Why we should care about F0 investors

|

| Le Quang Minh, head of Research at Mirae Asset Securities |

The pandemic has kept millions at home just as low-fee trading platforms spread from the United States to the rest of the world, including Vietnam. As a result inexperienced individual investors, or F0 investors, are assumed to be among those who have opened their first stock accounts this year. These mainly young people are excited about technology and are aggressive in investment. In the US, they have crowded the tech arena by purchasing stock from services and products they have experienced.

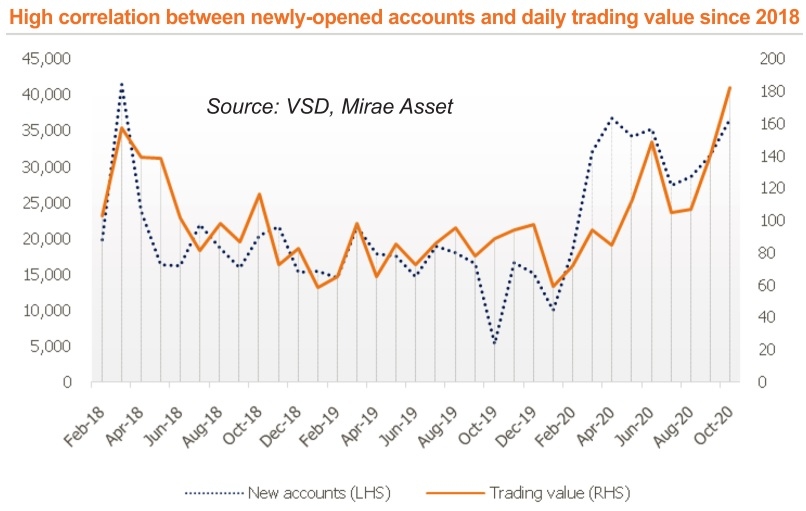

Though we do not have access to the detailed demographics of new investors in Vietnam, these types of participants have brought about higher trading value. On the one hand, new opening accounts have increased significantly from March and reached the highest rate in two years at around 36,000 in October (see chart). These new investors create a wave of “buying moments” in the local stock markets.

At the beginning of the COVID-19 pandemic, the stock market index plunged around 30 per cent in March. Afterwards, new investors come in with a sharp increase in stock trading accounts. In Vietnam as of last month, there were about 291,000 new accounts – an increase of 81.4 per cent on-year. On the other hand, the figure shows that a high correlation exists between new opening accounts and the trading value of the VN-Index as the two lines move closer to each other.

This correlation attracts the awareness of brokerage firms as the new investors have reshaped the market share of leading firms. We believe that any firms that succeed in opening accounts for new investors will gain market share. One of the characteristics of new investors is that most of them are local individuals.

|

In Vietnam, local individual investors account for more than 70 per cent of the daily trading value. Therefore, retail investors have already contributed their part and have played a major role in Vietnam’s stock market for years, well before the pandemic emerged. This is contrary to the US stock market, where institutions and professionals accounted for a major part in market share. And a hike in F0 investors strengthens the leading role of local individuals in Vietnam.

A boom on F0 investors may come from two reasons. First, stock markets are becoming more attractive. Supporting policies like lowering interest rates and increasing money supply would result in a devaluation of currencies and commodities. In addition, a stagnant real estate market would be a tap to increase stock investment.

Secondly, social distancing policies earlier in the year have led young people to find available trading platforms on mobiles or laptops. This way of brokerage has lower costs of trading and online interaction between brokers and investors. The communication is also more efficient than face-to-face meetings.

In the US, for example, mom-and-pop investors have fallen back in love with stocks, lured by commission-free trading apps such as Robinhood and Fidelity, as well as a resurgent bull market led by tech companies and a pandemic that has left millions of Americans at home with little to do. With efficient advisory services, not only trading value but also stock indices increase. The S&P500 gained 58 per cent from the recent bottom formed in March and 10 per cent in the year-to-date. The daily trading value of the S&P500 also recorded a new high with $59.2 billion, up 37 per cent on-year.

In Vietnam, the VN-Index gained 46 per cent from its bottom too, with its trading value increasing by 31 per cent on-year. We witnessed F0 investors bidding the trading value and the index during the height of the pandemic in this country. Their buying-moment has resulted in high demand for stocks, outweighing the net withdrawal of foreign institutional investors.

We believe that the tendency of F0 investors can continue as the stock market maintains its up-trend. This bullish environment attracts return seekers to invest more in stocks. However, some risks may arise as investors need background knowledge and further practical experiences. This threat opens opportunities for broker houses with good advisory services and training.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version