2022 outlook: Solid path to growth

|

| Nguyen Luong Hien - Deals strategy partner PwC Vietnam |

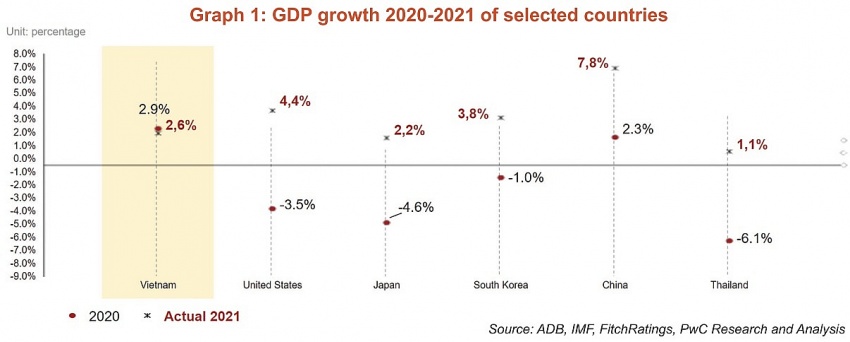

However, when considering both 2020 and 2021, Vietnam has been one of the only economies to record two consecutive years of growth since the start of this pandemic (see Graph 1).

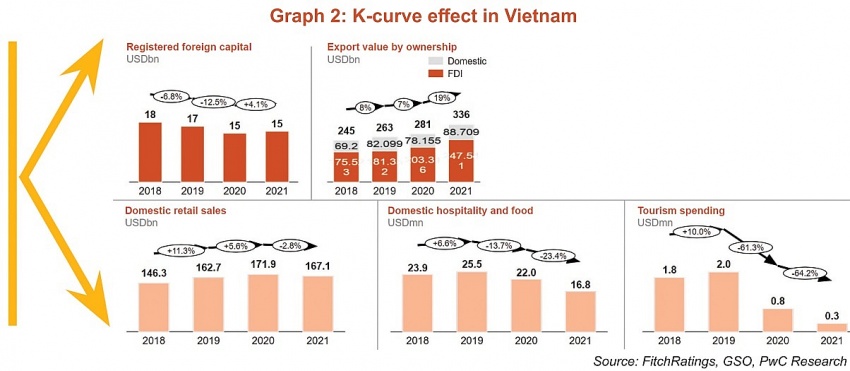

Of course, the GDP growth rate does not capture the actual impact. Vietnam has experienced what has often been referred to as a ‘K-curve effect’, meaning different industries have been impacted in different ways. For example, while tourism, hospitality, and food services have been struck the hardest, export-based sectors in Vietnam have shown resilience over the past two years (see Graph 2).

Building resilience through an export-based economy

The pandemic has reminded us of the fact that the country is an export-based economy, and Vietnam relies less on tourism and hospitality. When compared to neighbouring countries with a strong tourism sector, such as Thailand (-6 per cent GDP growth in 2020), the Philippines (-9.6 per cent) or Cambodia (-3.1 per cent), these countries have suffered substantial hits to their own GDP growth, while Vietnam was able to maintain positive growth during this time.

For an emerging economy like Vietnam, the K-curve is likely to also impact the broader population, potentially accelerating existing levels of inequality. For the first time in decades, food shortages had resurfaced in some parts of the country. This included certain districts in the more developed Ho Chi Minh City where households had to rely on humanitarian support to make it through the prolonged lockdown. For a still-developing country, the hard stop of activities across a number of sectors put tremendous pressure on millions of low- to mid-skilled workers.

Nevertheless, Vietnam remains a resilient economy as the country is expected to bounce back strongly in 2022 and become the fastest-growing ASEAN economy, with GDP growth at 6.6 per cent followed by the Philippines (6.3 per cent) and Malaysia (6 per cent), per the latest findings from the International Monetary Fund (IMF). Based on the figures of 2021, the country is also on track to recover in terms of the total export value with 19 per cent growth.

Given the enforcement of the Regional Comprehensive Economic Partnership this year, the trading relations with global markets will continue to be on the upward curve, allowing Vietnam to strengthen its growth in the region.

|

|

An attractive investment destination

Outside the COVID-19 pandemic, other recent profound economic shifts still warrant mention and consideration.

Vietnam has become the destination of multiple supply chain and manufacturing relocations, due to strong economic fundamentals and a favourable investment environment when compared with neighbouring markets. According to the Ministry of Planning and Investment’s Foreign Investment Agency, the country still recorded a total of new capital, adjusted capital, and share purchases by foreign investors of $31.1 billion as of December 20, up 9.2 per cent annually. Since 2019, Vietnam has continued to rise as an emerging manufacturing hub in the region, capturing the bulk of new manufacturing investments. Relocations from China, or from other parts of Southeast Asia, have driven growing foreign direct investment in recent years. This trend has been a key driver for strong economic performance during the pandemic.

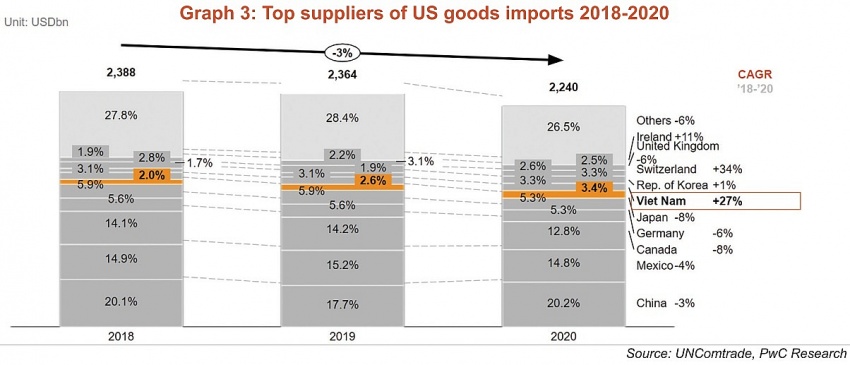

For instance, while it resulted in a slowdown of trade with the United States, which represents the largest export market for the country, Vietnamese exports have continued to grow and since 2019 and the country has significantly increased its market share within US imports (see Graph 3).

|

Home to a favourable supply chain environment

The capacity to build a robust and productive manufacturing ecosystem is one of the main reasons leading to Vietnam being one of the key winners in the supply chain relocation battle. This has included the means to build a network of industrial suppliers and providers to support large inbound manufacturers, as well as improve the country’s power, road, and transport infrastructure.

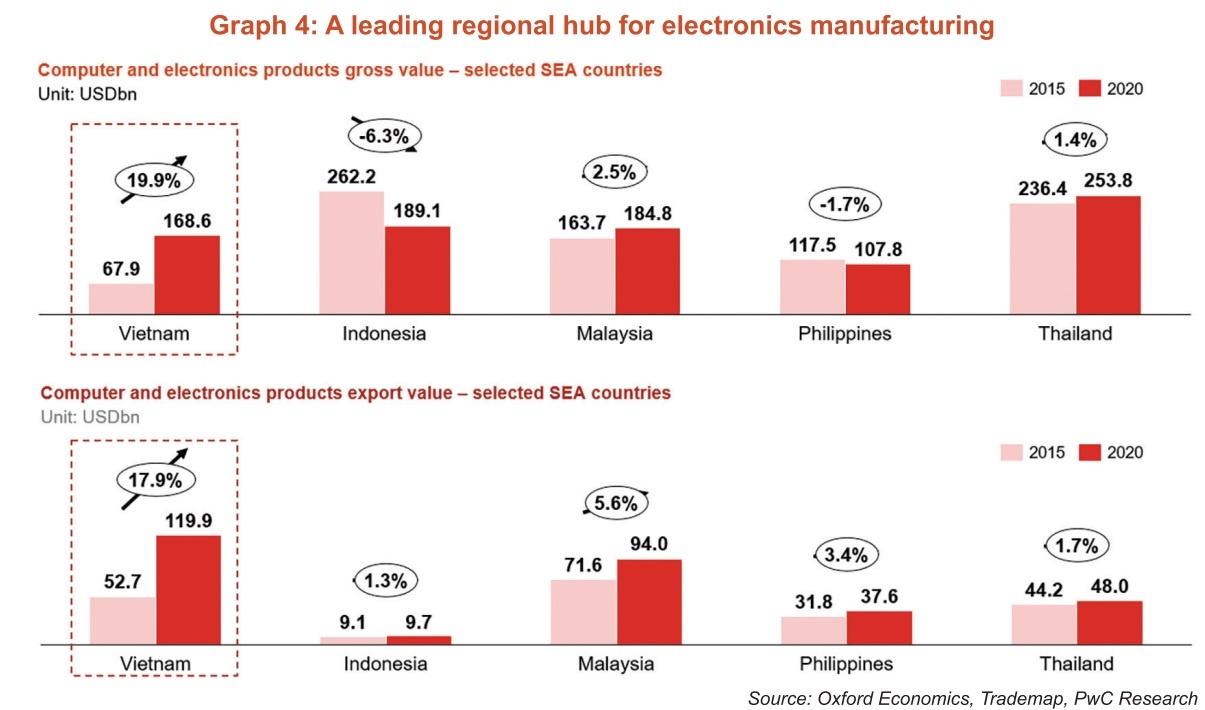

Up until quite recently, Vietnam has chiefly been known for textile and garment manufacturing. However, in recent years, Vietnam has emerged as a leading hub for the manufacturing of electronics in Southeast Asia (see Graph 4).

|

This trend is expected to carry on for the next few years. Both the relocation of investment from other markets and the surge in foreign manufacturing investment will continue so long as there are overall strong fundamentals and an attractive investment environment.

Vietnam is projected to grow at a noticeably higher pace in 2022. This optimism, in part, is due to the high vaccination rate which has allowed the nation to restore most of its economic activities in late 2021. As we enter a new epidemic phase and short of the country tightening restrictions, Vietnam is well placed to realise its growth potential with businesses resuming operations and borders reopening progressively.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version