Banks saw mixed 2023

The non-performing loans ratio was kept at 2 per cent. Sacombank was also the banking sector leader in terms of profit growth in the first three quarters of 2023 with a 66 per cent jump on-year.

At the Hanoi-based lender PVcomBank's 2023 summary meeting on December 22, Nguyen Viet Ha, the bank’s deputy director general revealed that the bank was expected to reach 129 per cent of its revenue target for the year, with a capital adequacy ratio exceeding 8 per cent.

The bank is set to rake in $634 million in revenue and $3.37 million in pre-tax profit, with consolidated revenue and pre-tax profit targets set at $656.4 million and $4.6 million, respectively.

|

When the banking sector's third-quarter (Q3) financial statements were announced, Ho Chi Minh City-based lender OCB reported strong profit growth at 47.8 per cent on-year, and Kien Long Bank saw a 24.6 per cent increase.

Some forecasts, however, paint a less upbeat picture, with several banks seeing a fall in profit.Of the 28 banks that filed Q3 financial statements last year, eight banks failed to achieve even half of their full-year profit targets, with the majority attaining between 50-60 per cent.

Furthermore, many listed banks saw a lowered net interest margin (NIM), which reflects a bank's’ profitability, compared to one year ago.

Nguyen Huu Huan, head of the Faculty of Financial Markets at the Ho Chi Minh City University of Economics, said, "Banks have failed to see a boost in lending as businesses and individuals face multiple hardships. In addition, bad debts have increased, pushing banks to boost loan loss provisioning, causing a bigger dent in profits."

The Vietnam Investors Service and Credit Rating Agency has forecast that the banking sector’s profit will grow in 2024 thanks to higher NIM, as deposits with high interest rates from Q4 of 2022 expire and the demand for deposits increases in the low-interest environment.

This will allow for a significant reduction in borrowing costs for banks, and allied with surging credit demands thanks to the expected global economic rebound, should contribute to a boost in loan yields.

| Raft of deals to brighten up foreign funding picture Positive signs in economic growth alongside trust from foreign investors are the driving forces helping Vietnam hit between $36-38 billion in foreign investment capital commitment in 2023, up 30 per cent on-year. |

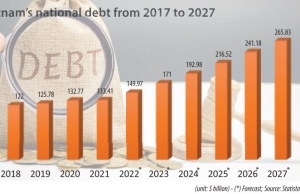

| Public debt management picture clears towards 2025 Vietnam’s plan for borrowing and paying public debt has been revealed, and the budget landscape finalised for this year, with public debt set to stay within the permissible limit. |

| Charter capital of banks to increase sharply in 2023 Many banks plan to increase their charter capital in 2023 in order to ensure operational safety and have more resources for business development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Mobile Version

Mobile Version