A strategic assessment for Vietnam’s adoption of IFRS

|

| By Tran Hong Kien - Partner of Assurance and Accounting Services PwC Vietnam |

International Financial Reporting Standards (IFRS) has become the most common accounting language globally. The official approval by the Ministry of Finance (MoF) in Decision No.345/QD-BTC in March last year signifies Vietnam’s commitment to enhancing the quality and transparency of financial reporting in Vietnam towards global standards.

The final IFRS roadmap adoption is to be implemented along two tracks: IFRS adoption for specific targets and Vietnam Financial Reporting Standards (VFRS) issue and adoption for all other entities.

Conversion to IFRS is much more than a technical accounting issue. Across the globe, many countries that successfully adopted IFRS have different adaptation and customised preparation frameworks. Although each country has unique experiences, there are certain valuable lessons that Vietnam can learn from and leverage on.

Lessons learned for Vietnam

According to a United Nations report, there is a growing appreciation of the usefulness of IFRS by countries in different regions irrespective of country size or financial reporting traditions. To fully benefit from the IFRS introduction in Vietnam, there are two notable and relevant lessons we can learn.

Firstly, there is the need for effective coordination and communication throughout the transition plan to IFRS and its implications for preparers, users, educators and other stakeholders. This means a country’s transition plan will need to include a logistical framework of activities that must be completed within a realistic timeframe. The support of a proper communication programme is also important. It raises the awareness of the potential impacts of the conversion among regulatory bodies, and temporary effects on business performance and financial position for businesses that fall into the above two tracks.

Secondly, an IFRS implementation programme needs to adequately assess the level of expertise required to ensure competent and continuous support. The shortage of expertise in the field of IFRS would bear consequences not only for the private sector, but also regulators and other government agencies. As IFRS adoption is a result amendment to existing and/or new standards, it’s also important for regulatory agencies to have a plan in place to keep up with the changes and new issues that may arise. Thus there is a need for Vietnam to prepare a suitable human resources development programme.

The role of professional accountancy organisations is crucial in building the technical capacity for implementing IFRS in a sustainable manner. In the same UN report, case studies from different countries illustrate how professional accountancy bodies facilitate communication between government agencies and other local stakeholders, on the one hand, and the International Accounting Standards Board on the other.

|

Practical implementation

IFRS may significantly affect the way in which an organisation’s day-to-day operations are handled or even impact the reported profitability of the business itself.

Companies that have benefited most from such a transition are those that have looked at this as a chance to make improvements to their systems and processes and have used it as a focus for more efficient, punctual and meaningful internal and external financial information.

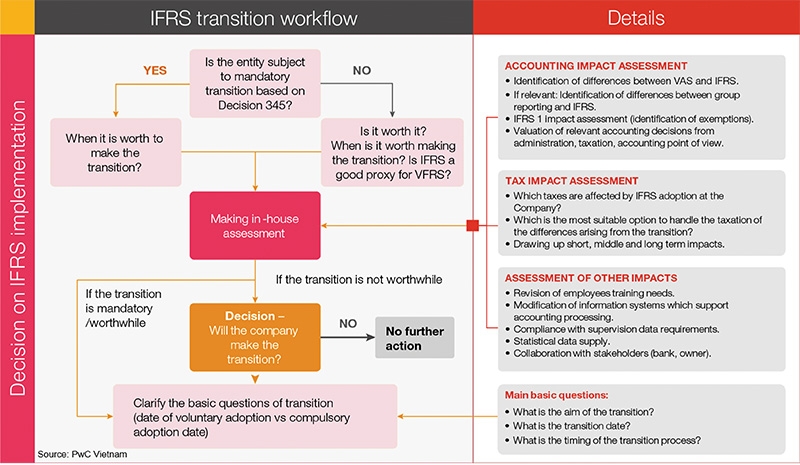

Whether the business is looking at IFRS as a mandatory or voluntary transition, there are certain basic questions and assessments that companies need to map out to stay ahead in this journey: What is the aim of the transition? What is the transition date? And what is the timing of the transition process?

The answers to these questions will be helpful when enterprises carry out initial and in-depth assessment before putting the preparation plan in place.

Alongside such assessments, there are three key areas that businesses can consider today to prepare for IFRS conversion.

First is IFRS skills and needs analysis. This is a good opportunity for companies to take a look at the capabilities of the overall financial and accounting department and decide the level of training needed to facilitate the transition process. Knowing what level of knowledge and skill you have today - and mapping this to what is needed will effectively position your business for IFRS implementation success.

This is an important step. With this skill and needs gap analysis, organisations can now determine the extent of training, resources and planning needed to upskill their people to achieve operational effectiveness with regard to IFRS.

Another important consideration for management is whether the current systems can deliver the quality of data to support IFRS adoption. The majority of Vietnam’s current information systems and data processing are moulded in the familiar Vietnam Accounting Standards.

While the requirements will vary depending on specific industries, in most cases, a new set of data requirements may entail system modification, upgrade or even replacement.

A question, therefore, to ask is “When my company adopts IFRS or VFRS, can my current information system provide all the information that is needed?” The answer to this question will help organisations figure out their next course of action.

The third area companies need to look at is the anticipated impact that IFRS adoption will have on the enterprise as a whole, because adopting IFRS presents challenges that many organisations underestimate.

While first-time adoption, or IFRS 1, helps companies prepare for their first IFRS financial statements, businesses still need to understand what financial statement output changes are likely, and then work with all affected parties to minimise the impact of those changes.

For example, IFRS adopting entities may encounter negative changes to gearing ratios or profitability ratios resulting in the breach of loan covenants with banks unless these are discussed and re-negotiated well in advance with banks. Even with the new standard, the transition process remains complex and time-consuming for many companies.

As we saw with any mandatory transition, being behind in the process might lead to costly consequences. It is important that companies take a proactive stance and take care of the issues step by step, starting now, for both effectiveness and cost efficiency.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version