Domestic banks gain CPTPP benefits

|

| Mergers and acquisitions are likely as international banks team up with local businesses in order to travese the regulatory landscape in Vietnam, Photo: Le Toan |

|

When it comes to the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), most talk has been focused on Vietnam’s exports and manufacturing sector rather than finance and banking. However, the CPTPP does have a separate chapter on financial services among its 11 members, and experts believed that the country’s banking system will change dramatically thanks to this historic trade deal.

The most significant impact of the CPTPP is that trade and investment in the Asia-Pacific region will increase, and Vietnam is expected to receive a bigger flow of foreign direct investment (FDI) from member countries along with the rest of the world.

According to Farhan Faruqui, CEO of International Banking at ANZ, more cross-border business activities will lead to a greater need for financial services in Vietnam, ranging from transactions and foreign exchange to trade finance. He noted that the banks’ home markets of Australia and New Zealand are both members of the CPTPP alongside Vietnam, which is why ANZ views the CPTPP, as well as other trade pacts that Vietnam recently signed, in a very positive light.

Faruqui added that with its long history of serving businesses in Asia-Pacific, ANZ will ensure that it can assist multinational companies investing in the country, and major Vietnamese businesses looking abroad. “Vietnam’s economic integration and buzzing trade activities provides great opportunities for the bank, as we pride ourselves in helping the regional flow of trade and capital,” Faruqui told VIR.

Other experts stated that Vietnam’s integrated market upon joining the CPTPP means good business for banks. Oliver Massmann, general director of law firm Duane Morris, noted that the trade deal will stimulate domestic reforms in the financial sector, making Vietnam a great investment environment for financial institutions.

Besides the CPTPP itself, banks also emphasised Vietnam’s appeal as a growing market for financial services. This includes a vast population, a rising middle class with higher disposable income, and a need for more sophisticated services. Among CPTPP members, Vietnam’s banking sector is among the least developed, which means ample room for funding from regional and overseas banks.

Foreign partnerships

In a recent study, analysts Nguyen Thuy Linh, Vu Ngoc Diep, and Le Mai Trang from Vietnam University of Commerce pointed out that the CPTPP allows banks to operate overseas without a physical presence there. This means a Japanese bank can offer services such as credit cards or cross-border transactions to Vietnamese consumers, without having to open a branch in Vietnam. According to the researchers, the most likely target for these overseas banks is middle-class consumers in urban areas. A wider range of services, from both Vietnamese and foreign banks, benefit consumers and enhance the competitiveness of the Vietnamese banking sector.

When expanding their business in Vietnam for the CPTPP, overseas banks may also choose to team up with a Vietnamese partner in a merger and acquisition (M&A) deal. This is a quicker and more convenient route than seeking licences for a new branch, and foreign banks can take advantage of the existing local network and know-how of the domestic partner. Simultaneously, the Vietnamese side gains access to international standards of banking, creating a win-win relationship.

“Foreign banks have the clear advantage of financial capacity, human resources and technology. They may choose to be a strategic partner of Vietnamese banks via M&A transactions for quicker access to the local market,” said the analysts from Vietnam University of Commerce.

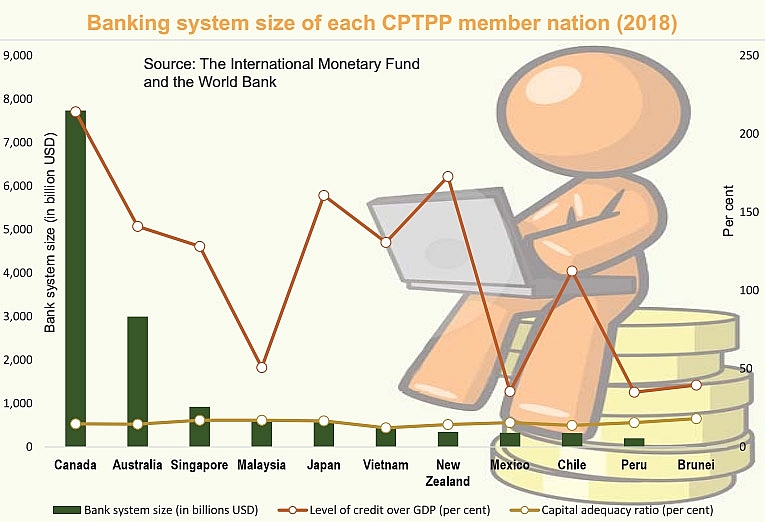

M&A deals with banks from other CPTPP members also inject fresh money into Vietnam’s banking industry, which is struggling with capital requirements for the Basel II banking regulation recommendations. Specifically, local commercial banks are racing to increase their funding to satisfy the capital adequacy ratio (CAR) of Basel II, which means seeking deep-pocketed foreign partners. Data from the World Bank shows that Vietnam has the lowest CAR among all CPTPP member countries, which weakens the defence of Vietnamese lenders against loan defaults or bank runs.

According to economist Can Van Luc, the CPTPP and other trade deals signal to the world that Vietnam is ready to join a level playing field on global markets, and investors can find opportunities in the country’s banking sector. The government is also looking to divest from some major lenders, and scores of private banks are also preparing for their public listing.

Integrating globally

Still, difficulties remain for foreign banks to enter Vietnam, especially those looking for M&A transactions, said Luc. This is due to a strict limit on the foreign-owned stake at banks, currently at 30 per cent for all overseas investors. One strategic partner can own only 20 per cent of stake at a Vietnamese lender. The level of transparency in Vietnam’s banking sector is also low although there have been improvements in recent years, said the economist.

“To integrate our economy as part of the CPTPP movement, we need to gradually and cautiously revise the foreign ownership cap at Vietnamese banks. The first step can be relaxing the limit to 49 per cent, and in the long run, the government can continue to consult the trade deals in their subsequent decisions regarding this limit,” said Luc.

Luc emphasised the need to balance between Vietnam’s openness to foreign banks while still maintaining a level of control over the domestic system, which is a conditional and highly-sensitive sector of the Vietnamese economy.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: CPTPP

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version