Hoping for investment boom in healthcare

|

| Last year it was estimated that $22.7 billion was spent on health in Vietnam, Photo: Le Toan |

Private investment is encouraged in all areas of the health sector, from production and distribution to training and consulting. However, medical facilities is the sector receiving the most abundant private investment.

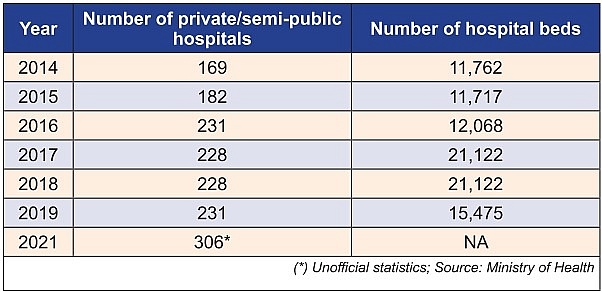

The number of private hospitals increased steadily year by year. In 2012, the whole country had 102 private/semi-public hospitals, providing over 5,800 beds. After five years, the number of hospitals has increased to 182, providing over 11,700 beds. By 2021, the number of private hospitals has been predicted to surge to just over 300.

The private hospital system contributes significantly to health service provision for both healthcare and prevention in Vietnam, providing 43 per cent of outpatient services and also 2.1 per cent of the total inpatient services.

The figures showed that in Vietnam, foreign capital inflows into private equity are popular in the medical, pharmaceutical, and healthcare sectors. In August 2020, VinaCapital continued to invest $26.7 million in the Thu Cuc general hospital system. Hoan My Medical Group, after the acquisition of Hanh Phuc International Hospital and Huu Nghi General Clinic, became the largest private medical group in Vietnam with 15 hospitals and 6 clinics with a scale of more than 3,400 hospital beds, 870 doctors, and nearly 5,300 nurses and other staff.

Private healthcare has grown rapidly in both size and quantity over the years. Accordingly, a number of new large-scale private medical facilities have been established, such as Vinmec Hai Phong International General Hospital, Medlatec General Hospital, and Tam Anh Hospital.

|

Multinational healthcare

Among the world’s leading multinational pharmaceutical companies, many brands have a commercial presence in Vietnam including Abbott, Novartis, Roche, AstraZeneca, Pfizer, Sanofi, GlaxoSmithKline, Bayer, Nipro Pharma Corporation, Taisho Pharmaceuticals, and more.

According to the Health Sector Statistical Yearbook, the average growth rate of the drug supply network from foreign-invested enterprises is 16.7 per cent annually, for example, 29 drug supply establishments in 2014 increased to 30 in 2015 and 35 in 2016, and continually increased each year.

Vietnam is considered an attractive destination for multinational pharmaceutical corporations to establish medical production facilities. There are large-scale projects like drug factory construction in Saigon Hi-Tech Park in Ho Chi Minh City between Vinapharm and the French pharmaceutical group Sanofi with a total investment of $80 million.

Besides that, multinational corporations are also remarkably increasing their ownership percentage in leading pharmaceutical companies in Vietnam. For example, Taisho Group raised its ownership percentage in Hau Giang Pharmaceutical JSC to 51 per cent in 2020.

These moves presented the long-term investment commitment of multinational corporations to provide financial and technological resources to develop the pharmaceutical industry in Vietnam, contributing to the rapid and timely supply of high-quality pharmaceutical products to the Vietnamese.

Recently, another member has been on the list of multinational pharmaceutical companies operating in Vietnam. Last year during the visit of a Vietnamese delegation to the AstraZeneca factory in Sweden, AstraZeneca and its Vietnamese partner reached an agreement to contribute to the domestic pharmaceutical development industry and support the country’s efforts in controlling the ongoing pandemic.

AstraZeneca will invest about $90 million to help Vietnam enhance the national pharmaceutical production capacity, giving patients better access to high-quality medicines manufactured in Vietnam.

AstraZeneca Vietnam has signed cooperation agreements with many units. In distribution cooperation with National Phytopharma, the latter combines its networking strength to distribute AstraZeneca’s medicinal products throughout the country.

Additionally, AstraZeneca Vietnam has brought the first 30 million doses of COVID-19 vaccine to deal with the pandemic in Vietnam. In addition, Pfizer Corporation also contributes to the pandemic prevention campaign by providing vaccines from Pfizer/BioNTech.

According to data from Business Monitor International, the amount of money spent on health in Vietnam in 2017 is estimated at $16.1 billion, accounting for 7.5 per cent of GDP, and last year it was estimated to have increased to about $22.7 billion.

Drug expense per capita has increased gradually year by year, from less than $50 in the period 2005-2015, to over $100 in 2021. This is expected to grow to over $150 in 2025 and $250 in 2027.

Besides people’s needs, changes in regulations and policies are also one of the “driving forces” for private investment and foreign investment to continue developing. The Law on Investment 2021 was enacted to encourage investment in five key fields, including healthcare. Projects relating to these fields will benefit from corporate income tax incentives, land rent exemption and reduction, and credit support.

Required cooperation

In 2020, Minister of Health Nguyen Thanh Long sent a letter to organisations, individuals and the business community to encourage the development of private hospitals and increase the proportion of private beds to 10 per cent by 2025 and 15 per cent by 2030. Currently, the proportion of private hospital beds is only about 6 per cent. Besides, several provinces do not have private hospitals.

Therefore, in order to meet residents’ needs, especially in the provinces, the state is still encouraged to invest and develop private hospital establishments.

In fact, there are many public hospitals in Vietnam that possess brand names, human resources and the ability to train high-quality human resources, but infrastructure and equipment are still limited.

Therefore, the Ministry of Health also encourages public non-business units to cooperate with investors, borrow capital from credit institutions, enter into joint ventures, and associate with organisations and individuals to invest in construction, equipment installation, joint management, operation and exploitation. These units are also encouraged to mobilise capital or borrow capital to establish independent accounting units in order to increase the capacity of providing medical services to society.

Previously, public-private partnership (PPP) agreements were not effective, which makes it difficult to attract investment. Fortunately, the law on PPP investment in 2021 introduced changes to reduce risks for investors.

The mechanism of revenue risk sharing and foreign currency balance assurance has been included in the law on PPP investment. Accordingly, when the actual revenue is less than 75 per cent of the revenue in the financial plan in the PPP project contract, the state would share with the investor 50 per cent of the difference between 75 per cent revenue in the financial plan and actual revenue.

Regarding the guarantee of foreign currency balance, if the money market cannot meet the legal demand for foreign currency, the investor is guaranteed a foreign currency balance of under 30 per cent of the project’s revenue in VND after deducting the amount of foreign currency spent in VND.

Investors who commit to using domestic contractors, goods, and materials are entitled to a preferential rate of 5 per cent when evaluating bids. In addition, Decree No.28/2021/ND-CP has approved the financial indicators of the financial plan calculated on the basis of after-tax cash flows. This change is highly appreciated because investors can better calculate costs for the company when implementing PPP projects.

The law also requires projects to apply an open bidding process to select priority investors, except for projects in priority areas. Foreign investors will be able to compete in good faith to win bids for large projects.

Moreover, the Ministry of Health has issued Decision No.2628/QD-BYT approving a scheme for remote medical examination and treatment for the period of 2020-2025. The goal is that every citizen can be managed, consulted, and examined for diseases, treatment, and professional support of doctors from commune level to central level.

The private sector can take advantage of the shift to digital healthcare services. Many startups jumped into this field in Vietnam before the pandemic. When it broke out, remote healthcare proved its vital role in the form of telehealth consultations, remote imaging, and remote surgical consultation.

In addition to capital from public investment, developing a telehealth system requires cooperation and investment from the private sector. There are several missions required in order to achieve this. Corporations can consider and invest while the government is still working to promote digital transformation in all areas, including health.

| Ngo Thanh Hai, lawyer at LNT & Partners |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Healthcare Platform

- Hanoi intensifies airport monitoring amid Nipah disease risks

- Cosmetics rules set for overhaul under draft decree

- Policy obstacles being addressed in drug licensing and renewal

- Sanofi, Long Chau Pharmacy relaunch medicine blister pack collection initiative

- Takeda Vietnam awarded for ongoing support of Vietnam’s sustainability efforts

Related Contents

Latest News

More News

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

Tag:

Tag:

Mobile Version

Mobile Version