Public debt management picture clears towards 2025

Deputy Prime Minister Le Minh Khai has signed and promulgated Decision No.458/QD-TTg on approving the country’s plan for borrowing and paying public debt for 2023 and the programme on public debt management for the 2023-2025 period.

Under the move, the government this year seeks loans worth a maximum of $28 billion, which covers loans for central budget balance of up to $27 billion; of which borrowing to offset the central budget deficit will be a maximum of $18.71 billion, borrowing to repay the principal will not exceed $8.28 billion, and on-lending is $1.01 billion.

Such loans will come from government bond issuance instruments, with the average issuance term may be less than nine years; from official development assistance loans and foreign preferential loans; and from other lawful financial sources or from issuance of government bonds directly to the State Bank of Vietnam.

The government’s debt repayment is about $14.23 billion, of which the government’s direct debt payment is a maximum of $12.75 billion and the repayment of on-lending projects is $1.47 billion.

When it comes to the loan and repayment plan of localities, borrowing from the government’s foreign loans and other domestic loans is as much as $1.18 billion. Localities’ debt repayment is $217.08 million, including principal payment of $121.9 million and interest payment of $95.17 million.

As for foreign commercial loans of enterprises that are not guaranteed by the government, the limit of medium and long-term foreign commercial loans of enterprises and credit institutions by the self-borrowing and self-payment method is up to $7.5 billion; the growth rate of short-term foreign debt is about 20 per cent as compared to the total debt as of the end of 2022.

It is expected that by late this year, the economy’s public debt will be as much as 44-45 per cent of GDP, the government’s debt around 41-42 per cent of GDP, and foreign debt 41-42 per cent of GDP – levels lower than the National Assembly’s permissible limits.

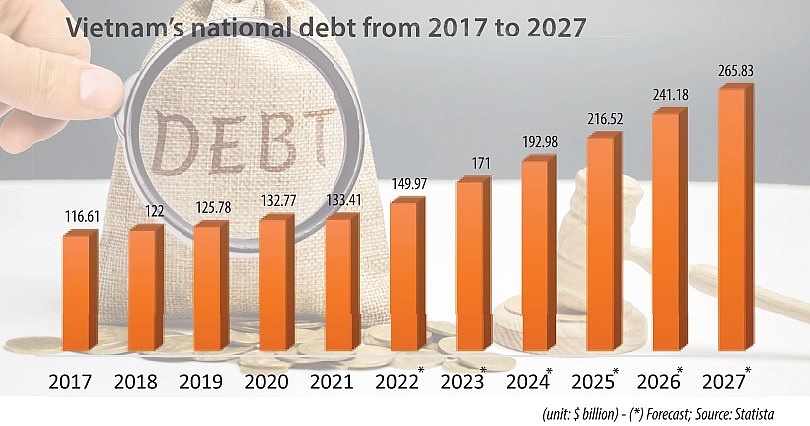

However, according to German data group Statista, the national debt of Vietnam was projected to continuously increase between 2022 and 2027 by a total of $115.9 billion (+77.28 per cent). After consecutive increasing years, the national debt is estimated to reach $265.83 billion and therefore a new peak in 2027.

|

Public debt journey

According to The Economist’s Global Debt Clock, by late last week, Vietnam’s public debt in GDP sat at 45.6 per cent, and per capita public debt was $1,039, while total public debt was almost $94.85 billion.

The Ministry of Finance (MoF) a fortnight ago released a bulletin on the country’s public debt between 2018 and June last year. It stated that Vietnam’s public debt to GDP has tended to reduce, from 58.3 per cent GDP in 2018 to 55.9 per cent GDP in 2020 and then down to 43.1 per cent in 2021.

The nation’s foreign debt within the first half 2022 stood at $142.82 billion, higher than $140.26 billion recorded in 2021. In which, enterprises’ foreign debt sat at $99.43 billion – accounting for nearly 70 per cent.

At the same time, the government’s debt also came down from 49.9 per cent of GDP in 2018 to 39.1 per cent in 2021. The government-guaranteed debt decreased from 7.9 per cent of GDP in 2018 to 3.8 per cent in 2021. In addition, localities’ debt in 2021 reduced to 0.6 per cent of GDP in 2021 to 0.9 per cent in 2018.

By late 2021, the nation’s total foreign debt to GDP was 38.4 per cent, lower than 46 per cent in 2018. Vietnam’s foreign debt to its total export-import turnover in 2021 stood at 6.2 per cent.

Also, the government’s debt to the state budget revenue in 2021 sat tat 21.8 per cent.

The MoF also reported that as of late June 2022, the biggest bilateral creditors include Japan ($11.91 billion), South Korea ($1.21 billion), France ($1.17 billion), and Germany ($521.74 million).

Creating new pressures

Meanwhile, the biggest multilateral creditors are the World Bank ($15.39 billion), the Asian Development Bank ($7.87 billion), and other organisations ($521.74 million). The government’s total debt as of late June 2022 was $139.96 billion; just over 70 per cent came from domestic lenders.

Last year, the MoF reported, the total state budget recorded a surplus of $9.67 billion. The total budget spending is estimated to be over $67.93 billion, up 8.1 per cent on-year. Meanwhile, the state budget revenue is estimated to hit $77.6 billion, up 13.8 per cent on-year. All kinds of revenues have registered an on-year climb, reflecting recovery in almost all sectors in the economy.

Based on forecasts that there will be massive difficulties both at home and abroad, the state budget overspending in 2023 will likely sit at $19.8 billion, which will be equivalent to 4.42 per cent of GDP. The central budget deficit will reach more than $18.7 billion or 4.18 per cent of GDP; and local budget overspending will touch over $1.08 billion or 0.24 per cent of GDP.

The budget revenues this year are expected to be $70.46 billion, which is far lower than the realised figures of $77.6 billion last year, which was tantamount to 126.4 per cent of 2022’s estimates and up 13.8 per cent on-year.

“In the context that the world economy’s growth is forecasted to be slow down, while a number of major economies are facing with a danger of depression, and a very high hike of prices of oil and input materials is creating big pressure to global inflation,” the MoF said.

“In addition, the political situation in the region and the wider world have become all the more complicated, coupled with climate change, natural disasters, and epidemics. All of these challenges have and will continue increasing risks and difficulties for the Vietnamese economy in 2023 and the country’s budget situation as well.”

| Vietnam’s public debt management programme for 2023-2025 Under Decision 458, in the 2023-2025 period, the government will have loans worth a maximum $81.43 billion, including loans for central budget balance of up to $78.82 billion, and on-lending of $2.56 billion. The government’s total debt payment for the period will be at most $47.74 billion, which includes $42.04 billion for direct debt payment and $5.7 billion for payment of on-lending debt. It is necessary to arrange resources for fully implementing the government’s debt obligations, not allowing any situation of overdue debts that can badly affect the government’s international commitments. When it comes to government guaranteeing, the government guaranteeing level must ensure that the growth rate of the government-guaranteed debt must not exceed the growth rate of GDP of the previous year and must stay within the permissible level of the government guaranteeing in the 2021-2025 period approved by the National Assembly.Source: Ministry of Finance. |

| Cost-cutting measures aid debt drop Vietnam is witnessing a strong reduction in its public debt following its close control of the issue, with the government exercising a stringent policy on increasing revenues and reducing expenditures. |

| Vietnam’s public debt control goals for year within reach Despite big spending, Vietnam will ensure its financial landscape is healthy with close control of public debt next year. |

| Debt rates set to remain lower than planned limits With Vietnam’s borrowing plan revealed and budget landscape finalised for next year, Vietnam is expected to see its public debt stay within the permissible limit, ensuring financial security for the nation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Mobile Version

Mobile Version