Brewers seek answers to new habits and strict rules

Nguyen Van Viet, chairman of the Vietnam Association of Beer, Wine, and Beverages, said in a letter sent to the National Assembly Standing Committee in late May that the industry has been recording a sharp decline in revenue and profits, leading to commercial systems, restaurants, entertainment areas, transportation, and input supply chains all being impacted.

|

| Roadmaps are being laid out to discuss the optimal way to introduce new taxes on products like beverages |

“Currently, 90 per cent of the beer consumption market share in Vietnam belongs to the four largest beer companies of Heineken, Saigon Beer-Alcohol-Beverage Corporation (SABECO), Habeco, and Carlsberg, which are all struggling with difficulties including unstable foreign exchange rates, fluctuating interest rates, and soaring input costs. Some businesses have recorded negative business results, such as AB InBev,” the document noted.

Meanwhile, the government is set to apply a special consumption tax (SCT) on drinks. The association called for putting off the tax until at least 2025 as this year this industry continues to face challenges. This is not the first time the association called for a delay in the tax.

“The government has proposed important tax laws including on VAT, corporate income tax (CIT), and SCT in the direction of expanding taxable subjects and increasing tax rates. These laws are being proposed by the Ministry of Finance and the government with very close implementation schedules,” Viet said.

The revised VAT law, which has been included in the 2024 programme, is expected to be passed in October. The CIT and SCT laws are being considered for inclusion in 2025, with a roadmap for discussion also set for October.

“Amending three important laws in a short time will create financial pressure for the business community, especially manufacturing enterprises, which are under significant additional pressure from newly arising financial obligations such as recycling, responsibility for inventorying and reducing emissions, and a series of additional environmental fees,” Viet added.

According to the consolidated financial report for the first quarter of 2024, SABECO recorded a net revenue increase of 15.6 per cent on-year. This result helps the beer giant end a series of four consecutive quarters of negative revenue growth.

However, the company’s gross profit margin decreased to 29 per cent compared to 30.7 per cent in the same period last year and its profit after tax inched up by nearly 2 per cent on-year.

Meanwhile, Heineken latest reports on 2024 first-quarter trading’s noted, “In Vietnam, we estimate the beer market declined by a mid-single-digit in the first quarter as it continued to be impacted by a soft consumer environment and stricter enforcement of zero tolerance drink-driving regulations.”

Habeco, one of the top four brewers in Vietnam based on market share, experienced a net loss of $828,570 in the first quarter. This is the largest quarterly loss since Q1/2020 and the first quarter loss after three straight quarters of positive results.

SSI Research is cautious about the prospects of the beer industry in 2024 because beer consumption may continue to suffer from the double impact of current drink-driving rules and reduced consumer income this year. It also cited evidence from the Chinese market that it applied stricter driving laws from 2011, the growth of beer consumption slowed significantly.

“Therefore, similar strict laws applied in Vietnam from 2020 is likely the main factor causing beer consumption growth to slow,” SSI Research said.

| Fork in road for special consumption tax on alcohol Industry insiders are worried that changes to taxes on beer will damage the domestic industry in favour of higher priced foreign brands. |

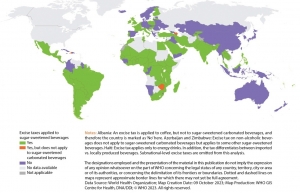

| Vietnam edges towards decision on sugary drink taxes Proposals to tax sugary drinks continue to receive mixed opinions in the country, with Vietnam planning to submit a special consumption tax law for debate in October. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version