World economy impacts on credit default swaps

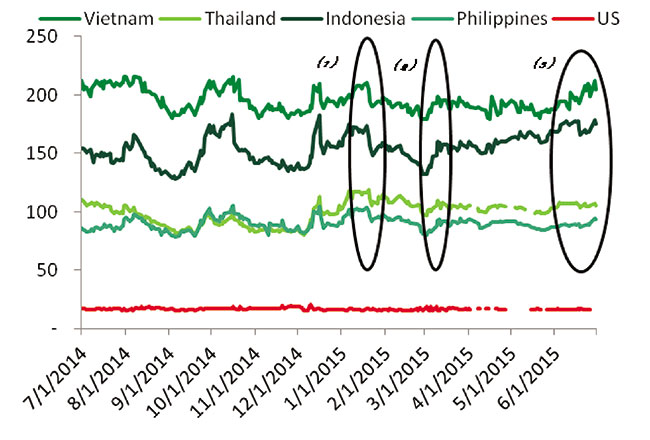

CDS spreads can be impacted not only by events within a country but also by global events that make the country seem more or less risky relative to other investment destinations. During the first six months of 2015, CDS spreads of the four emerging countries in the Southeast Asia region, including Vietnam, Thailand, Indonesia and Philippines fluctuated in a tight band compared to last year, when they recorded strong declines. Then beginning in June, these CDS spreads began to rise slightly.

During the second quarter of 2015, Vietnam’s average CDS spread reached to 190.95 basis points or bps (one basis point equals 1/100 of one per cent). This average CDS spread has decreased continuously since early 2014 but its decline has recently been slower than previous quarters. CDS spreads of Philippines shared the same general downward trend, reaching 88.80 bps, down 1.99 bps from the average of the last quarter of 2014. However, the average CDS spreads of Thailand and Indonesia actually rebounded in the first half of this year compared to last year, reflecting higher risks.

During the first six months of 2015, the world witnessed many geopolitical and economic events that directly or indirectly impacted emerging ASEAN nations. The US economy, being the largest in the world, will often impact CDS spreads of other countries. As the US dollar rose in the early months of 2015, investors were more attracted to investments there, which made them demand higher risk premiums for emerging markets and pushed up CDS spreads of the four ASEAN markets.

The US economy got warmer in January, which supported the US dollar to rise against other currencies. According to Bloomberg, the USD/EUR rate reached a four-year peak to trade at $1 per €0.8923 on January 23. The US unemployment rate fell in January to 5.7 per cent, despite increasing 0.1 per cent compared to December 2014, but still posing at its lowest level since 2010. At the same time, economists maintained a positive outlook on the US economy compared with other major countries while the European and Japanese economies continued to sink. That increases rumours about the possibility of raising interest rates by Fed.

Being under the above pressures, CDS spreads of the emerging markets rose to the high levels in the end of January. CDS of Vietnam reached 210 bps on January 19, the highest level in a three month period. Thailand’s and Indonesia’s CDS reached 119 and 173 bps on January 20, eight and ten basis points higher than their 2014 average spreads, respectively.

At the same time, the US Federal Reserve Bank (the Fed) held several meetings over the first quarter of 2015 but did not confirm any timing or magnitude for a policy interest rate increase. In a meeting on February 25, Fed Chairwoman Yellen indicated that interest rates will not rise for "at least the next couple of meetings". Previously economists had expected the Fed to raise interest rates as early as mid-2015. CDS spreads of the four countries then declined and bottomed out at the end of February after two hearings of the Fed Chairwoman. On the same day of February 25, CDS of Vietnam, Thailand, Indonesia and the Philippines fell to 179.52, 97, 132 and 79.74 bps respectively, the lowest levels in the first half of 2015.

One of the factors that led the Fed to remain cautious regarding an interest rate increase was the strength of a dollar. Meanwhile, other countries started issuing massive credit packages to boost their economies (such as the Eurozone quantitative easing (QE) program in March of $1,200 billion and the ¥80,000 billion QE package announced by the Japanese government on March 17, 2015).

During the second quarter though, the uptrend of CDS spreads was driven more by the intrinsic economic factors of each country. Indonesia and Thailand both reduced interest rates to stimulate exports and enhance competitiveness in the international markets (Indonesia cut interest rates to 7.5 per cent in February, while Thailand cut twice from 2.00 per cent to 1.75 per cent on March 11 and then down to 1.50 per cent in April). As a result, the IDR and BAHT were devalued which was likely to stress their repayment obligations for international loans. Vietnam continued to record high deficits during the first six months. As of the end of June, Vietnam's trade deficit was $3.8 billion, which also put pressure on the state budget deficit because of declining oil sale revenues.

WTI oil prices remained at low levels from $43 to $61 per barrel, which made crude oil exporting countries like Vietnam and Indonesia tighten state revenue, subsequently imposing more possibility of a higher budget deficit this year.

The Greek crisis in June also impacted ASEAN, with the tough negotiations between creditors and Alexis Tsipras’s government. The news around debt negotiations of Greece – land of Gods also decreased the CDS spreads of emerging markets at particular moments. These events made emerging Asia seem more stable than Europe and helped strengthen CDS spreads somewhat.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version