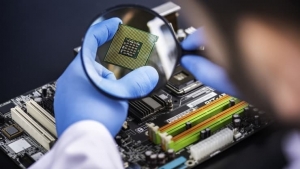

Capitalising on semiconductor market

Overall semiconductor market revenue was $575 billion in 2022, the highest-ever annual total and an increase of 3.2 per cent compared to the 2021 total of $555 billion.

Sales slowed during the second half of the year, however. Fourth-quarter sales of $130 billion were 14.7 per cent less than the total from the fourth quarter of 2021 and 7.7 per cent lower than the total from the third quarter of 2022.

It is estimated to grow at a slower pace of around 6 per cent to $680 billion by 2025, versus pre-2020 growth of around 8 per cent. The growth is driven by increasing needs for semiconductors due to digitalisation, electrification, AI, the metaverse, and the Internet of Things.

Asia-Pacific remains by far the largest region for semiconductors and possesses a dominant position in semiconductor manufacturing, capturing around 75 per cent of global semiconductor capacity. The region is home to leading players such as TSMC, Samsung, Hynix, Renesas, and SMIC, and Asia-Pacific is expected to capture around two-thirds of the global revenue share by 2025.

Within Asia-Pacific, South Korea, Japan, Taiwan, and China are key semiconductor markets. ASEAN however, is still underrepresented with most existing capacity for semiconductor wafer manufacturing concentrated in Singapore, Malaysia, and Thailand, and for assembly and test in Malaysia, Thailand, Indonesia, and the Philippines.

| Timothy Wong, leader for Southeast Asia Industrial Practice, and Dr. Michael Alexander, founder at the Advanced Technology Centre for Roland Berger |

ASEAN to benefit

Further growth and demand for semiconductors in ASEAN are expected due to a growing downstream electronics assembly industry in this region. This can be attributed to the following main factors, including the favourable macroeconomic environment in ASEAN, diversification from Chinese semiconductor supply chains, and the low-cost supply base advantages

The ASEAN region represents one of the world’s most important growth markets, with a combined population of over 660 million. ASEAN countries have an increasingly strong manufacturing foundation. The emerging economies there have long been a destination for global manufacturers seeking abundant low-cost labour.

Singapore, Thailand, and Vietnam also served as a hub for high-value research and development (R&D) and trade-supporting services. ASEAN also stands out as a growing and dynamic domestic market, gaining importance not just for operations but also for demand in the long run.

The increasing geopolitical tensions threaten Chinese semiconductor supply chains. The United States has been tightening export controls with stricter licensing policies, which jolted and paralysed players in China. Additionally, some Chinese players have been placed on a US trade blacklist to create China-free supply chains.

Companies, such as in the electronics industry, adapt to these risks by moving their supply chains from mainland China to other regions. Since 2018, Apple has reduced its number of Chinese supplier sites by 30 per cent and moved production to Southeast Asia and the Americas.

The US and EU have been trying to further bring back semiconductor manufacturing into their regions with huge incentive packages. However, for the US and EU, the focus is expected to be primarily on wafer manufacturing – whereas the assembly and test part of the semiconductor supply chain is still expected to remain in and be focused on Asia to a large extent.

This is the case due to the higher share of labour costs in the semiconductor backend compared to the front-end. Lower labour costs in countries in Asia were one key reason to build up these parts of the value chain there. Additionally, the know-how in the backend technology and operations has been in Asia for the last decades and, hence, a potential further near-shoring towards EU and US will also be a challenge from a skill perspective.

Among the ASEAN nations, Vietnam possesses unique value propositions to attract semiconductor investment. The country is already part of the global supply chain of prominent semiconductor players such as Samsung and Intel. Continuous industrialisation and economic growth provide an attractive base for semiconductor players to manage their global supply chain risks.

Regarding trade openness, economic growth, and demographic advantages, Vietnam’s economy has proven to be resilient and weathered the pandemic crisis well. Its economy is expected to reach close to 7 per cent growth in 2023, one of the highest among Southeast Asia nations. In addition, Vietnam continues to adopt open trade policies.

It maintains diplomatic neutrality amid geopolitical conflicts between China, US, and its allies. It has signed multiple free trade agreements, and foreign direct investment continues to rise, with the manufacturing sector receiving the largest amount of it.

The Vietnamese government has also issued Decision No.667/QD-TTg, approving the foreign investment cooperation strategy for this decade, to further enhance the efficiency of foreign investment and position Vietnam as the choice destination for foreign investment in ASEAN.

| Thanks to a solid foundation, electronics production has become a key economic pillar of Vietnam’s economy, Photo: Shutterstock |

Vietnam is well-positioned

Moreover, the strong macroeconomic fundamentals are augmented by Vietnam’s favourable demographic profiles. Vietnam has one of the largest and youngest workforces in Asia with a working-age population of close to 50 million. The proportion of skilled workers is also on the rise. This differentiates Vietnam against other ASEAN neighbours.

With a solid foundation in electronics and semiconductors, electronics production has contributed to a significant part of Vietnam’s manufacturing output and exports, hence a key economic pillar of Vietnam’s economy. Today, Vietnam ranks eighth as one of the key electronic exporters globally, and second among ASEAN nations behind Singapore.

Pioneering foreign investment in the electronics sectors in Vietnam includes Samsung, Intel, Panasonic, LG, and Canon. More specifically for the semiconductor sector, notable investments in recent years include Samsung Electronics, which has a total of six production corporations, one sales corporation, and one R&D centre in Vietnam. Samsung’s total investment in Vietnam has grown from $607 million in 2008 to exceed $20 billion to date.

In 2021, Intel Corporation also announced an additional investment of $475 million in Intel Products Vietnam, the largest assembly and testing plant in Intel’s network. It is expected to continue to evolve to take on more complex technologies and new products to enable Intel to tap new market opportunities, such as with 5G products and core processors.

Vietnam is also putting in more efforts to attract more investment in the high-tech and semiconductor sectors. Decision 667 lays out the strategy for foreign investment cooperation for this decade. One of the objectives is to attract foreign projects that utilise advanced and high technology of Industry 4.0, modern administration, yield high added value, and connect global production and supply/demand chains.

Vietnam’s unique value propositions as a stable, geopolitically neutral, low-cost supply base coupled with favourable government policies would help to attract more high-tech and semiconductor investment. The Ministry of Planning and Investment has also been tasked to draft the mechanisms and policies to attract overseas funding in chip production.

At the same time, the country should prioritise improving education. Based on a culture where learning and education are highly valued, and with a global, well-educated and networked overseas Vietnamese community, the fundamentals are laid out. The Vietnamese government should further foster STEM education from the primary school level onwards, establish academic learning and on-the-job training facilities together with foreign investors, make semiconductors an attractive industry for women, and grow a few lighthouse research institutes by attracting foreign academics with attractive packages.

Attracting, transforming, and upskilling local Vietnamese semiconductor supply chain players would be another strategic imperative for Vietnam. Local supplies for chemicals, spare parts, facilities construction, and maintenance are paramount for a sustainable semiconductor industry in a country.

Since not all parts of the semiconductor supply chain can be covered by local suppliers, and response times are crucial for an industry that works 24/7, international suppliers need to be incentivised to set up local offices and support centres.

The global semiconductor industry has shifted to the “war of technology” phase. While the global supply chain is disrupted due to geopolitical tension, it also creates opportunities for ASEAN, and particularly in Vietnam, as companies are starting to renew their supply chain for further independence from China.

Vietnam should continue to play to its advantages by building on its strong semiconductor capabilities, supported by favourable government policies to attract foreign investment as well as to encourage upskilling local workforce and semiconductor supply companies.

| Japanese manufacturer Kyocera to expand semiconductor investment in Vietnam Kyocera Corporation, a Japanese multinational ceramics and electronics manufacturer, will double its previous three-year investment in semiconductor-related manufacturing and other industries in a number of countries, including Vietnam. |

| MPI to attract investment capital in chip production The government has assigned the Ministry of Planning and Investment (MPI) to study and build a policy for attracting foreign investment capital in the chip manufacturing sector. |

| US semiconductor manufacturers survey Vietnam opportunities Vietnam was one of the destinations for US semiconductor manufacturers to survey in a recent fact-finding tour of Southeast Asia. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version