Daring Starbucks move in Italy

|

| The design of Starbucks cafés in Vietnam is intended to highlight the company’s international image and still strike a chord with Vietnamese customers |

At the same time, looking at the company’s lagging performance in the Europe, Middle East, and Africa region, Italy, with its long-standing coffee traditions and national pride in domestic brews, might not be the safe bet.

Ambitious reinforcements in Europe?

According to its 2016 annual report, Starbucks had a rather successful fiscal year, with total net revenue increasing 11 per cent on-year, to $21.3 billion. The company’s operating income was $4.2 billion, with a 19.6 per cent consolidated operating margin, an 80 basis point increase from the 18.8 per cent in 2015, “largely driven by sales leverage and lower commodity costs, partially offset by investments in our partners and digital platforms.”

These results were a continuation of positive growth since the fiscal year of 2012, growing in total net revenue from $13.3 billion and doubling operating income from $2 billion, with the exception of 2013, when Starbucks was burdened with a pre-tax charge of $2.8 billion in an arbitration decision in favour of Kraft Foods Global, Inc but even despite the hefty charge, Starbucks only reported a net operating loss of $325 million in 2013.

The fast-coffee giant’s operations remained centred on company-operated stores, sourcing 79 per cent of its total net revenues from these units.

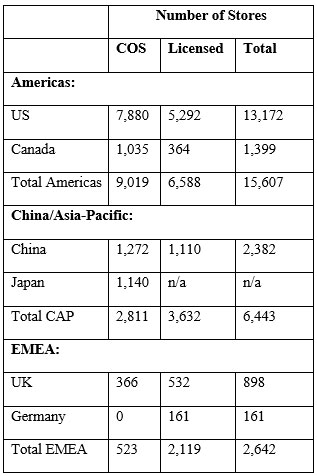

These numbers seem to align well with the number of Starbucks shops. As of October 2, 2016, the company had 25,085 stores worldwide, with the lion’s share located in its primary market, the Americas (mainly the United States, Canada, and to a lesser extent, Brazil). As can be seen on the table summarising the figures of Starbucks 2016 annual report, the company had 15,607 stores in the Americas region, making up 62 per cent of the total. The China/Pacific-Asia region, with its 6,443 stores, is the company’s second largest market (25.6 per cent of total stores) and the EMEA (Europe, Middle-East, and Africa) closes the file with 2,642 stores (10.5 per cent).

These results show just how much Starbucks’ performance is lagging in Europe, necessitating expansion in Italy. This need is justified both in the changes in the number of stores (both company-operated and licensed).

Store-numbers-wise, during the 2016 fiscal year, Starbucks reported opening 348 new company-operated stores (COS) in the Americas and 359 in the China/Asia Pacific region. However, there are now 214 less such stores in the EMEA region, although this is largely due to a whole-scale licensing deal in Germany whereby all 144 company-operated stores were transferred to licensees. The company’s home market, the United States, and China seem to be the biggest growth engines (321 and 246 new COS, respectively).

The effects of large-scale transferring in Germany can be seen in the growth of the number of licensed stores, however, even with this boost the EMEA region is falling behind: the Americas saw 456, China/Pacific 622 new licensed stores, while the EMEA produced 494 new licensed units, including the 144+3 transferred shops in Germany, where otherwise 4 new licensed stores were put up. The major sources of increase were, again, the US and China with 330 and 325 new licensed stores, while the United Kingdom added 118 new licensed stores (53 of which were a result of a transfer).

The numbers speak for themselves and they seem to be saying that Starbucks is not doing so hot in the EMEA region, which would (could?) necessitate expansion.

|

But why Italy? Surely, the country reigning as the absolute master of espresso brewing is a difficult target for conquest. And true enough, newswires Forbes and The Local have reported negative sentiments among Italian coffee-drinkers, who resolutely said “I will never choose American coffee over an Italian one.”

Performance in China/Pacific-Asia

As opposed to its European-Middle-Eastern-African markets, Starbucks is doing rather well in Asia. Based on the company’s annual report, the region fetched it a total net revenue of $2.94 billion, a $543 million, or 23 per cent, increase on-year.

The company’s total operating income was $631.6 million, effecting a 21.5 per cent operating margin, definitive improvement since 2015’s $500.5 million operating income and 20.9 per cent margin.

Starbuck’s operations in the region are reporting ever-improving figures both in scale and profitability, it is important to see that COS have been mainly responsible for this success: they contributed about 89.8 per cent of the company’s regional revenue, $2.64 billion against licensed stores’ $292.3 million, a solid continuation of last years’ 88.8-11.0 portions.

According to the annual report, Starbucks’ performance was mostly due to new company-operated store openings, with 359 new units generating altogether $246 million and its strong presence in Japan ($105 million). Licensed stores, on the other hand, provided a $28 million increase in revenue, despite the huge number of new units—622 new licensed stores were opened during the year in the region.

Starbucks in Vietnam

Starbucks has been present in Vietnam since 2013 and now has 25 shops dotted around Hanoi and Ho Chi Minh City. While usually struggling to change tea and coffee-drinkers consumption habits to carve out a slice for the brand, Starbucks found little difficulty joining the multitude of coffee-shops on a well-established market.

However, Starbucks has been aiming to strike a difference between itself and traditional Vietnamese coffee stores.

“Being fully in touch with the Vietnamese taste will undermine our identity,” said Patricia Marques, CEO of Starbucks Vietnam.

In addition to offering Asian Dolce Latte and Dolce Misto, two products that fall particularly close to traditional Vietnamese coffee, Starbucks has been striving to keep the same-old, long-standing palette it offers all over the world, so that foreign customers can drop by for a taste of home.

This differentiation, at the same time, allowed Starbucks to go up-market. While a regular cup of Robusta at a Vietnamese café goes for VND25-30,000 ($1.09-1.31), Starbuck’s Arabica Coffee Latte is priced at VND70-80,000, similar to domestic competitor Highlands Coffee.

On the other hand, Starbucks has been eager to pick up the advantages of its Vietnamese market and add Da Lat Arabica beans to its international line-up in 2015. Debuting the coffee in its US stores, the company announced intentions to distribute the beans through 21,500 stores in 56 countries.

"When we received a sample of this coffee, we were delighted at the quality," Leslie Wolford, senior coffee specialist for Starbucks, told on the company website, celebrating it as excellent for espresso, brewed coffee, and even cold brew.

| RELATED CONTENTS: | |

| Vietnam, one of the cheapest destinations in 2017 | |

| Indian coffee chain launches IPO to ward off Starbucks | |

| Starbucks to sell Da Lat Arabica coffee globally | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

Mobile Version

Mobile Version