Facilitating recovery of Vietnam’s yarn sector in midst of US policy enforcement

What are the concerns surrounding the Uyghur Forced Labor Prevention Act (UFLPA) implementation among Vietnamese garment exporters to the US?

|

| Association chairman Vu Duc Giang |

Some of the concerns are real. Since the UFLPA became effective in June, Vietnam has witnessed certain impacts on its garment exports to the US. Vietnam has maintained its position as the world’s third-largest cotton importer with a volume of 1.5 million tonnes per year. This includes 800,000 tonnes of cotton imported from the US, accounting for 60 per cent of the total imports.

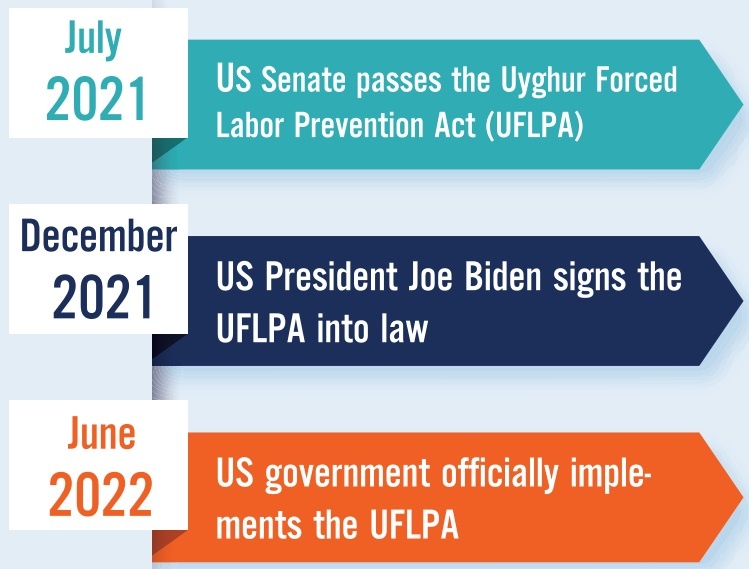

In January 2021, US Customs and Border Protection announced a ban on raw fibres, apparel, and textiles made from Xinjiang-grown cotton, which also covers cotton products made in third countries. Customs will detain imported merchandise unless the importer can prove by clear and convincing evidence that the goods were not from Xinjiang.

What is the status of the recommendations from the US on Chinese cotton?

Vietnam no longer imports Chinese cotton to produce garments for export. Vietnam only imports 0.2-0.5 per cent of Chinese cotton each year, which is a very small number to produce some domestic consumer goods.

As Vietnam is increasingly integrated globally, the country has made efforts to comply with the import and export regulations in overseas markets, including the US. As soon as the US issued warnings, Vietnamese exporters have become more cautious in choosing raw materials for export orders. They have rejected the orders using Chinese cotton.

How does the implementation of the UFLPA affect Vietnam amidst the rising global cotton prices?

|

As cotton prices have been on a reverse trend, Vietnam is likely to face three problems.

Firstly, the price hike is attributable to speculation in the financial market. In the international market, cotton prices maintained a high level of more than $2 per kg in 2021. In Q1 of this year, cotton prices skyrocketed by 33 per cent but, at present, these prices are declining due to the shrinking purchasing power in the global market. This has a positive impact on the input of Vietnam’s textile sector. If cotton prices remain at $2.40-2.50, Vietnam’s yarn prices will be relatively competitive in export markets, including the US and EU.

Secondly, the reverse trend of cotton prices also facilitates the recovery of Vietnam’s yarn sector. This is especially true for the knitwear segment, which Vietnam holds enormous strengths. The knitwear segment is expected to rebound in the fourth quarter of this year.

Thirdly, this reversal will also have a positive impact on the restructuring of the yarn industry. Vietnam boasts advantages in producing and exporting blended yarns, polyester yarns and synthetic fibres. However, the country remains stagnant in cotton yarn production.

At the same time, Vietnam targets to become one of the key pillars of the global yarn market. To facilitate the goal, the country needs to ramp up efforts to diversify its products and upgrade cutting-edge technologies to meet the global demand.

What are the factors affecting the cotton supply to the Vietnamese market?

The cycle of the cotton industry is based on a number of factors, including speculation and weather. The US government is now paying more attention to the cotton industry with favourable policies to promote US cotton in Vietnam.

The US is also restructuring its market to increase cotton exports from the US to Vietnam.

High-quality American cotton is suitable for Vietnam’s export orders. However, the unfavourable weather in six key cotton-growing US states could lead to a drop in cotton production for the 2022-2023 crop, according to the American Cotton Association.

The US is Vietnam’s largest cotton import market as well as Vietnam’s largest garment export market. We are considering rebalancing the trade of textile and garment products with the US towards sustainable development. Currently, Vietnamese garment exports to the US market have registered over $14 billion per year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Rising consumption and travel fuel ‘Tet season’ stocks (February 11, 2026 | 11:43)

- Education as strategic capital: why Dwight School Hanoi represents a long-term investment in Vietnam’s future (February 10, 2026 | 19:00)

- Green logistics–the vital link in the global energy transition (February 09, 2026 | 19:35)

- Wages and Lunar New Year bonuses on the rise (February 09, 2026 | 17:47)

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

Mobile Version

Mobile Version