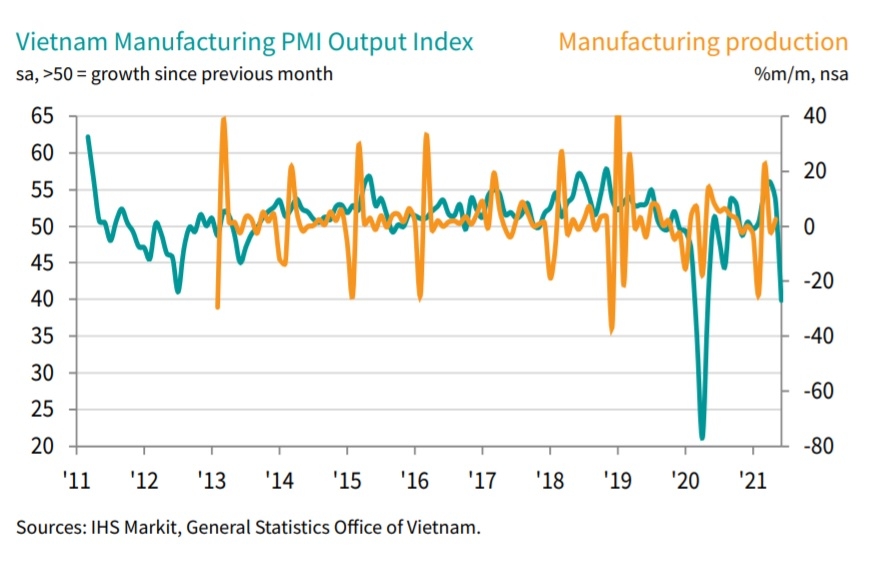

COVID-19 outbreak leads to sharp fall in manufacturing output

|

| Steepest reductions in output and new orders for over a year |

The pandemic also impacted supply chains, resulting in a near-record lengthening of delivery times. Meanwhile, the rate of input cost inflation remained marked but slowed sharply from that seen in May, and firms raised their own selling prices at only a marginal pace amid weaker demand.

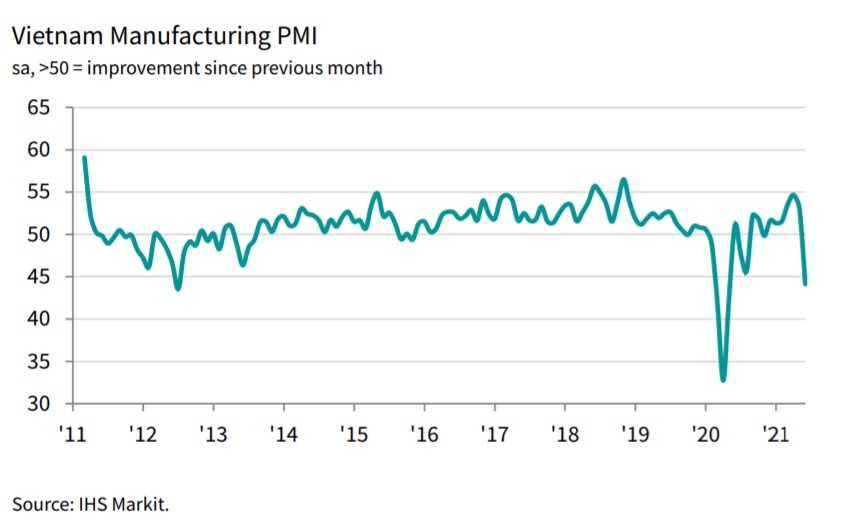

The Vietnam Manufacturing Purchasing Managers' Index (PMI) dropped sharply to 44.1 in June from 53.1 in May, pointing to the sharpest deterioration in business conditions for over a year and ending a six-month period of growth.

|

The COVID-19 pandemic, lockdown measures, and temporary company closures were all mentioned as factors leading to sharp reductions in both output and new orders during June. Meanwhile, new business from abroad also decreased as transportation issues and container shortages exacerbated the impacts of the rise in virus cases.

These transportation issues, added to material shortages and restrictions linked to the pandemic, led to a marked lengthening of suppliers' delivery times. In fact, the extent of delays was the second-largest on record, just behind that seen in April 2020.

Manufacturers in Vietnam responded to falling workloads by cutting back their staffing levels and purchasing activity at the end of the second quarter. Employment decreased for the first time in five months, and at a sharp pace that was the second fastest since the survey began in March 2011. Similarly, purchasing activity fell at the fastest pace since the decline in April 2020 following the initial outbreak of the pandemic. Declining input buying fed through to a steep reduction in stocks of purchases.

Stocks of finished goods also decreased in June, following broadly no change in May. Falling production and a desire to hold less stock amid declining new orders were behind the reduction in stocks of finished goods. Firms were able to deplete their backlogs of work for the first time in three months in line with lower new orders, and at a sharp pace that was unprecedented prior to the COVID-19 pandemic.

|

There were signs of inflationary pressures easing in June as a lack of demand across the sector led to reduced pricing power. Although input costs increased at the slowest pace in seven months, the rate of inflation remained above the series average amid reports of material shortages leading to higher prices. Metals were mentioned in particular as costing more.

Output prices, meanwhile, rose only marginally as firms responded to a lack of demand. Business confidence fell to the lowest since August last year, reflecting concerns about the ongoing impact of the pandemic. That said, firms remained optimistic overall that output will increase over the coming year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version