Getting a market perspective on low-emission materials

In recent years, government regulations have encouraged an increasing number of enterprises to invest in developing and manufacturing locally accessible, low-emission, and energy-efficient construction materials. Indeed, the government’s $5 billion social housing credit package may influence the market for low-emission construction materials.

|

| Getting a market perspective on low-emission materials, illustration photo |

This product line is becoming more abundant and varied, from autoclaved cellular concrete with an insulation effect to energy-efficient glass with the capability of blocking solar radiation.

This greatest obstacle is that these things have not yet become widespread in buildings, which has a direct impact on manufacturers’ product consumption. In contrast, green building materials are often modern and innovative goods. Hence, their prices are frequently greater than those of conventional building materials.

Thus, many investors, design consultants, and consumers continue to use conventional construction materials as the use of low-emission and energy-efficient building materials is believed to raise construction prices.

Manufacturers are subject to a variety of negative effects as a result of ineffective policy processes and poor implementation of these regulations. Several times, standards and technical rules on green building materials, as well as user manuals and economic and technical norms, have been established, but they have yet to meet real demand. Even now, many investors, design consultants, and consumers lack sufficient evidence to use low-emission building materials.

Vietnam follows the global trend of increasing production and usage of low-emission, energy-efficient construction and housing materials. Green Star-certified buildings in Australia lower greenhouse gas (GHG) emissions by 62 per cent and water usage by around half, according to the World Green Building Council.

Green buildings certified by the Indian Green Building Council save 40-50 per cent more energy and 20-30 per cent more water than conventional structures. In South Africa, Green Star-certified green buildings save an average of 30-40 per cent of energy, 30-40 per cent of carbon emissions every year, and 20-30 per cent of water annually.

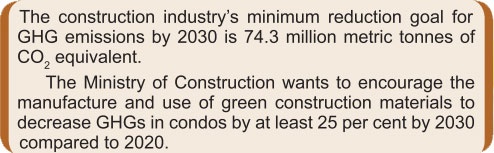

At the end of 2021, Vietnam pledged to cut its overall GHG emissions by 9 per cent by 2030 compared to the development scenario via domestic initiatives and by 27 per cent with the assistance of international organisations. In order to accomplish these objectives, the government has proposed several regulations to promote the development of green, low-emission construction materials, mineral resource conservation, energy conservation, and environmental friendliness.

As the annual average growth rate of the building sector in Vietnam is approaching 9 per cent, the need to cut emissions is rising. The urbanisation rate has reached about 41.7 per cent in 2022, which has raised the need for energy utilised in the building industry.

|

Now, the government must continue issuing, reviewing, modifying, and supplementing preferential processes and regulations for construction projects using green building materials. Concurrently, punishments should be established to address infractions of the stated guidelines, methods, and regulations governing their execution.

Functional authorities must establish complete guidelines, product technical rules, user guides, and economic and technical norms for the use of low-emission building materials. Particularly for social housing developments, precise requirements and specifications are required. Manufacturers of construction materials continue to look for ways to maintain and enhance quality, lower product prices, and encourage the use of low-emission and energy-efficient products.

Meanwhile, firms that manufacture building materials will continue to develop technology and equipment, enhance product quality, cut input costs, and boost consumption of this material product line.

| Recycled building materials struggle for development Traditional natural building materials are being gradually depleted and have shown great limitations, while the development of new and artificial types of building materials has encountered difficulties. |

| Fourth Industrial Revolution nudges green building materials along Industry 4.0 is pushing the building materials industry to increase capacity, decrease the consumption of raw materials and energy, and reduce CO2 emissions, while encouraging the development of environmentally friendly materials. |

| Building materials market forecast to be robust in 2021 The building materials market is forecast to be robust this year, with the demand fuelled by the increase in infrastructure development investment and the recovery of the property market, according to the Ministry of Construction. |

| Price hikes leaving constructors short of building materials to be stabilised The unexpected price hikes of important building materials pose roadblocks to constructors. Moreover, the construction price index climbed by 3.65 per cent in the first nine months of 2021 on-year. |

(*)Dr. Thai Duy Sam - General secretary Vietnam Association of Building Materials

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version