry giants like Kido and Vinamilk.

Unilever’s Wall’s brand, re-entering Vietnam in 2008 through a tech transfer agreement with Kido, has successfully gained a significant market share. Wall’s ice cream, featuring popular brands like Paddle Pop and Cornetto, currently commands over 10 per cent of the market.

In contrast, Trang Tien Ice cream, a subsidiary of the Ocean Group, has been operating in Hanoi since 1958 with an extensive network of 200 stores across Vietnam. Surprisingly, it experienced a remarkable resurgence in 2020 after decades of relative complacency.

According to Mordor Intelligence Private, the global ice cream market is poised to ascend with an exponential compound annual growth rate (CAGR) of 2.87 per cent throughout the 2022-2027 period. Within this trajectory, the Asia-Pacific region is expected to exhibit the most dynamic growth.

Vietnam’s own ice cream market is poised to embrace a robust CAGR of 5.5 per cent in terms of consumption, coupled with 6.1 per cent surge in overall market value over this timeframe.

| New faces and flavours intensify ice cream competition Not much after going on sale in Taiwan, brown sugar bubble ice cream has been selling through online shops in Vietnam since May. Demand is so high that vendors are usually sold out even with the price of VND50,000-60,000 ($2.2-2.6) per ice cream bar. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version