Energy-intensive industries urged to approach decarbonisation objectives

Addressing the need for decarbonisation at a hybrid conference in Ho Chi Minh City on March 16, the International Finance Corporation (IFC) under the World Bank Group noted that remaining behind in technology adoption and being shut out from traditional export destinations due to high emissions will result in dire consequences.

“The decarbonisation trends in manufacturing including the cement industry is becoming more and more populous,” said Li Tu, global manufacturing sector lead and senior investment officer from the IFC. According to Tu, customers, governments, and investors are all seeking more sustainable development paths and therefore underline decarbonisation.

“The demands of customers in developed markets such as the United States and Europe are pushing producers in the supply chain to focus on decarbonisation. Governments globally are also moving very fast in this space,” she noted.

|

| Energy-intensive industries urged to approach decarbonisation objectives, illustration photo/ Photo: Duc Thanh |

Vietnam is the world’s third-biggest cement producer after China and India. According to associate professor Luong Duc Long from the Vietnam Cement Association, low carbon cement production is possible with reuse of waste or alternative materials in production, or use of alternative fuels from industrial waste. As in the circular economy, cement production can open the door for biomass development and reducing plastic waste.

“Over the past 20 years, the heat consumed to burn clinker has decreased from around 1,000 kcal per kg to 750-850. Electricity consumption has decreased by about 5-10 per cent and some plants have used up to 20-27 per cent of alternative fuels over the years,” Long said.

To be able to reduce carbon emissions in cement production even more and to meet net-zero targets by mid-century, Long suggested continuing to accelerate the achievements of past years, developing a mechanism to compensate for carbon emissions when using alternative raw materials and fuels, and using waste as an alternative fuel for burning cement clinker. In addition, a domestic carbon market will provide more incentives.

Meanwhile, figures from the Vietnam Plastic Association showed that, last year, the Vietnamese plastic industry produced 9.54 million tonnes and generated $25.18 billion in revenues. According to Huynh Thi My, the association’s secretary general, the country imported about 7,000 tonnes of plastic beads to process.

Bhardwaj Vinay, Vietnam country head of Indorama Ventures who took over PET manufacturer Ngoc Nghia JSC last year said, “When we talk about the circular economy, we operate around the three key principles of reuse, reduce, and recycle. In order to facilitate recycling, the design stage is important. For shopping bags and flexible packaging, for example, the latest trend is using homogeneous materials. If you use two different kinds of polymers, then you cannot recycle them because separating them then recycling them is impossible.”

Vietnam’s steel industry is also a big energy consumer and greenhouse gas (GHG) producer that needs to change its practice. According to the Energy Conservation Research and Development Centre (ENERTEAM) in Ho Chi Minh City, the industry is currently characterised by high raw material consumption, high energy demand, and high emissions of GHGs and others such as dust, heavy metals, dioxins, and pollutants in wastewater and noise.

To decarbonise the steel industry, ENERTEAM suggests focusing on areas including energy saving, environmental protection, and material recycling. Nguyen Sy Linh, head of Climate Change and Global Issues at the Institute of Strategy and Policy on Natural Resources and Environment, pointed out policy implications for manufacturing sector decarbonisation, including following a domestic carbon market that includes an emissions trading scheme.

“Currently, the Ministry of Natural Resources and Environment is developing the market including a GHG inventory database, which is a positive sign for carbon market. In addition, competent authorities should review the list of facilities that must conduct inventory to prepare for reduction measures, such as carbon capture and storage technology, along with taking advantage of Vietnam’s fresh commitments to tap into green funds under the Just Energy Transition Partnership,” Linh said.

According to Decision No.01/2022/QD-TTg, all GHG-emitting establishments must carry out inventory, which could pave the way to establish a carbon exchange mechanism sooner rather than later.

| Antonio Della Pelle - Manufacturing decarbonisation lead, East Asia & Pacific International Finance Corporation

The challenges that Vietnam faces are no different from anywhere else. We need to create an ecosystem where we all work towards decarbonisation, and cost is going to be the biggest hurdle. Regarding the technology required for decarbonisation, Vietnam is not the only country which needs to double down on new technologies for this. Some analysts said competent technologies could be ready in the next 15 years, but we cannot wait. So, what we need to do is starting the journey together. Vietnam needs to start a comprehensive plan focusing on a decarbonisation roadmap and then implement the technology and learn from the best international practices. Maybe these technologies are not fully ready, but you can start to issue pilots and see what you can do with new technologies. |

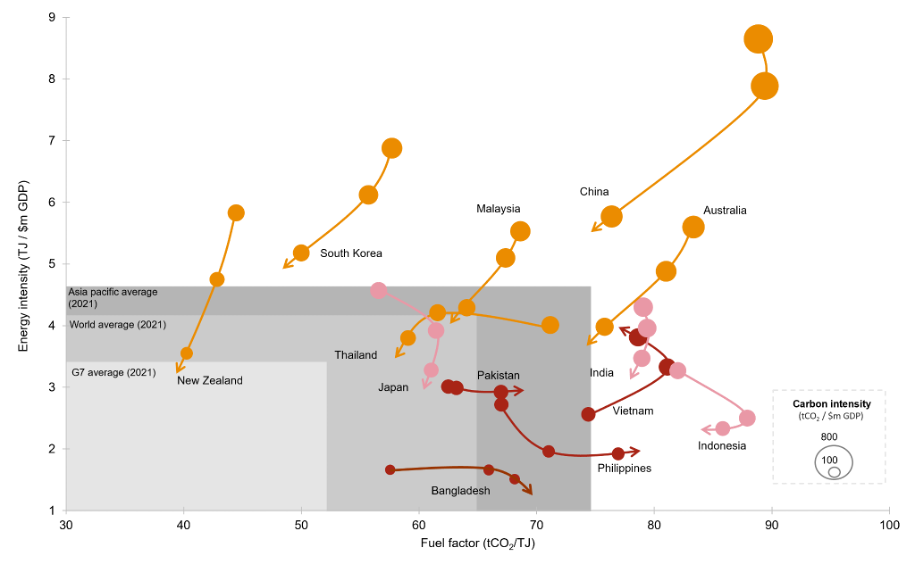

| Asia-Pacific outperforms global decarbonisation in 2021 The Asia-Pacific region outperformed its global counterparts in 2021 with a decarbonisation rate of 1.2 per cent versus 0.5 per cent elsewhere, as stated in a newly-released PwC report that highlights the efforts to decouple greenhouse gas emissions from economic growth despite the global headwinds. |

| Japan, US, Australia to assist Vietnam in decarbonisation Government-backed financial institutions from Japan, the US, and Australia have pledged to support Vietnam's efforts to cut carbon emissions, according to the chairman of the Japan Bank for International Cooperation (JBIC). |

| Taking a five-step approach towards decarbonisation Companies are facing geopolitical upheavals, supply chain disruption, inflation, and the threat of recession. Despite this perfect storm, their commitment to decarbonisation has not fundamentally wavered. The number of companies embracing science-based targets is continuing to grow at a rapid pace. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

Tag:

Tag:

Mobile Version

Mobile Version