Foreign investors optimistic on added property attraction

The Vietnam Real Estate Association and Vietnam Real Estate Research Institute published its annual report on Hanoi’s mid- and high-end property market for the next three years in early June, which gives the perspective of domestic and foreign experts on the current market.

|

| Foreign investors optimistic on added property attraction |

After surveying 300 large investors and organisations, the report said 10.5 per cent of respondents saw the real estate market and prices in Vietnam as ‘highly attractive’; 47.4 per cent rated them ‘very attractive’ but said the country needed to improve conditions; 21.1 per cent rated it ‘rather attractive’, 15.8 per cent ‘slightly attractive; and the remaining 5.3 per cent cited it as ‘not attractive.’

Eric Park, chairman of the Korea Real Estate Services Development Association, said that Vietnam’s real estate market was one of the top investment priorities of South Koreans. “The reason is that the interest rates are very low in recent years, so they are keen to invest in real estate. I think as long as there is economic growth, real estate prices will continue to increase,” Park said.

Not only at home, South Korean investors are also a big factor in the global real estate market, with investment decisions ranging from $50 to $400 million, according to Park.

|

In the Vietnamese market, many Korean developers have already invested in Vietnam and many individuals own apartments in the big cities.

However, while some are eager to invest, many are concerned about the laws for foreign investors. However, with an improved legal system, Park said Vietnam would remain Korea’s top-priority investment market.

“Currently, the flow of South Koreans living and working in Vietnam is increasing every year. The demand for housing, workspace and entertainment for this group is also increasing,” he said.

“For example, offices for lease and the hybrid working model are the main trends in the rental market. Tenants from the tech and biotech industries are growing. Office streets where many corporations and companies are concentrated, will draw tenants to move in to find the best rental price.”

Many domestic experts assess that Vietnam is facing many problems, similar to the period of economic crisis in the 2008-2013 period. However, Datuk Joseph Lau, CEO of Parkcity Group, a real estate developer from Malaysia, is optimistic that the real estate market in Vietnam will soon improve.

“The market in Vietnam has not always been smooth sailing, especially during the global financial crisis and the pandemic. We are optimistic that soon the overall local real estate market will perform better with an anticipated GDP growth and that our products will continue to draw positive buyers and investors,” he said.

In Vietnam, the control of credit and bonds has made it difficult for both businesses and people to access financing loans for real estate. The rising lending rate has weakened demand. Financial funding is one of the main struggles and difficulties faced by our consumers.

“To overcome this, we have introduced flexible payment schemes and collaborated with banks in offering a better lending rate,” Lau added.

According to Lau, sustainability will be one of the key drivers defining Parkcity’s business. In order to create sustainable communities, they need to be diverse, well connected, and conveniences need to be thoughtfully designed. Parkcity will place more sustainable elements and features across all its developments in the near future.

He also emphasised the importance of diversifying products to meet the needs of customers of different ages, with different needs and desires.

“There are many opportunities, along with challenges. It is necessary to keep a positive attitude and explore new ways of the digital age and explore potential markets,” he added.

As of May 20, the total registered foreign investment capital into Vietnam in the first five months reached nearly $10.86 billion, down 7.3 per cent over the same period of last year.

Among those, the processing and manufacturing industry took the lead with a total investment of more than $6.64 billion, accounting for 61 per cent of the total registered investment capital and down 2.5 per cent over the same period.

Banking and financial activities ranked second with a total investment of more than $1.53 billion, accounting for more than 14.1 per cent of total registered capital and increasing more than 12 times over the same period.

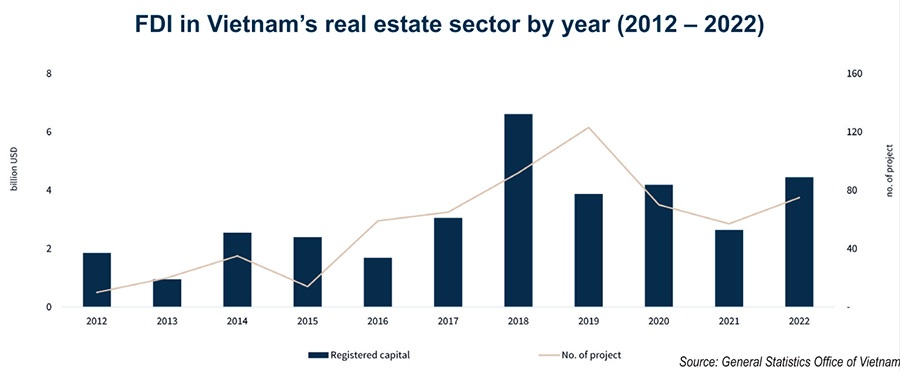

Real estate business and science and technology ranked third and fourth respectively with the total registered capital of nearly $1.16 billion (down 61.3 per cent) and nearly $481 million (up 28.3 per cent).

| Jeff Foo - Chairman Singaporean Real Estate Association I just had a trip to Ho Chi Minh City and found many high-end real estate products. I predict real estate prices in Vietnam will increase. People with money can choose to invest in stocks, bonds, establish a business or invest in real estate to make a profit. For Singaporeans, investing in real estate is still the most popular because it is simply a freehold property. Particularly in the high-end apartment segment, prices have increased a lot in recent years. Singaporean investors have invested in the Vietnamese real estate market for the past 20 years, such as CapitaLand, Keppel Land, City Development, GuocoLand, and Ascendas, Mapletree. Those groups have been investing in all ranges of the Vietnam real estate market from offices, retail, supply chains, and factories, to information institutes, residential units and serviced apartments. Singaporean investors will remain keen to invest here because prices here are lower than those in Singapore and continue to grow. As a foreigner investing in Vietnam, when deciding to invest in a project I may consider the investor’s prestige, the brand and especially the potential for price increase. In addition, Vietnam’s population is increasing, so there will be more real estate products that are not only high-end but even mid-range products. I can see an increase in high-end real estate because this market is still attracting foreigners to come and invest in long-term, not only high-end apartments but also offices. Advice for Vietnam’s real estate market from Singapore’s experience in developing high-end real estate projects is to follow construction standards and use quality building materials. Upon completion of the work, all initial construction standards must be reviewed and strictly followed regulations set forth by the government on construction quality. Yoshi Nori Takita - President’s Ambassador to Vietnam, Laos, and Cambodia American Association of Realtors International investors will wait for a more transparent market. To attract more foreign investors, Vietnam’s real estate market needs more transparency so that foreign investors can have enough information to compare prices and choose products. I would like to see Vietnam change its regulations to make it easier for foreigners to buy and invest in real estate in the country. In the Philippines, for example, they promote their high-end apartment products abroad a lot, targeting Filipinos living abroad and other international investors. Everything is transacted in English. They use English in purchasing and setting up dossiers, and their administrative procedures are simple. The payment steps are quite similar to those in the United States. I have not seen this in Vietnam. I want to emphasise that there are not enough databases for individual investors to find out information about the real estate market in Vietnam. We want to see market trends, average market prices, rate of increase in value, and economic parameters. This information is available, but very difficult for foreigners to access. |

| Real estate living on borrowed time In the first five months of 2023, 554 realty firms went out of business, up 30.4 per cent year-on-year. Others became worse off as their revenue and profit fell by nearly 7 and 40 per cent, respectively. |

| Many foreigners continue to buying property in Vietnam According to a report compiled by the Ministry of Construction, a total of 3,197 foreign individuals and 236 foreign entities, have purchased and obtained ownership of residential properties across Vietnam, and the issuing authority continues to grant certification to permitted foreign entities and individuals. |

| Vietnam, RoK boost intellectual property cooperation The Intellectual Property Office of Vietnam (IPO) under the Ministry of Science and the Korean Intellectual Property Office (KIPO) of the Republic of Korea (RoK) signed a Memorandum of Understanding (MoU) on strengthening intellectual property cooperation at a ceremony on June 22 in Hanoi. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

Tag:

Tag:

Mobile Version

Mobile Version