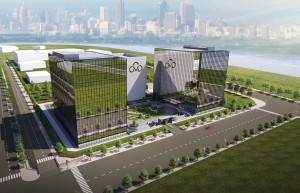

Data centres in Vietnam: an investment goldmine

With unprecedented growth in digital technologies and interconnectivity, the Vietnamese economy is set to evolve in the coming decades. To embrace such a shift, developing and investing in data centres and the renewable energy sector is necessary, especially with consumers, businesses, and governments all pushing in this direction.

Data centres will need strong and continuous energy security and a tremendous amount of power to operate, offering a great opportunity for investors to develop and invest in the Vietnamese renewable energy sector, especially when the government wants the data centre industry to meet targeted green standards by 2030.

|

| Quentin Peres - Foreign legal scholar (left), DFDL and Kevin Hawkins Partner, DFDL |

There are currently many incentives at different levels that favour the development and investments in data centres in Vietnam.

At the consumer level, there’s a growing demand for digital products and services. The impact of the pandemic can still be felt in the country with an increasing trend towards remote work, which will increase the need for better processing speed across the country. Furthermore, the growing use of over-the-top services and online shopping platforms by end-users is no stranger to such trends. The internet penetration rate in 2022 has more than doubled compared to 2012, and it will continue to increase rapidly.

At the business level, Vietnam’s industrial sector using digital technologies or digitalising its existing processes is growing.

The Ministry of Planning and Investment and the Agency for Enterprise Development are currently helping 100 enterprises adopt digital transformation by 2025 and have set up a support programme that helps more than 30,000 businesses move towards digital transformation.

This transformation must include cloud computing technology. It will enhance the development of data-generating and data-hungry technologies, such as the Internet of Things, AI, 5G, big data, and machine learning.

From an urban development perspective, Ho Chi Minh City, Hanoi, Danang, and Nha Trang all form part of Vietnam’s vision towards highly connected smart cities, which requires extensive data storage capacity and high-performing connectivity.

From a legal perspective, Vietnam provides a favourable regulatory landscape to invest in data centres, including a decision in 2020 to approve a National Digital Transformation Programme, a cybersecurity law, and a decree that came into force last month to force onshore online service providers to store Vietnamese users’ information inside the country.

In a developing data centre industry with profitable potential, challenges await investors and service providers. Vietnam has specific laws and regulations regarding foreign investment, as well as detailed requirements for the data centre industry.

Investors must comply with the country’s technical regulations and standards issued by the Ministry of Information and Communications. Some licences related to trade, import, export, or manufacture of cyber information security products or civil encryption products may also be required on a case-by-case basis under Vietnamese law.

The nation’s high-tech parks provide strategic geographical locations near industrial parks, helping develop interconnected and supportive industries with attractive investment incentives and a favourable regulatory and tax environment.

Data centre operations must rely on strong energy security and infrastructure to keep pace with an energy-consuming industry. Service providers must rely on uninterrupted power supplied by third parties to limit their exposure to system failure or security breaches. Exposure cannot always be limited entirely, but investors and service providers will have to consider this important issue when negotiating power purchase agreements.

The strong and continuous energy security required by the data centre industry will also result in growth in renewable energy, energy storage technology, and peer-to-peer energy-sharing platforms in Vietnam.

Data centre investors and providers will have stringent environmental, health and safety standards to comply with as data centres here must meet green standards set by the government by 2030.

Another important aspect for data centre service providers is the security of the land tenure on which the data centre is located. This can be particularly challenging to navigate for foreign investors as there is no private ownership of land in Vietnam, but rather the granting of long-term land use rights by the government. Considering the potential material adverse impact that termination, failure to renew, or disputes arising from the terms of the leaseholds could have, investors must clearly understand their land use rights.

Finally, investors must ensure that material contracts with customers are well drafted and cover all aspects of data centres’ service agreements.

Investment in data centres in Vietnam should be a growing opportunity for foreign and local investors. The country has embraced a full-on digital economy approach, and all regulatory, governmental, economic, and social actors are moving in this direction, creating a favourable economic landscape for investment in the industry. However, several challenges remain for any investor who wants to enter this industry, and getting advice from your legal advisor is essential.

Investors should pick up their pickaxes and start digging, because data centres could be a gold mine.

| Japanese technology giant NTT looking to expand data centres in Vietnam NTT Ltd.’s Global Data Centers division is considering further expansion in southern Vietnam, Bangkok (Thailand), and Osaka Metropolitan area (Japan) in response to the strong demand of its clients. |

| ABB smart solutions safeguard power to one of Vietnam’s largest data centres ABB technologies will safeguard critical power and ensure uptime for CMC Creative Space, a leader in providing cloud computing infrastructure. |

| More Singapore firms develop new data centres in Vietnam Singaporean businesses are increasingly investing in new data centres in Vietnam to serve the rising demand for data storage solutions in Vietnam. |

| Data centres mark new digital stage Domestic and international investors are increasingly turning to alternatives in the Vietnamese market such as data centres and self-storage services to diversify their portfolios and enhance return. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

Tag:

Tag:

Mobile Version

Mobile Version