Digital transformation with smart factories proves urgent

Vietnam is emerging as an attractive post-COVID destination for large corporations with the goal of enhancing supply chain resilience and reducing dependence on one country.

According to the report "Vietnam Manufacturing Outlook 2022" by the British Chamber of Commerce (BritCham), the manufacturing industry led with 58.2 per cent of total foreign direct investment (FDI) in 2020 and contributed 25.1 per cent of Vietnam's GDP in 2021. This industry also accounted for 95.1 per cent of total exports in the same period, with two key sectors being electronics and textiles.

In textiles, Vietnam has been in the top five exporting countries for many consecutive years, especially for the US and European markets. By 2021, Vietnam's textile and garment exports total value was $39 billion.

Vietnam has overtaken China to become the top manufacturing location for Nike and Adidas. The two fashion giants currently have 200 and 76 domestic factories, respectively.

The country’s development in electronics is mainly reflected in the attraction of well-known brands such as Samsung, Intel, and Xiaomi. These enterprises soon realised the potential and established supply chains in Vietnam for over a decade.

Last year, Apple also mentioned Vietnam as the market with the best growth rate when 25 partners are processing products here.

In addition to possessing a strategic location, Vietnam's production costs are more competitive than other countries in the region. The average hourly income of workers is about $3, only half that of China ($6.5). Vietnam's manufacturing enterprises also benefit from tax incentives and operating costs thanks to the recently effective FTAs.

|

| Digital Transformation Maturity level - ABeam Consulting |

Those advantages are a great driving force for the impressive growth of the whole industry, helping Vietnam become a bright spot for FDI attraction. Vietnam is also appreciated for its anti-pandemic policies, economic recovery support and timely production promotion to bring society back to the ‘new normal.’

However, there is still a long way to go for Vietnam to transform itself into a smart manufacturing hub and usurp the "made in China" position. In a document published in September 2022, Nikkei Asia pointed out several urgent tasks that Vietnam needs to perform, including preparing a skilled workforce and improving production capacity for domestic enterprises.

Efforts to innovate manufacturing

Vietnam has been determined to promote digital application, digitisation, and automation of domestic production processes for many years.

Developing smart production amid industrialisation and modernisation is an important goal. This has also been mentioned in many high-level Forums on Industry 4.0.

The rapid development of technology is a solid premise for promoting smart manufacturing.

Many large enterprises have boldly invested in building smart factories with a production control system, automatic line connection and seamless data transmission, such as Thaco Mazda, VinFast complexes in Dinh Vu-Cat Hai Economic Zone (Haiphong), Vinamilk dairy factory (Binh Duong), and Rang Dong plastic factory (Long An) among others.

| As a consulting firm with more than 40 years of experience, ABeam Consulting has supported Japanese textile and garment manufacturing enterprises in Vietnam to transform digitally. |

Furthermore, the Vietnamese government issued Decision 17/2021/QD-TTg on vocational training support, showed the effort to radically solve the shortage of skilled human resources, especially in the IT sector.

Earlier this year, the Ministry of Industry and Trade teamed up with Samsung in a smart factory development project with the goal of training 100 local experts and assisting in consulting and improving 50 smart factory development enterprises in two years. The participating enterprises have all harvested inspiring initial results.

Smart factories are still mainly a game for the major players in Vietnam. Experts from ABeam Consulting said that many businesses are still struggling with the question of what smart manufacturing is and where to start, and 70 – 80 per cent of firms have not yet prepared human resources and are confused about choosing technology for digital transformation.

“A Smart Factory aims to streamline existing business processes and optimise entire production capacity by visualising all processes and using data to improve customer value, along with boosting efficiency and productivity of products and services,” explains Kato Yoichiro, senior manager, Smart Factory solution consultant at ABeam Consulting.

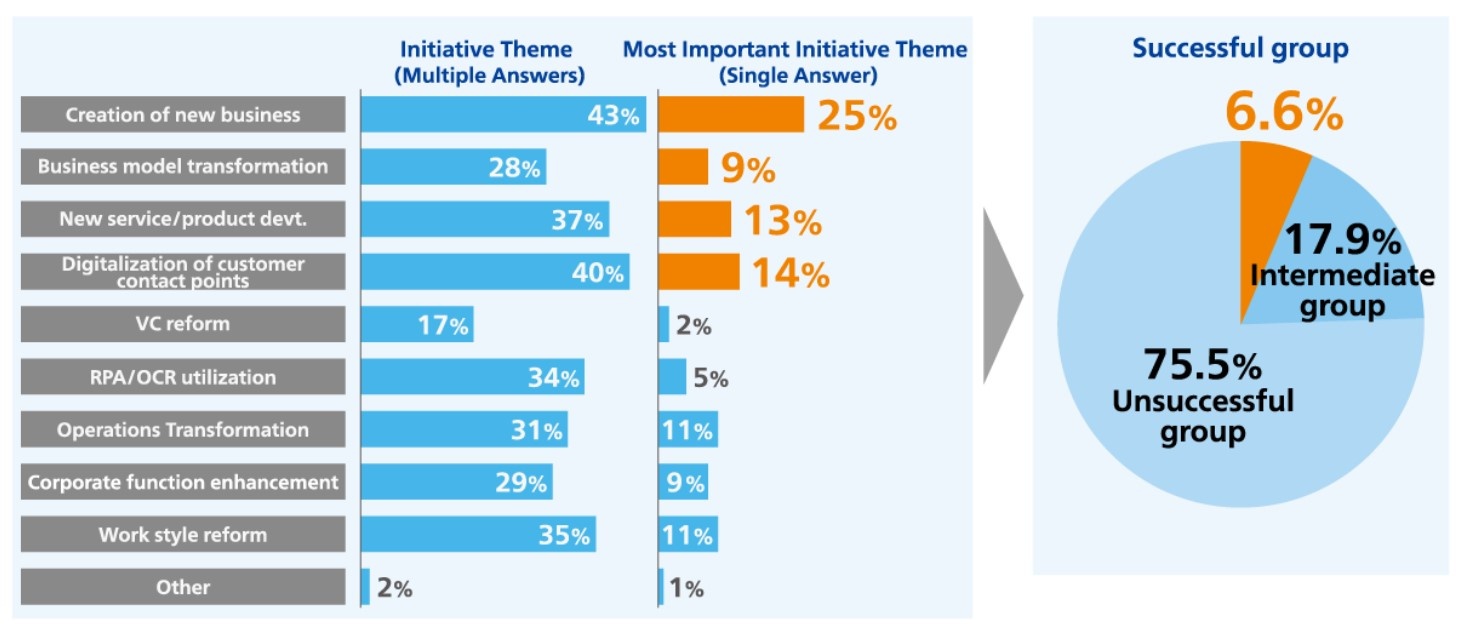

According to the digital maturity survey conducted by ABeam Consulting in five Southeast Asian countries, the digital transformation vision and strategy are currently at an ideal level, but the lack of clear direction and practical experience can lead to unsuccessful conversions. Businesses, therefore, need help from consulting units to effectively implement the Smart Factory model.

As a consulting firm with more than 40 years of experience, ABeam Consulting has supported Japanese textile and garment manufacturing enterprises in Vietnam to transform digitally.

“We help partners reduce product defects with data. Specifically, technicians diagnose the cause, collect data and recommend edge devices to control data from the factory. Then, the data science department analyses them to find out which processes are having problems,” Yoichiro said.

ABeam Consulting experts believe that 2022 is a golden time for Vietnamese enterprises to develop smart factories. In addition to benefiting from the ‘China + 1’ trend and strong support from the government, the increasing appearance of new tools and solutions for smart Factories, such as Digital Twin help businesses save costs, increase productivity, reduce downtime, and better end-product quality control.

|

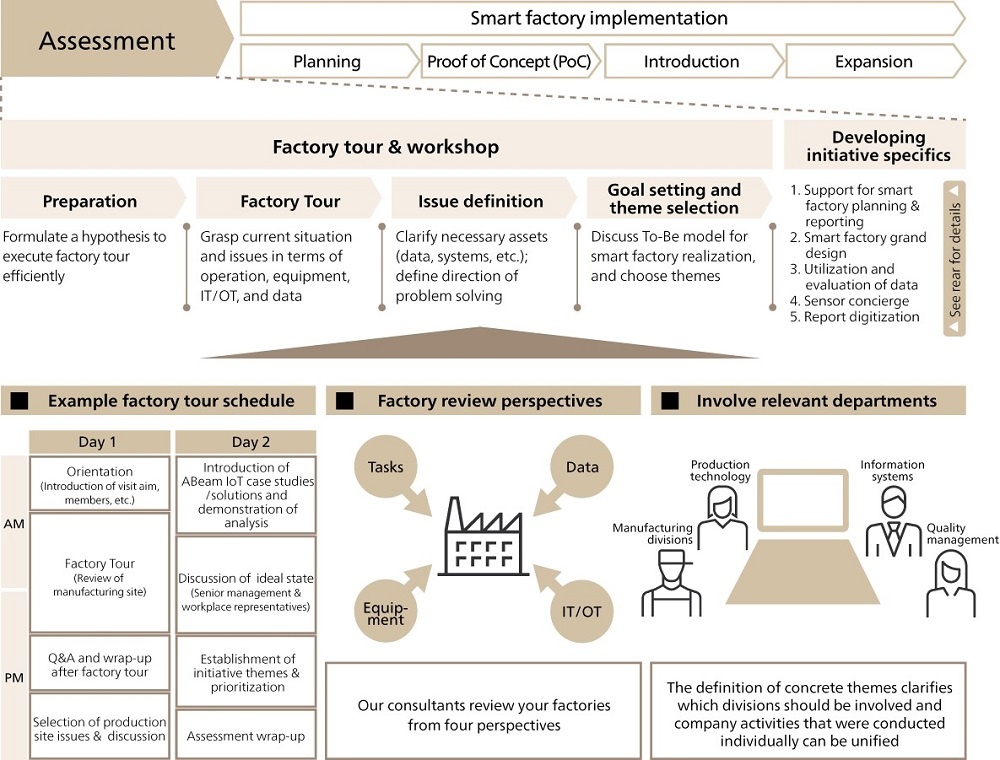

Whether businesses are worried about investment budget, human resource allocation, or technical difficulties in the process of argument transfer, ABeam Consulting is ready to assist with “Quick Smart Factory.”

This toolkit is considered suitable to help businesses build a basic foundation for a smart factory with minimal cost and time.

To understand the problem affecting the production line, experts with unique expertise at ABeam Consulting will embrace surveys and make evaluations through key target indicators, including production costs and production costs. After collecting and analysing, the experts will propose solutions to help businesses to make the most of digital technology and their core technology potential.

| Although smart factories that utilise data and digital tools at factory sites play an important role within Industry 4.0, new issues arise, such as disappointing returns on IoT system investment, or low company-internal IoT proficiency levels. ABeam Consulting provides a variety of Internet of Things (IoT) solutions that leverage manufacturing industry expertise and cutting-edge technology. With the right assessment, the service identifies issues and assigns tasks to develop resolution approaches, assisting many factories in the Vietnamese market in taking the first steps toward smart factory implementation. Find more info about ABeam Consulting – Smart factory solutions at: abeam.com/my/en/expertise/SL268 |

| Digital transformation accompanying SMEs for viability and growth The Ministry of Planning and Investment (MPI), the Vietnam Chamber of Commerce and Industry (VCCI), and Meta just organised the Forum on Accompanying SMEs with Digital Transformation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version