Further scrutiny urged to prevent unethical insurance schemes

|

| Further scrutiny urged to prevent unethical insurance schemes, illustration photo/ Source: freepik.com |

Last week’s investigation by the ministry (MoF) noted high contract termination rates among the four dominant insurance firms, posing big questions about the ethics of their business practices.

The inspection, encompassing Prudential, MB Ageas Life, Sun Life, and BIDV MetLife, revealed an alarming contract cancellation spectrum of 32-73 per cent.

Sun Life, offering its services through TPBank and ACB, recorded the highest rate, while ACB experienced a comparatively lower rate at 39 per cent.

Meanwhile, Prudential’s insurance sales last year, transacted via an extensive network of eight banks, suffered a first-year cancellation and termination rate of 41 per cent.

BIDV MetLife reported a post-first year cancellation rate of 39.4 per cent, leaving MB Ageas Life at the lower end of the scale, albeit with a substantial rate of 32.4 per cent.

The MoF’s Insurance Supervision and Control Department has request Prudential to cost account for a $30.8 million expense and supplement an additional tax liability for this expense.

The inspection unveiled 39 cases where the company’s insurance agents and bank employees failed to comply with regulatory requirements during the sales process, with infractions including procedural non-adherence, inappropriate fee management, and improper customer advice.

Inappropriate expenses, including marketing support costs and bonuses for individual insurance agents, as well as direct incentives for bank employees involved in insurance product sales, accounted for the hefty financial adjustment. The rectification relates to the 2021 accounting period, necessitating accurate expense deductions for taxable corporate income.

On a parallel note, a similar investigation into Sun Life Vietnam has brought to light significant operational issues. The MoF’s comprehensive examination spanned the entirety of 2021, revealing non-compliance with regulations during insurance sales, improper handling of customer complaints, and certification issues in agent training.

A total of over 80,000 new insurance contracts were issued via the bancassurance platform, with a 4.05 per cent cancellation rate. However, discrepancies between cancellation rates and shortcomings in procedural adherence were highlighted.

Furthermore, the MoF has pinpointed Sun Life Vietnam’s inappropriate accounting for expenses and revenue associated with bancassurance activities, necessitating a financial adjustment of over VND600 billion ($25 million).

Nguyen Duc Chi, Deputy Minister of Finance, has also indicated an aggressive oversight plan for the insurance sector from the beginning of the current year.

“By the close of 2023, we are set to audit 10 insurance enterprises, entailing a thorough examination of three life and two non-life insurance enterprises. Furthermore, three life insurance and two non-life insurance companies will undergo additional scrutiny,” he said.

The inspection focus pivots on the intricate business links between these enterprises and financial institutions, namely commercial banks, thereby aligning with governmental directives and resolutions ratified by the National Assembly.

The MoF has slated the continuation of insurance enterprise inspection plans for the remaining half of this year, setting the stage for extensive audits of these businesses in 2024.

As per the regulatory guidelines capping life insurance brokerage fees at 40 per cent, and for this case, banks selling insurance worth VND1 trillion ($41.67 million) stand to gain $16.67 million. This potential profitability is compelling banks to pressure credit officers into prioritising insurance sales, driving annual revenue growth from this sector by 30-50 per cent.

However, Truong Thanh Duc, director of ANVI Law Firm, has highlighted concerns over this practice, suggesting the high first-year contract cancellation rates indicate customers being pressured into buying policies.

“Such unethical practices, if not addressed, erode the customer trust, harming both the banks and the insurance sector’s reputation, both of which heavily rely on customer trust and credibility,” he said.

Professor Dinh Trong Thinh, a senior lecturer at the Finance Academy, said that the first-year insurance contract termination rates reflect customers’ significant financial losses, given the general insurance policy does not permit refunds. He emphasised the necessity for increased scrutiny by the MoF to rectify such malpractice.

“A recent proposal suggests customers not be required to buy insurance for at least 3-6 months post loan procurement, helping mitigate forced insurance policy sales,” he said.

The General Statistics Office has recorded the first decline in premium revenue since its data tracking began in 2016, reflecting financial strains in the industry. Q2 of 2023 premium revenue is approximately $2.55 billion, down 3.12 per cent on-year, with H1 of 2023 revenue at $4.88 billion, a 1.62 per cent on-year decrease.

The life insurance sector, previously a market growth driver, saw just a $125 million new business premium increase in Q1 of 2023, far from the robust 13-35 per cent growth during the first six months of 2016-2021.

| MoF urgently orders inspections at four life insurance companies The Ministry of Finance (MoF) has just assigned the Insurance Supervisory Authority the urgent task of conducting inspections at four insurance companies, namely Prudential Vietnam Life Insurance, MB Ageas Life Insurance, BIDV Metlife Life Insurance, and Sunlife Vietnam Life Insurance. |

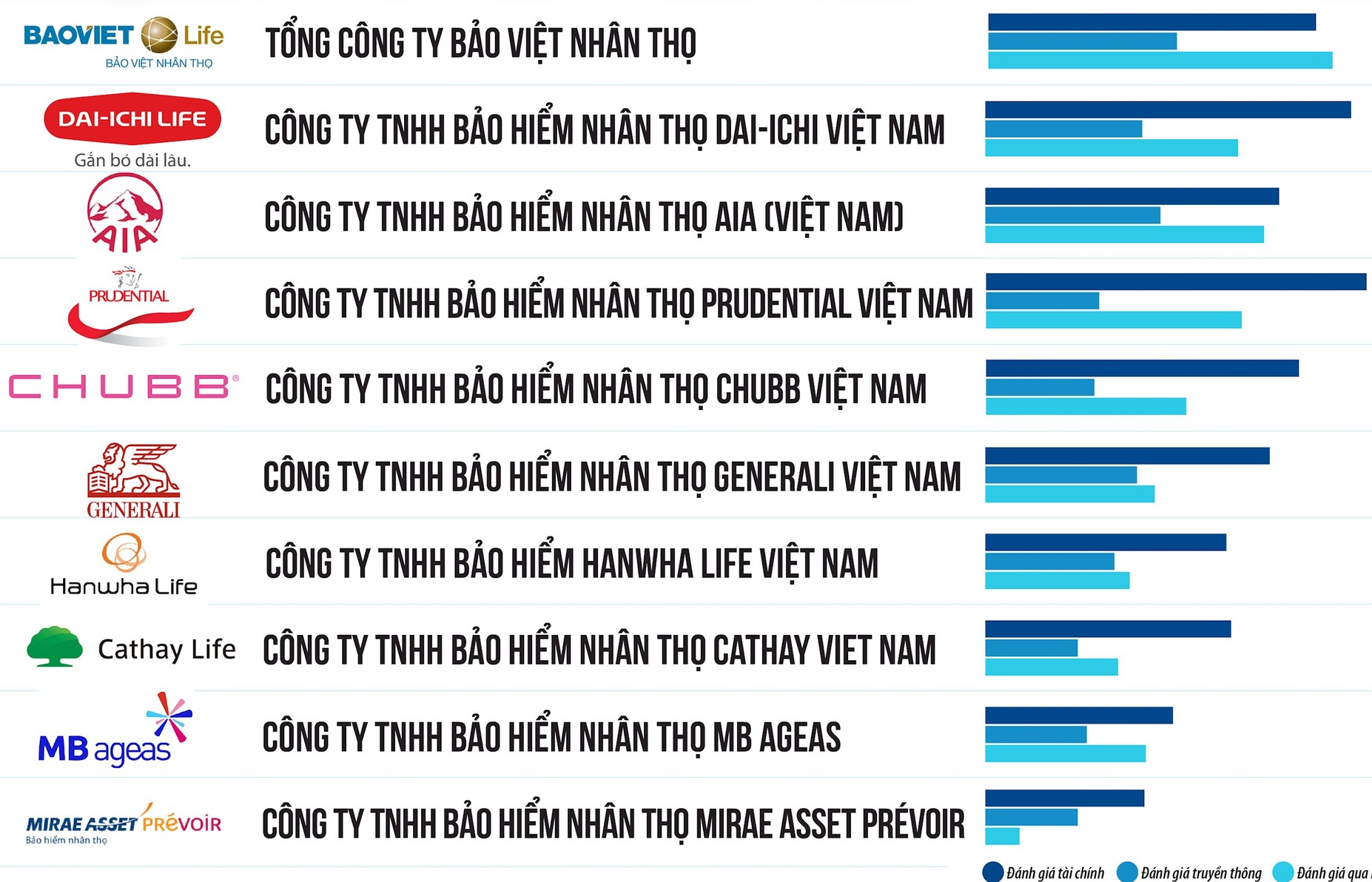

| Vietnam Report reveals Top 10 insurance companies in Vietnam in 2023 Vietnam Report has just released its highly anticipated list of the 10 most reputable insurance companies in Vietnam for 2023. The list encompasses two categories, life insurance and non-life insurance. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version