Will the application of technology help Masan transform the financial sector in Vietnam?

|

| Will the application of technology help Masan transform the financial sector in Vietnam? |

Financial and banking products have yet to meet the demand of a large proportion of the Vietnamese population. The traditional banking model is currently incapable of growing its network over the entire country.

It is estimated that two-thirds of Vietnamese consumers do not have a bank account. This gives rise to informal consumer lending channels with loan interest rates being 3-5 times that of traditional banks.

Merely 2.4 per cent of the population has access to insurance goods, while only four per cent of people use credit cards. Due to hurdles in registration procedures and income proofs, consumers find it difficult to use formal banking channels, which explains the low penetration rate.

Masan intends to overcome these complex difficulties by leveraging an online-to-offline distribution network and digitalising customer records through credit ratings based on AI and machine learning (ML).

Therefore, Masan has recently invested $65 million to buy 25 per cent shares of Trusting Social JSC, a Vietnamese subsidiary of Singapore-headquartered Trust IQ Pte. Ltd. The cooperation with Trusting Social contributes to accelerating Masan's transformation into an offline-to-online consumer and technology ecosystem. Thus, the group can adopt AI and fintech application solutions in retail and consumption to deliver a superior customer experience.

The cooperation was announced by Masan Group right at the 2022 Annual General Meeting of Shareholders. At the launch, thousands of online and offline participants had the opportunity to experience the simple and easy way to open the card when accessing masan.goevo.vn with just a few clicks on the phone.

After only three minutes, almost 2,700 EVO cards successfully passed through eKYC with a total credit limit of $35.5 million.

This shows that the approval and granting of financial limits will improve with outstanding performance, thereby supporting the diverse financial needs of consumers. EVO is the first financial partner of the Masan ecosystem. In the coming time, Masan will continue to cooperate with many other banking partners to serve Vietnamese consumers.

|

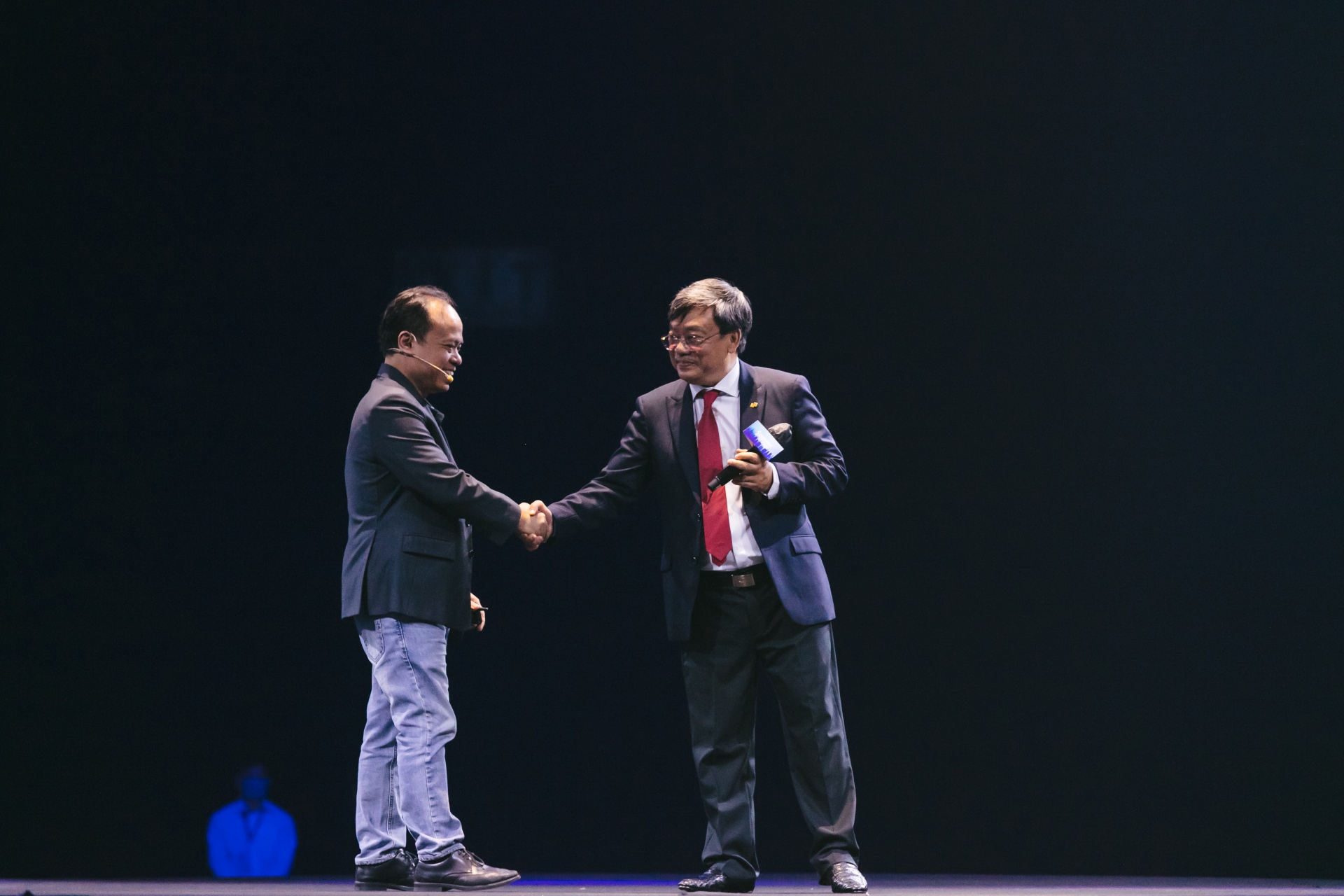

| Masan shakes hands with Trusting Social to meet the demand for financial services |

Gaining a competitive financial advantage

The financial service market is governed by accessibility and simplicity of use, especially for new clients.

With nationwide retail coverage, Masan aims to serve the financial needs of consumers. The group will build a simple process for new customers through an integrated service. A unique user ID automatically syncs account information of customers shopping at the WinCommerce system into a financial platform. This platform provides contactless payment, saving, investment, and loan products based on AI and ML tools.

In 2022, Masan will begin rolling out digital banking kiosks, allowing consumers to deposit, withdraw, and access financial products, such as credit card insurance. Offline points of sale will act as service points and online portals, ensuring the connection of consumers with on-demand services.

Accordingly, Masan will provide consumers with spending solutions through credit cards at a reasonable fee. This is an important milestone for Masan to become a digital retail banking service platform.

Masan's offline touchpoints will help build consumer trust by providing referrals and guidance for financial products, which acts as a starting point to increase the penetration of banking services.

The process of credit scoring, screening, and customer evaluation will help Masan to personalise financial services for consumers, such as consumer loans, partner credit cards, and insurance solutions. This also brings potential customers for banks and other financial institutions.

During its operation, Masan has launched consumer innovations to reshape the consumer industry with a view to helping Vietnamese people pay less for essential products and services, while simultaneously increasing their quality of life.

In 2022, Masan will digitalise all its platforms. The move not only cuts 10 per cent of operating costs but also makes use of AI and ML to improve operations. Masan has transformed itself from a retail consumer group to a digital consumer platform to satisfy the unmet demands of customers.

| Backed by leading startup investment funds such as Sequoia Capital, Beenext, Tanglin Ventures, 500 Startups, and Genesis Alternative Ventures, Trusting Social can score more than 1 billion people, affiliated with more than 170 financial institutions throughout Vietnam, Indonesia, India, and the Philippines. Through cooperation with Masan, Trusting Social aims to apply AI and ML to provide personalised products and services, serving a variety of needs from groceries and finance to other interests of consumers. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Agency of Foreign Trade warns of trade disruption due to Middle East conflict (March 02, 2026 | 17:11)

- Vietnam manufacturing sees improved growth (March 02, 2026 | 16:27)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

Tag:

Tag:

Mobile Version

Mobile Version