Taking a five-step approach towards decarbonisation

However, as they make pledges to reduce their carbon footprint, executives need to acknowledge the ways the environment for decarbonisation and climate has quickly changed.

Setting ambitions has proven to be the easy part, but meeting those goals is difficult. Companies now find themselves needing to look beyond setting ambitions to tackling the real challenges of decarbonising and finding ways to monetise it.

Global policy has become more prominent. Some governments are acting more boldly to make the carbon transition a source of competitive advantage, rather than risk losing green business to another country. However, many governments also have had to make difficult near-term energy policy decisions, in some cases choosing between a looming climate disaster, keeping their people fed, and keeping energy costs from breaking the backs of the population.

|

| Taking a five-step approach towards decarbonisation, photo Shutterstock |

As the effects of climate change quickly become more evident, so does the need to not only mitigate by reducing emissions, but also adapt by adjusting to a changing climate. As developing economies and underserved communities struggle with rising energy and food prices, companies face the reality that the carbon transition needs to be addressed in a way that is fair to all.

These changes come when companies are devising and implementing downturn strategies and require difficult new choices. They need to address cost in an inflationary environment, reset supply chains for resilience, and scrutinise strategic investment in the face of uncertainty. Each of these can be tackled with carbon and climate in mind.

In cost reduction, for example, the best companies will deal with cost and carbon simultaneously to emerge from the downturn with a more competitive cost and carbon base. There can be an overlap between cutting cost and cutting carbon: less material, less energy, and less waste all equal less cost and less carbon.

While some companies might view decarbonisation efforts as discretionary budget items in a downturn, the best will maintain those investments, even optimising them in the face of increased cost scrutiny.

It will take a combination of vision and pragmatism for companies to reach their decarbonisation goals and create value in the process – and there are five areas that companies must get right to succeed.

Firstly, companies do not need more climate scenarios but, rather, clarity on the relevant ones. Most importantly, they need to identify the signposts that will indicate what is coming next. This is especially vital given the recently accelerated pace of policy changes and advances in tech.

Historically, scenarios and signposts were focused on climate transition risks, such as changes in economics and market demand. Now, that is extending to climate physical scenarios – changes to weather patterns and business resilience.

Especially in the current downturn, and with climate change intensifying, winners will adopt a living strategy, taking steps to deliver results today, such as improving energy efficiency and optimising supply chains, while investing in next-generation solutions like hydrogen.

Secondly, as companies face sharpened expectations of shareholders and lenders, it will be critical for them to double down on proof points to clearly explain how a more profitable business in the medium-to-long term is also a more sustainable one. This means showing how they have started to reduce carbon in a cost-effective manner while also making the business resilient to transition and physical risks. They will also be required to show that they have the options to get to net-zero and how they will be flexible based on evolving regulations and technology.

Next, companies that are most successful in their climate transitions start decarbonisation with the customer in mind and work backward across offerings, operations, and the supply chain. More than ever, it will be critical to clearly understand the sustainability priorities of customers who are navigating a downturn and are very focused on costs.

Not all customers are moving at the same pace, so targeting the right ones based on their carbon ambition, progress, and internal carbon price used is the best way to achieve the right green premium.

Furthermore, the carbon transition is a problem far too big to be solved by any company on its own, and companies need to engage the wider ecosystem of customers, suppliers, and peers up and down the value chain.

For example, when building the hydrogen economy, many players will need to come together, everyone from renewable energy generators to electrolyser producers to off takers. Policymakers should be part of these partnerships, as corporations can offer solutions that regulators may not have considered.

Finally, top management may be fully convinced of the need for aggressive decarbonisation, and new recruits often have chosen an employer based on its green credentials. Yet the task of delivering on decarbonisation has solidly moved into middle management, and some companies underinvest in convincing and empowering middle management to get the job done.

It is now critical to integrate decarbonisation delivery into a company’s current performance management system by aligning incentives to decarbonisation, by putting a price on carbon in the decisions that matter – and by providing clarity and guidance to middle management on how to resolve trade-offs.

| Vietnam and Denmark double-down on decarbonisation co-operation The two-day visit of the Danish Permanent Secretary for Climate, Energy and Utilities, Morten Baek, to Vietnam on November 4 and 5 has enhanced the government-to-government partnership between Vietnam and Denmark in the energy sector. |

| Shipping sector prioritises five solutions for decarbonisation Global energy giant Shell together with Deloitte Netherlands and Deloitte UK today published a joint research outlining industry perspectives on decarbonising the shipping sector. |

| Vietnam’s roadmap to decarbonisation Global demand for energy is increasing due to population and economic growth, especially in large emerging countries, which will account for 60 per cent demand growth by 2025. Vietnam, as a developing country, is therefore facing some barriers. |

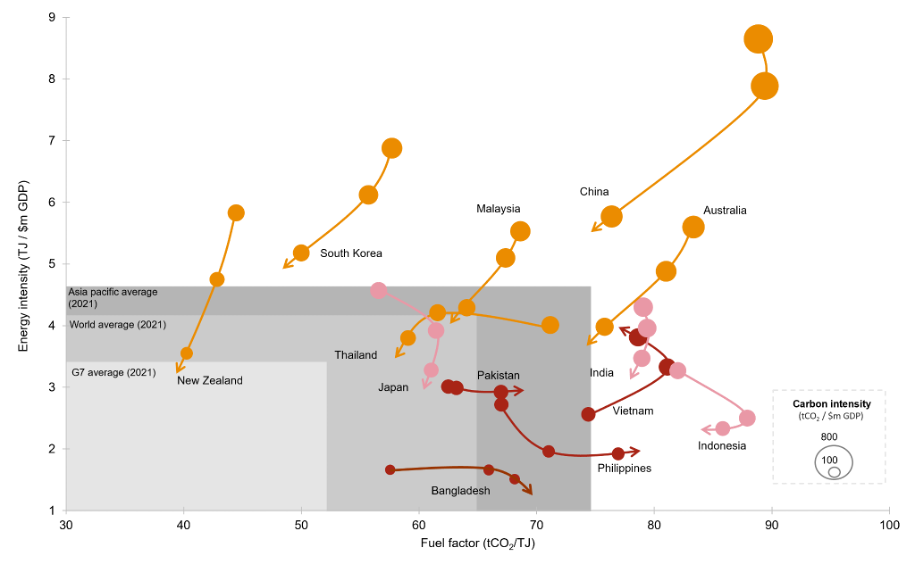

| Asia-Pacific outperforms global decarbonisation in 2021 The Asia-Pacific region outperformed its global counterparts in 2021 with a decarbonisation rate of 1.2 per cent versus 0.5 per cent elsewhere, as stated in a newly-released PwC report that highlights the efforts to decouple greenhouse gas emissions from economic growth despite the global headwinds. |

| Japan, US, Australia to assist Vietnam in decarbonisation Government-backed financial institutions from Japan, the US, and Australia have pledged to support Vietnam's efforts to cut carbon emissions, according to the chairman of the Japan Bank for International Cooperation (JBIC). |

(*)Torsten Lichtenau Partner, Bain & Company London and Andrea Campagnoli Partner, Bain & Company Vietnam

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

Tag:

Tag:

Mobile Version

Mobile Version