G-bond issuance slides to dismal low

Specifically, the State Treasury (ST) offered VND3 trillion ($133 million) of five-year and ten-year bonds, but did not successfully issue any of them. The Vietnam Bank for Social Policies (VBSP) also offered VND1 trillion ($44.5 million) of bonds across different tenors, but there were no registered bids in the bond auction.

The Vietnam Development Bank (VDB) offered VND2 trillion ($89.0 million), equivalent to one-third of the last week’s total offer. However, only VND29 billion ($1.29 million) of fifteen-year bonds were issued successfully, at a yield of 7.9 per cent per annum, unchanged from the previous week.

As of August 28, VND112,046 billion ($4.99 billion) of government bonds and government-guaranteed bonds have been issued. Of these, VND94,258 billion ($4.19 billion) were ST bonds, completing 38 per cent of the full year target; VBSP accounted for VND8,459 billion ($376 million); and the Vietnam Development Bank (VDB) has mobilised VND9,329 billion ($415 million).

There were no bill transactions recorded during the reviewed week.

During the week, VND2 trillion ($89 million) of five-year municipal bonds were mobilised from the Hanoi State Treasury. The winning ratio reached 100 per cent, due to an attractive bond yield of 7.9 per cent per annum. Thus, the Hanoi State Treasury completed the first phase of its capital construction bonds issuance plan.

Next week, VND4 trillion ($178 million) of bonds will be offered on the primary market. The ST will offer VND2 trillion ($89 million) of five-year bonds and VND1 trillion ($44.5 million) of fifteen-year bonds. The VBSP will offer VND500 billion ($22.2 million) of three-year bonds, VND200 billion ($8.9 million) of five-year bonds, and VND300 billion ($13.4 million) of fifteen-year bonds.

Secondary market

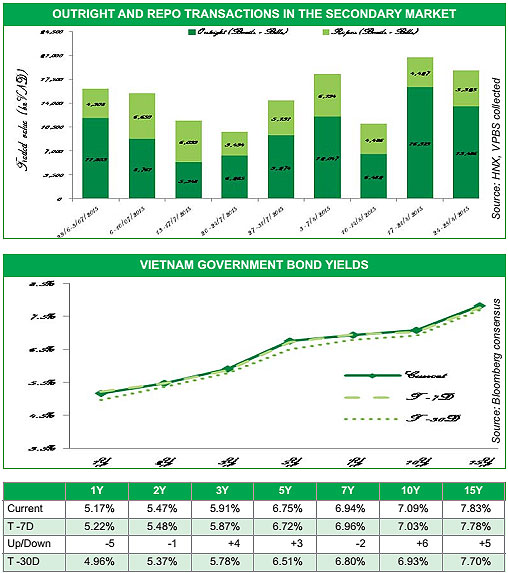

The secondary market slightly decreased last week from the previous week’s strong results, with total trading value of VND18,810 billion ($837 million). The average value per session was VND3,762 billion ($167 million), down 9.31 per cent from the previous week.

Outright transactions dominated trading, with 72 per cent of total volume, equivalent to VND13,486 billion ($599 million). Meanwhile, trading volume of repo transactions was VND5,325 billion ($237 million), which only accounted for 28 per cent of the total.

Trading of three-to-five-year bonds dominated the market, with 30 per cent of total outright transactions. Less-than-one-year bonds and more-than-seven-year bonds transactions occupied 21 per cent and 26 per cent, respectively. One-to-three-year bond transactions accounted for 15 per cent, while five-to-seven year bonds were the lowest, occupying only 9 per cent.

Foreign investors net sold for the fifth consecutive week, with their highest volume year-to-date of VND2,121 billion ($94.4 million)

Bond yields fluctuated in a narrow band last week. Yields continued to rise for most tenors except for a slight decrease of one-year, two- year and seven-year bonds. The VND devaluation significantly reduced demand for domestic currency bonds, thereby pushing bond yields up continuously over the last month. However, in the absence of other specific factors affecting the market, once the exchange rate started to cool down, bond yields only fluctuated in a narrow band.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version