ASEAN embraces apt growth model

|

The ongoing pandemic is posing a difficult time for companies like aluminum maker Tri Dat JSC, which has to maintain its furnaces for different partners while hurrying to build a new workshop – all amid successful albeit challenging social distancing efforts led by the government.

“How to fluently carry out all the work and ensure the safety of workers, and particularly how to follow instructions of social distancing, made us think a lot. During these times, digitalisation seems to be a key solution for us,” Nguyen Dinh Chi, deputy director of Tri Dat, told VIR.

According to Chi, although ideas of a digital transformation within the company are not new, they mean a big jump in how it operates. “We use software to manage our employees and their working time and progress. We also discuss and exchange works of different departments through this,” Chi said. “Besides this, we also started to deploy a robot to reduce the number of workers in the workshop at the same time.”

Necessary transformation

Along with Tri Dat JSC, many other enterprises have found digitalisation to be a necessity, especially at the moment.

Being unable to promote their latest products to foreign customers at promotional events due to the pandemic, Nha Xinh AKA Furniture Group and other enterprises who are members of the Handicraft and Wood Industry Association of Ho Chi Minh City (HAWA) have thought about shifting towards e-commerce models combined virtual showrooms to reach out to potential customers.

“This application allows buyers to view all the products on the computer and smartphone. With this virtual 3D showroom, they can even interact directly with the products that they care about. Despite not being able to present products directly to customers, we can still introduce, promote, and export products online,” said Nguyen Quoc Khanh, chairman of HAWA at a recent online conference.

According to Khanh, the wood and furniture processing industry needs large space to display and introduce its products, serving customers’ habit of touching and seeing products before eventually deciding to purchase them. Virtual technology can help customers to visit showrooms and factories visually from afar.

“The around-the-clock operating digital platforms helps firms quickly reach customers and eliminate geographical distance while customers can reach manufacturers with shortened order times,” Khanh said.

Promoting and exporting goods through e-commerce platforms are a solution being promoted by wood furniture businesses in the complicated context of the global health crisis to compensate for the paralysis of the offline market. Therefore, besides HAWA, Binh Duong Furniture Association and Dong Nai Wood and Handicraft Association have also embraced digital transformation among their member companies to optimise operations, save costs, and improve the sector’s competitiveness.

Statistics from Amazon in Vietnam shows that in just the last month, the number of wood enterprises selling goods on this platform has grown five-fold.

In the Vietnamese market, among other big e-commerce names, Tiki has been the fastest seller with a record speed of 4,000 orders per minute.

Meanwhile, Saigon Co.op has been witnessing growth with geometric progression, and Grab immediately launched a new platform called GrabMart to serve customers’ online shopping demand for groceries.

Vo Thi Phuong Mai, head of retail services at CBRE Vietnam, said that the health crisis has negatively impacted traditional shopping channels while creating chances for positive growth for small- and medium-sized models of convenient stores, drug stores, and particularly e-commerce.

“E-commerce represents the silver lining for the traditional retail market amid the pandemic,” she said.

Mutual bloc efforts

In order to cater to the growing bandwidth demand and mobile adoption rate, countries in Southeast Asia are intensifying investments in ICT, bringing about greater worldwide connectivity.

This encourages firms in the ICT space to rethink business strategies, build new capabilities, and develop competitive advantage by tapping on advancements in network connectivity, cloud computing, and information security.

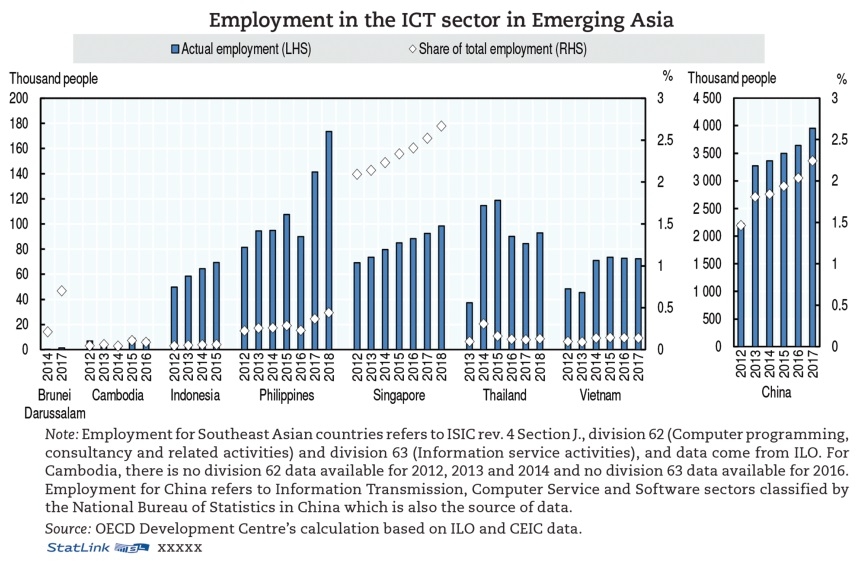

For example, the infocomm industry in Singapore is expected to employ more than 210,000 workers and create more than 13,000 professional jobs by 2020.

Last year in Singapore, the Infocomm Media Development Authority and Enterprise Singapore launched Start Digital, an initiative of the SMEs Go Digital programme. Start Digital will enable new small- and medium-sized enterprises to get a head start with two foundational digital solutions – with costs waived for a minimum of six months – to accelerate growth and scalability.

At the end of last year, Vietnamese Minister of Information and Communications Nguyen Manh Hung said that 2020 would be the year of digital transformation, premising to a digital Vietnam. “This is a profound and comprehensive change in way of working,” he said. “Digital technology will be the best tool to carry out this huge transformation in Vietnam.” Along with enterprises from Vietnam and Singapore, businesses from other ASEAN member states have also been pushing digital transformation.

As a partner of Microsoft Dynamics in the ASEAN region, Votiva Vietnam has been the provider of digital services for many conglomerates in the region, particularly in Thailand, with big names like Central Group, SCG, ThaiBev, and Singha.

“Thai enterprises have been accelerating their digital transformation for five years. During the pandemic, we also received orders from many other enterprises for digitalisation in this market,” Nguyen Chi Duc, regional director of business development at Votiva Vietnam, told VIR.

According to Duc, digital adoption can benefit companies, offering new strategies and better financial performance. “That’s why in the Southeast Asian region, the leading groups, convenient stores, and supermarket chains are still strongly digitalising.”

Meanwhile, a study by enterprise technology provider Workday has found that Malaysian companies are leading the ASEAN in quantifying the return from their digital transformation initiatives. Namely, 58 percent of C-level executives in Malaysia responded to the study saying that their digital transformation initiatives are seeing measurable returns, while this number in Singapore was at 47 per cent.

In the 2020 Computer Weekly IT Priorities survey by TechTarget, 44 per cent of nearly 200 respondents in ASEAN answered that digital transformation was their top priority.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Drive ASEAN Forward

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version