Experts scrutinise inconsistent accounting standards

|

| Experts scrutinise inconsistent accounting standards, illustration photo |

One of the biggest changes, for example, is how the International Financial Reporting Standards (IFRS) and the Vietnam Accounting Standards (VAS) differ on calculating the value of assets and account payables.

At last week’s tax and audit seminar organised by consulting firm RSM in Ho Chi Minh City, experts and businesses talked at length about this matter. Specifically, according to the IFRS 13, assets and account payables must be measured by their fair value, determined as the amount paid in a transaction if the asset is sold in the open market. Meanwhile, the VAS tells businesses to record the asset value in their historical cost, or the nominal or original cost of an asset when it was acquired. Historical cost, as its name suggests, does not change over time like fair value and thus does not reflect any ups and downs in the value of an asset.

Critics of the VAS said that this rigidity makes it difficult for foreign investors to understand the correct value of assets and account payables. This is especially concerning when the value of assets goes down over time due to depreciation or other losses. As a result, businesses in Vietnam are strongly encouraged to adopt the fair value system of the IFRS, applicable to their assets, as well as financial and real estate investments.

|

| Source: RSM |

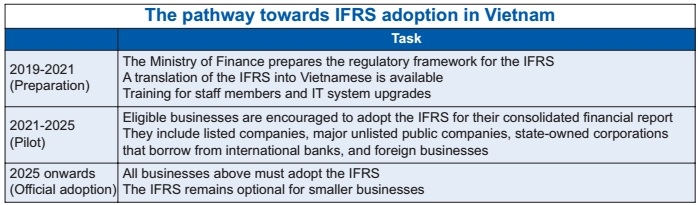

However, measuring fair value is not an easy task. According to Dang Xuan Canh, managing partner at RSM Vietnam, the calculating system for fair value in Vietnam remains lacking. Circular No.200/2014/TT-BTC from the Ministry of Finance allows businesses to gloss over this part if they do not have the right calculating tools, but the IFRS is strict with using only fair value in financial reports.

“If a company cannot measure the fair value on its own, it will have to outsource. Many accountants in Vietnamese companies are not yet trained to do this, because their undergraduate study does not meet the IFRS level yet,” said Canh.

Calculating fair value also means more work for the accounting team, as prices have to be updated frequently.

At the event, an accountant from a foreign-invested enterprise also shared her experience with the VAS and IFRS. According to this accountant, the IFRS includes 19 standards that are absent from the VAS, and she does not know how to find the fair value either. In general, her enterprise already had to invest significant resources in training and IT to keep up with the IFRS requirements. “I believe that we will need more regulatory frameworks to assist the adoption of the IFRS in Vietnam, especially in the area of fair value calculation,” said Canh.

The need to update their IT system and know-how is especially difficult and costly for small- to medium-sized enterprises. Senior executives at some companies might not be interested in switching to the IFRS, which is evident in their hesitance to use the IFRS in their day-to-day management.

However, most businesses agree that in order to draw in foreign investors, the only way to go for Vietnamese businesses is using the IFRS. These standards are widely used in 87 per cent of the countries around the world, creating a streamlined system for investment funds when studying a company. In the ASEAN, Thailand is making its way towards adopting the full IFRS, while Indonesia is at the basic level. In Singapore, the local accounting standards have converged with the IFRS.

Canh advised companies in Vietnam to take a step-by-step approach to adopting the IFRS. In the first year, businesses can start with setting up an IFRS version of their finances and begin with IFRS 1, which provides guidance for first-time adopters.

Besides the main focus on the IFRS, RSM experts and participants also discussed the latest tax updates in Vietnam, ranging from the revised Law on Tax Administration to the adoption of e-invoice rules.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Implementation of the circular economy in Vietnam (November 13, 2023 | 11:30)

- Banking’s development in data and digitalisation era (November 07, 2023 | 15:24)

- ESG enabling real estate businesses to attain funds (June 16, 2023 | 15:25)

- RSM Vietnam stays ahead of the changing business environment (March 14, 2023 | 10:07)

- What might the Vietnamese economy look like in 2023? (January 02, 2023 | 21:37)

- Neobanking: a trend-setting model for the digital revolution (December 19, 2022 | 14:30)

- Evaluating the prospects of M&A upswings next year (November 28, 2022 | 08:00)

- RSM Vietnam celebrates opening new office in Ho Chi Minh City (September 20, 2022 | 19:29)

- RSM Vietnam taking advantage of central region recovery to expand operations (September 19, 2022 | 08:00)

- Firm grasp of rules crucial in handling customer info (August 29, 2022 | 08:00)

Mobile Version

Mobile Version