Criteo: Vietnamese consumers turn to online shopping amidst COVID-19 pandemic

Covering data from the Asia-Pacific region, including Southeast Asia, Criteo’s research uncovered a definitive increase in online sales transactions. This may be attributed to the shift in shopper behaviour as consumers observe social distancing.

|

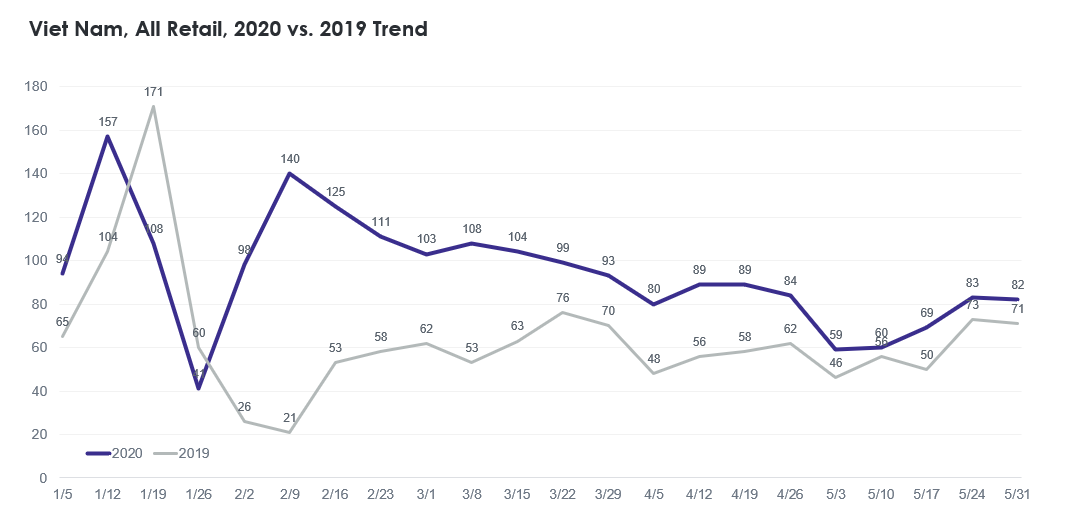

| Vietnam. Indexed Weekly Sales, 2020 compared to Average in January 1-28, 2019 |

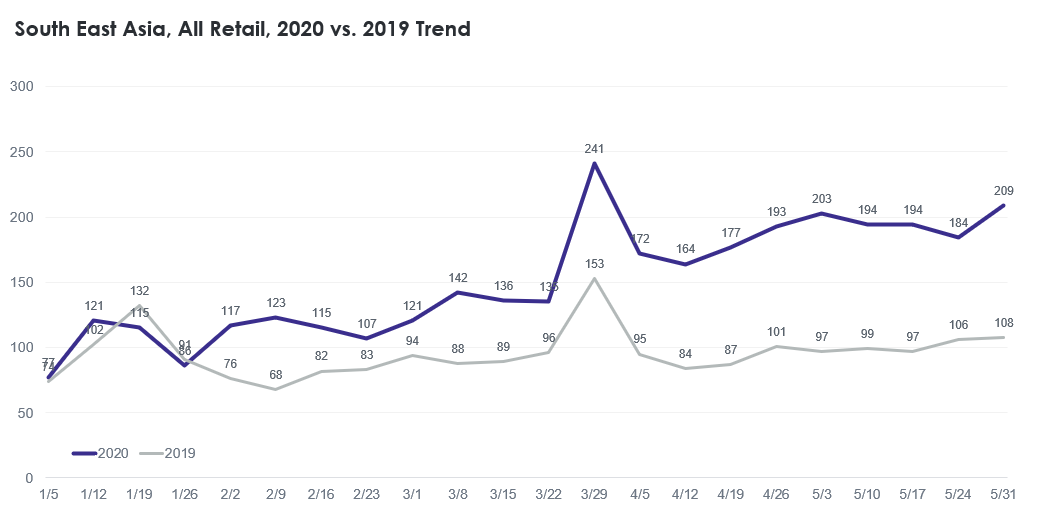

In Vietnam, online retail remains strong in the first half of this year compared to the same period in 2019, and recently it is getting close to what was observed in 2019, according to research results. As for the rest of Southeast Asia (SEA), online retail keeps growing as based on Criteo’s data on the impact of coronavirus in the Asia-Pacific, online retail sales in SEA are experiencing a higher uplift this year compared to 2019, with the highest sales uplift seen in the week of May 3 at 106 per cent.

|

| Indexed Weekly Sales, 2020 compared to Average in Jan 1-28, 2019 (Southeast Asia includes HK, ID, MY, PK, PH, SG, TW, TH, VN) |

“Based on our data, we see the increase in online shopping in Southeast Asia spanning various product categories, from health and beauty to consumer electronics, food and beverage to biometric monitors,” said Steven Nguyen, senior regional manager, SEA.

Criteo’s data on Indexed Sales from Southeast Asia on overall e-commerce trends has shown that consumer electronics such as laptops and computer components rose in demand as people prepared to work or learn from home.

Comfortable clothes are also on the list for online shoppers, with loungewear among top apparel categories – reflective of consumers’ need to feel more relaxed as they need to be home for longer periods than before.

The research also indicates that food and beverage remain strong business. Particularly, at-home cooks stock up more non-perishables – items like pasta and noodles, condiments, and baking supplies – which may last longer as people adhere to self-isolation rules.

| With online stores now the destination of consumers, retailers should also rethink the customer experience via more engaging campaigns that will not only draw loyal customers but securing new ones. |

Furniture purchases mainly engage items that make working from home more comfortable, with office chairs and desks among the top buys. Other interesting findings are that while everyday health and beauty items remain on demand, sales for biometric monitors have spiked and remain strong; and that shoppers are spending more on quality-of-life-oriented goods for comfort and entertainment to adapt to living almost entirely indoors.

“These trends reflect that as the global health crisis continues to affect countries, and measures like social distancing and travel restrictions limit people’s activities and movements, it is quite inevitable that their daily needs and routines have changed as well,” noted Steven Nguyen.

Apart from looking at online retail trends, Criteo also recently conducted a survey of more than 15,000 respondents across 15 countries to investigate the impact of the coronavirus on consumer behaviour.

Based on the survey data, more than half of consumers say they will purchase more online because of the coronavirus. GenZ and Millenials were the most inclined to do more online shopping, with 54 and 58 per cent of respondents stating this, respectively. In terms of product categories, groceries and household products are top items for continued online purchase, although four out of 10 shoppers plan to keep their spending stable in all other categories.

In Vietnam, 76 per cent of survey respondents said they plan to do more online purchases compared to their usual – while only 15 and 9 per cent of respondents said they will do the same amount of shopping or shop less, respectively. 62 and 50 per cent of Vietnamese survey respondents also said they will be doing more online purchases of groceries and beauty/personal hygiene products.

Advertising for the new normal

Given these insights, Steven Nguyen shared the importance for brands and businesses to rethink their advertising strategies in the face of what has become the “new normal”.

“As more and more consumers turn to e-commerce to shop for essentials and beyond, retailers now have to leverage their in-store brand equity and be able to present their offerings online in different ways to get engagement,” said Steven Nguyen, who added that brands must establish strong relationships with their clientele offline and on.

With online stores now the destination of consumers, retailers should also rethink the customer experience via more engaging campaigns that will not only draw loyal customers but securing new ones.

“Brands can think of creating programmes that will help customers build long-term relationships with their own online shopping channel or application,” noted Steven Nguyen. “These can include running app retargeting campaigns for high-demand products and features that the app offers, or loyalty programmes and incentives for top engaged users."

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Rising consumption and travel fuel ‘Tet season’ stocks (February 11, 2026 | 11:43)

- Education as strategic capital: why Dwight School Hanoi represents a long-term investment in Vietnam’s future (February 10, 2026 | 19:00)

- Green logistics–the vital link in the global energy transition (February 09, 2026 | 19:35)

- Wages and Lunar New Year bonuses on the rise (February 09, 2026 | 17:47)

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

Tag:

Tag:

Mobile Version

Mobile Version