FDI to raise up supporting industries

|

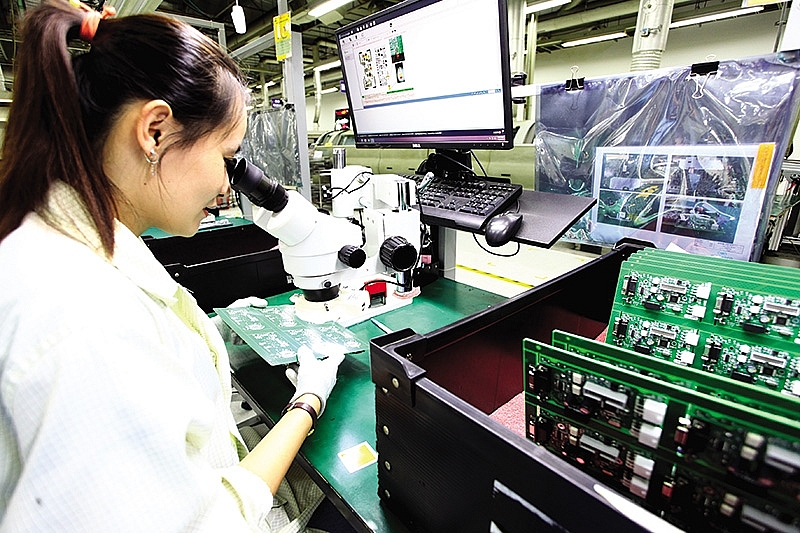

| Supporting industries are a major pillar of the economy and set to benefit from incoming foreign manufacturers, Photo: Le Toan |

More and more supply chain and procurement managers involved in outsourcing decisions are taking a closer look at Vietnam these days. Not only did Apple supplier GoerTek announce intention to begin producing wireless earphones in Vietnam, Cheng Uei and Pegatron, which supply chargers and connectors for iPhones, are also considering expanding production overseas, including in Vietnam.

Meanwhile, big names like Samsung, LG, Microsoft, and Intel have already picked Vietnam as their production base and began relocating technology and equipment from elsewhere, such as China, Malaysia, Thailand, and Costa Rica, to the Southeast Asian country.

Competitive advantages

Two South Korean light-emitting diode (LED) manufacturers plan to open factories in Vietnam. Seoul Semiconductor Co., Ltd. said it would invest $300 million in a new LED assembly facility, while Lumens Co., Ltd. also announced opening a LED factory. Lumens mainly manufactures LED products for TVs and smartphones.

Original equipment manufacturers (OEMs) and electronics manufacturing services (EMS) providers are turning to Vietnam to take advantage of low labour costs. Global OEMs and EMS providers like LG, Samsung, HP, Canon, Foxconn, Jabil, and Sparton are manufacturing printed circuit boards, camera modules, printers, servers, phones, networking equipment, television sets, and other electronics equipment in the country.

As for other components, Murata Manufacturing Co., Ltd. from Japan has four factories in Vietnam building discretes, according to Dan Panzica, chief analyst for outsourced manufacturing intelligence service at IHS Markit Technology, while Sharp makes camera modules, Sumitomo Electric manufactures connectors, Nidec makes motors and fans, and Foster Electric makes audio and speaker modules. Molex has factories in Vietnam producing connectors.

In Panzica’s view, while there is a limited supply base in Vietnam, it is growing. As device manufacturing takes hold, component and module manufacturers will follow. Also, there are a number of smaller Vietnamese companies that provide factory infrastructure support, cleanroom supplies, packaging materials, and printing capabilities.

Moreover, according to Panzica, the quality of products manufactured and assembled in Vietnam is very competitive.

Deputy managing director of Reed Tradex Co., Ltd. (Thailand) Suttisak Wilanan told VIR at a recent event, “This is good for Vietnam and the supporting industries themselves as the country has a growing electronics manufacturing industry and one of the lowest labour costs. Foreign electronic parts manufacturers will head to Vietnam as giant firms flock to the country.”

Panzica said electronics manufacturing in Vietnam is growing at a crazy pace and companies are adding capacity. Meanwhile, Vietnam’s chip market is expected to grow at a compound annual growth rate of 15.44 per cent from 2016-2020, according to researcher Technavio.

According to Panzica, Vietnam is a destination for low-cost manufacturing, but it will also climb the learning curve. Vietnam will be able to do more value-added activities such as developing its own tooling. In five-10 years, the country will develop the capability to become a turnkey manufacturing centre.

Besides, the on-going US-China trade war has added new energy to the debate over whether importers should shift production to Vietnam. According to Virginia B. Foote, co-chair of the Vietnam Business Forum (VBF), Vietnam has outperformed many of its peers in attracting foreign direct investment (FDI), with examples in manufacturing and infrastructure, services, consumer goods, and agricultural and industrial products.

“Today, there are tremendous opportunities in Vietnam for both domestic and foreign business sectors,” said Foote. “The ongoing US-China trade tensions have highlighted the risk of concentrating production bases in a single country and are triggering supply chain reorganisation. Companies are considering shifting some production flows, and Southeast Asia will compete to gain some of that business.”

The question is how Vietnam can fully capitalise on these global opportunities in order to continue its rapid upward economic trajectory. To help Vietnam step up its policies in this area, Foote flagged some areas of concern for further improvement, including the country’s supporting industries.

Bringing next-generation FDI strategy to life

In line with global trends and the development of new investment modes, Vietnam new-generation foreign direct investment (FDI) strategy keeps high-tech and new technologies in priority. Other points of focus will include luring large-scale projects from transnational corporations named on the Forbes Global 2000 list in sectors using high-tech, new and advanced technologies, and modern services.

As shown in the latest draft of the strategy, the top areas for FDI attraction in the coming years will include high-tech, new, and advanced technologies, IT and telecommunications, advanced electronics, automobiles, agricultural machinery, and supporting industries, among others.

According to Minister of Industry and Trade Tran Tuan Anh, in addition to supporting policies for the industry, the ministry would identify the key sectors which should be prioritised in order to bring about breakthrough development. Some sectors which have potential include electronics, automobiles, garments and textiles, leather shoes, and energy.

The minister said that he had asked the prime minister to allow the establishment of research and development centres for supporting industries.

According to experts, the country’s supporting industries are the foundation for major industries through the supply of parts, components, and technical processes. The supporting industries do not play the auxiliary, but the main role in the national industry. In the age of global economic integration, the domestic industry cannot grow without flourishing supporting industries because this is the factor that determines production costs and enhances the added value and competitiveness of final products.

Wilanan from Reed Tradex said that in recent years, the Fourth Industrial Revolution has been spreading its wings. This revolution now impacts investment trends on a global scale, and Vietnam will not be affected at this moment.

“However, we only expect to see distinct changes from 2020 onwards, but it does not mean Vietnam should ignore this trend until we are too outdated and cannot keep up with the times,” he said. “Manufacturing and processing, power distribution, and property will remain the top foreign investment channels in the year ahead. Small- and medium-sized entrepreneurs need to upgrade and take this opportunity to create their core advantages in the future.”

According to Wilanan, as one of the priority industries, it is a major concern whether the Vietnamese automobile manufacturing industry can catch the coming opportunities. The automotive industry is a high-tech industry and is a driving force for many other supporting industries, such as mechanics, electricity, electronics, plastics, rubber, glass, informatics, and automation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version